Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693985

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693985

South America Cat Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 280 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

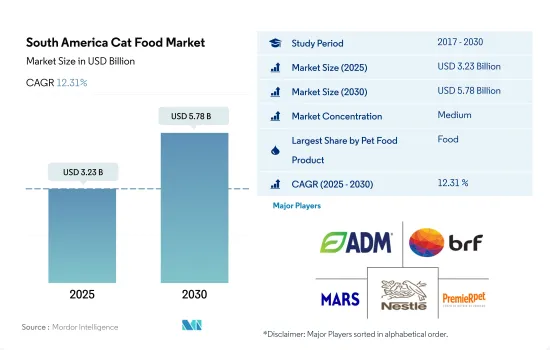

The South America Cat Food Market size is estimated at 3.23 billion USD in 2025, and is expected to reach 5.78 billion USD by 2030, growing at a CAGR of 12.31% during the forecast period (2025-2030).

Increasing focus of pet owners on their pet health and the potential benefits of commercial pet foods are driving the market

- The cat population in South America has been steadily growing in recent years, particularly in urban areas. Cats are known for their independent nature and finicky behavior, making them a popular choice for pet owners who prefer pets requiring less space and attention than dogs. In 2022, cats accounted for 19.5% of the South American pet food market, which increased by 46.2% between 2017 and 2021, with a rise in the cat population by 13.6% over the same period.

- Wet food has emerged as the preferred choice for cats due to its high moisture and meat content, which aligns with their natural diet and nutritional requirements. Therefore, in 2022, wet food accounted for 52.9% of the South American cat pet food market.

- The pet treats segment holds the second-largest share in the cat pet food market. In 2022, it accounted for USD 256.8 million in South America. Treats are widely used as rewards and for developing a bond, particularly with newly adopted cats. Freeze-dried treats have gained significant popularity, accounting for 24.6% of the treats segment in 2022. The irresistible aroma and flavor of meat make freeze-dried treats highly attractive to cats.

- The usage of treats is expected to increase further with the rise in cat adoption, while veterinary diets for cats with infections or allergies are also anticipated to grow. During the forecast period, treats and veterinary diets are projected to record CAGRs of 16.4% and 16.2%, respectively, in South America.

- Considering the growing cat population, increasing concerns about pet health, and the potential benefits offered by commercial pet foods, the cat food market in South America is estimated to register a CAGR of 12.8% during the forecast period.

Brazil and Argentina are major cat food markets in South America due to the higher cat population in these countries

- Globally, South America is one of the developing cat food markets. The region has a high potential to grow during the forecast period as there is a high population of cats, growing awareness about specialized pet food, and companies expanding their manufacturing facilities to meet the growing demand for cat food products. For instance, from 2017 to 2020, Agroindustrias Baires and Empresas Carozzi SA expanded their manufacturing facilities.

- Brazil has a significant market share in the region and is one of the important countries for the development of the South American cat food industry. The country had a market value of USD 1.3 billion in 2022 and a significant share of the regional market due to the highest cat population in the region. It had a cat population of 28.7 million in 2022 and accounted for 55.5% of the cat population in South America.

- Argentina is estimated to register a CAGR of 14.8% during the forecast period as there is an increase in premiumization, changing consumer preferences, and domestic companies such as Molino Chacabuco and Baires SA offering new premium products to their customers. In 2022, these companies added new treats, wet food, and veterinary diets to their product offerings.

- The companies in South America are focusing on providing their customers with premium pet food for cats in the local flavors and recipes through veterinarians, specialty stores, and pet shops. Additionally, they are offering these products in trilaminate packaging that ensures greater convenience and preservation of products.

- Factors such as an increase in product offerings, premiumization, and high cat population are expected to help in the development of the South American cat food market during the forecast period.

South America Cat Food Market Trends

Brazil accounted for the largest cat population in the region owing to their adaptability to smaller living spaces and lower maintenance

- The pet cat population in South America has been steadily increasing, and it increased by 13.3% between 2019 and 2022. This upward trend could be attributed to the higher adoption rates of cats as companions during the extended periods of home confinement brought on by the pandemic. Among the countries in the region, Brazil had the largest cat population, accounting for about 55.5% of the total cat population as of 2022. In South America, cats comprised 19.3% of the overall pet population in 2022. This relatively lower proportion of cats could be attributed to the cultural perception that dogs are more practical and valued pets. As a result, the number of cats represented only 50.0% of the total dog population in the region.

