PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431672

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431672

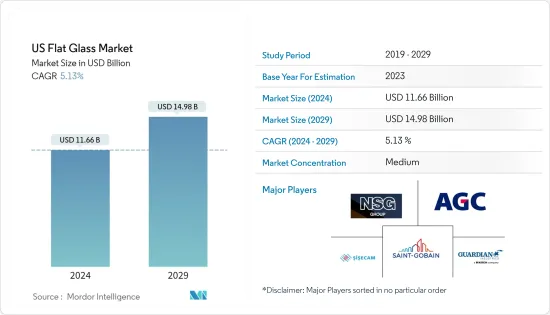

US Flat Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The US Flat Glass Market size is estimated at USD 11.66 billion in 2024, and is expected to reach USD 14.98 billion by 2029, growing at a CAGR of 5.13% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market, owing to several restrictions imposed by the United States government. However, post-pandemic, the market recovered significantly with the resumption of various residential and infrastructural projects and the implementation of new construction projects in the country.

Key Highlights

- The growing demand for electronic displays, increasing demand from the construction industry, and increasing usage of flat glass in the production of solar panels are significant factors driving the growth of the market studied.

- However, the fluctuating prices of raw materials and government regulations on carbon emissions are likely to restrain the growth of the studied market.

- Nevertheless, the rising initiatives related to the usage of flat glass for renovation projects in the construction industry are expected to create opportunities for the market during the forecast period.

US Flat Glass Market Trends

Annealed Glass to Dominate the Market

- Annealed glass is softer, thermally treated, and slowly cooled to release any internal stresses after the glass is formed. This process of treating the glass is known as the annealing process, deriving the name annealed glass. However, annealed glass is also commonly called plate or window glass. Float, clear, and tinted glass are prominent annealed glasses commercially used for varied applications.

- Annealed glass is used in residential and non-residential construction applications. It is widely used in shopping malls, athletic facilities, swimming pools, facades, hotels, schools, bathroom areas, and exhibition spaces. The increasing construction activities in the United States are driving the market for annealed glass.

- Annealed glass can be used for further processing to obtain laminated, tempered, toughened, and others. Laminated glass is widely used in the automotive industry. Tinted glass is used in cars and other motor vehicles to avoid excess heat and to block sun rays. It also helps in the effective cooling of ACs installed in the vehicles.

- The United States is the second largest automotive manufacturing country globally, falling only behind China. According to OICA, automotive production in 2022 accounted for 10.06 million units, an increase of 10% compared to the production in 2021, which was reported to be 9.16 million units.

- The National Automobile Dealers Association (NADA) predicts that the United States' new vehicle sales are likely to increase by 6.6% to 14.6 million units in 2023. The production of automobiles is anticipated to ascend in the future owing to the rising popularity and affordability of vehicles.

- Thus, the abovementioned factor is expected to drive the demand for annealed glass in the country during the forecast period.

Building and Construction Industry to Dominate the Market

- Flat glass is used significantly in the construction industry owing to its wide range of functions, from heat insulation to soundproofing and from safety applications to solar protection. In building and construction applications, flat glass is majorly used in windows for both functional and aesthetic purposes, which allows clear sight for customers looking out of the window and, at the same time, protects them from the elements such as UV radiation.

- The construction industry in the United States kept growing on the back of its strong economy, good market fundamentals for commercial real estate, and more money from the federal government and states for public works and institutional buildings.

- The construction industry in the United States is the largest in North America. According to the US Census Bureau, the annual construction in the United States accounted for USD 1.79 trillion in 2022, compared to USD 1.63 trillion in 2021, at a growth rate of 10.2%.

- Moreover, the annual value of residential construction output in the United States was valued at USD 908 billion in 2022, compared to USD 802 billion in 2021. The annual non-residential construction in the country was valued at USD 884 billion in 2022, compared to USD 823 billion in 2021.

- According to the AIA (American Institute of Architects) Construction Consensus Forecast Panel, non-residential building construction spending expanded to 5.4% in 2022. Further, the country's expenditure on new private non-residential buildings peaked at over USD 539 billion in 2022. By 2023, all the major commercial, industrial, and institutional categories are projected to witness at least reasonably healthy gains.

- Thus, the building and construction industry is expected to dominate the market for flat glass in the country during the forecast period.

US Flat Glass Industry Overview

The United States flat glass market is partially consolidated in nature. Some of the major players in the market (not in any particular order) include AGC Inc., Saint-Gobain, Nippon Sheet Glass Co. Ltd, Guardian Industries, and Sisecam.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Electronic Displays

- 4.1.2 Increasing Demand from the Construction Industry

- 4.1.3 Increasing Demand for Solar Panels Production

- 4.2 Restraints

- 4.2.1 Fluctuating Prices of Raw Materials

- 4.2.2 Government Regulations on Carbon Emission

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Annealed Glass (Including Tinted Glass)

- 5.1.2 Coater Glass

- 5.1.3 Reflective Glass

- 5.1.4 Processed Glass

- 5.1.5 Mirrors

- 5.2 End User Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Solar Glass

- 5.2.4 Other End-user Industries (Electronics, Aerospace, etc.)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 CARDINAL GLASS INDUSTRIES, INC

- 6.4.3 Central Glass Co.Ltd

- 6.4.4 Fuyao Glass Industry Group Co., Ltd

- 6.4.5 Guardian Industries

- 6.4.6 Nippon Sheet Glass Co. Ltd

- 6.4.7 Saint-Gobain

- 6.4.8 SCHOTT

- 6.4.9 SHENZHEN SUN GLOBAL GLASS CO.,LTD.

- 6.4.10 Sisecam

- 6.4.11 Specialty Glass Products

- 6.4.12 Swift Glass

- 6.4.13 TAIWAN GLASS IND. CORP

- 6.4.14 Vitro

- 6.4.15 ZIBO YURU GLASS COMPANYFOUNDED

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in the Usage of Flat Glass in Renovation Projects in Construction Industry

- 7.2 Other Opportunities