- However, the adaptability of cats to smaller living spaces, without feeling confined, coupled with their lower maintenance costs compared to dogs, contributed to an increased preference for cat ownership. This trend led to a significant rise in the pet cat population across the region. In Brazil alone, as of 2020, about 14.3 million households owned cats as pets. Similarly, in Argentina, the rate of cat ownership was higher, with 31.4% of households, or 4.6 million households, having cats as pets.

- An important emerging trend in the region is the establishment of cat cafes. As of 2021, around 20 cat cafes were in Brazil, providing customers with a unique opportunity to enjoy a drink while interacting with cats in a comfortable setting. This growing trend of cat cafes and the cat's ability to adopt smaller living spaces can further enhance the adoption of cats as popular pets in the region.

Higher-income pet owners' preference for natural ingredient cat food and growing product premiumization driving pet expenditure

- The expenditure on pet cats in South America steadily increased by about 22.3% between 2019 and 2022. This increase was mainly due to the rising pet ownership across the region. For instance, the number of households owning a pet cat in Brazil increased by about 11.1% between 2016 and 2020, while in Argentina, it increased by about 10.3%. Pet owners in the region are increasingly focused on pet humanization, and higher-income pet owners are driving sales growth through the use of natural ingredients and product premiumization. For instance, the retail sales value of premium dry cat food in Brazil saw a rise from USD 100.2 million in 2016 to USD 122.4 million in 2022, with a CAGR of 3.4%, reflecting the rising demand for premium cat products.

- However, with an economic downturn prevailing across the region, price sensitivity has become a crucial factor in choosing cat food brands. In Argentina, pet owners frequently switch brands or opt for the most affordable options to manage their expenses. The largest portion of sales in 2020 belonged to 'Economy' food brands, which accounted for 49.5% of the total dry cat food sales value. This trend indicates the leading preference for cost-effective cat food options.

- Offline retail channels such as pet shops, vet clinics, and supermarkets are the preferred distribution channels for purchasing pet food products in the region. However, during the COVID-19 pandemic, e-commerce's share in pet food distribution reached 11.1% as of 2022. The higher consumption of premium pet food and growing awareness about the benefits of healthy, nutritious pet food helped increase pet expenditure in the region.

South America Cat Food Industry Overview

The South America Cat Food Market is moderately consolidated, with the top five companies occupying 50.26%. The major players in this market are ADM, BRF Global, Mars Incorporated, Nestle (Purina) and PremieRpet (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001467

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.2 Pet Expenditure

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Pet Food Product

- 5.1.1 Food

- 5.1.1.1 By Sub Product

- 5.1.1.1.1 Dry Pet Food

- 5.1.1.1.1.1 By Sub Dry Pet Food

- 5.1.1.1.1.1.1 Kibbles

- 5.1.1.1.1.1.2 Other Dry Pet Food

- 5.1.1.1.2 Wet Pet Food

- 5.1.2 Pet Nutraceuticals/Supplements

- 5.1.2.1 By Sub Product

- 5.1.2.1.1 Milk Bioactives

- 5.1.2.1.2 Omega-3 Fatty Acids

- 5.1.2.1.3 Probiotics

- 5.1.2.1.4 Proteins and Peptides

- 5.1.2.1.5 Vitamins and Minerals

- 5.1.2.1.6 Other Nutraceuticals

- 5.1.3 Pet Treats

- 5.1.3.1 By Sub Product

- 5.1.3.1.1 Crunchy Treats

- 5.1.3.1.2 Dental Treats

- 5.1.3.1.3 Freeze-dried and Jerky Treats

- 5.1.3.1.4 Soft & Chewy Treats

- 5.1.3.1.5 Other Treats

- 5.1.4 Pet Veterinary Diets

- 5.1.4.1 By Sub Product

- 5.1.4.1.1 Diabetes

- 5.1.4.1.2 Digestive Sensitivity

- 5.1.4.1.3 Oral Care Diets

- 5.1.4.1.4 Renal

- 5.1.4.1.5 Urinary tract disease

- 5.1.4.1.6 Other Veterinary Diets

- 5.1.1 Food

- 5.2 Distribution Channel

- 5.2.1 Convenience Stores

- 5.2.2 Online Channel

- 5.2.3 Specialty Stores

- 5.2.4 Supermarkets/Hypermarkets

- 5.2.5 Other Channels

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Alltech

- 6.4.3 BRF Global

- 6.4.4 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 6.4.5 Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- 6.4.6 Farmina Pet Foods

- 6.4.7 General Mills Inc.

- 6.4.8 Mars Incorporated

- 6.4.9 Nestle (Purina)

- 6.4.10 PremieRpet

- 6.4.11 Virbac

7 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.