PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645032

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645032

Europe Pharmaceutical Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

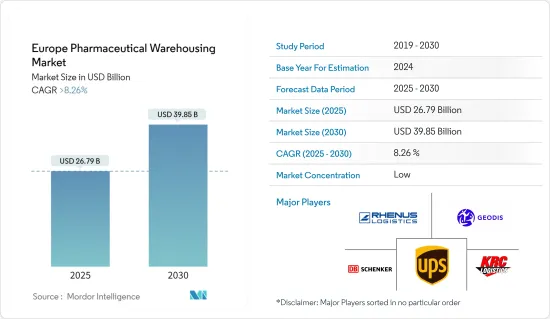

The Europe Pharmaceutical Warehousing Market size is estimated at USD 26.79 billion in 2025, and is expected to reach USD 39.85 billion by 2030, at a CAGR of greater than 8.26% during the forecast period (2025-2030).

The European pharmaceutical warehousing market is undergoing rapid changes, primarily due to the rising demand for temperature-sensitive logistics and the need to adhere to stringent regulatory standards. The European Medicines Agency (EMA) reported that, as of October 2024, more than 85% of the region's approved pharmaceutical products necessitate specific storage conditions, such as exact temperature and humidity controls. This requirement has led to heightened investments in cutting-edge warehousing technologies. Furthermore, the European Union's Good Distribution Practice (GDP) guidelines stress the importance of rigorous monitoring and documentation in pharmaceutical storage. In response, many facilities have begun integrating IoT-enabled systems to ensure compliance.

Cold chain warehousing is a primary focus, with data from the European Commission indicating that almost 60% of pharmaceuticals managed in 2023 were temperature-sensitive. Consequently, there's been a notable uptick in the establishment of refrigerated facilities across the region. Between January 2023 and August 2024, Germany, France, and the UK together contributed over 200,000 cubic meters to the cold storage capacity. In addition, to address labor shortages and boost operational efficiency, the industry is embracing automation advancements, including robotic sorting and climate-controlled zones.

Sustainability initiatives are also making waves in the market. New directives from the EU, effective mid-2024, call for a 40% cut in hydrofluorocarbon refrigerant usage by 2030. This has catalyzed a move towards greener cooling technologies. Renewable energy is becoming the norm for warehouses; in 2023, over 30% of facilities in Spain and the Netherlands adopted solar panels. Such measures are anticipated to reduce operational emissions by a minimum of 20% each year, resonating with Europe's overarching environmental ambitions.

Europe Pharmaceutical Warehousing Market Trends

Expansion of Cold Chain Storage for Pharmaceuticals

The European pharmaceutical sector is increasingly prioritizing cold chain logistics, driven by stringent regulatory standards and a surging demand for biologics. Biologics, which encompass vaccines and cell and gene therapies, are highly sensitive to temperature fluctuations, underscoring the need for meticulous temperature-controlled logistics. As of March 2024, the European Medicines Agency (EMA) highlighted the significance of a robust cold chain infrastructure, noting that biologics constituted nearly 30% of new drug approvals. Furthermore, the European Union's Good Distribution Practice (GDP) guidelines, updated in 2023, emphasize stringent temperature controls throughout the supply chain to safeguard product efficacy and ensure patient safety.

A pivotal factor fueling this trend is the escalating investment in technology-driven cold chain systems. By February 2024, nations like Germany and the Netherlands unveiled plans to bolster their cold chain capabilities. Notably, Germany has augmented its refrigerated storage capacity by over 15% since 2022. With a focus on reducing product spoilage and ensuring regulatory compliance, advancements like real-time temperature monitoring via IoT devices have emerged. These initiatives resonate with Europe's ambition to uphold its stature as a dominant player in global pharmaceutical exports, which reached an impressive EUR 223 billion (USD 248.9 billion) in 2023.

Sustainability Initiatives Driving Logistics Evolution

Sustainability has emerged as a pivotal focus in Europe's pharmaceutical logistics sector, propelled by consumer demand and regulatory mandates. The European Green Deal, targeting 2030, is steering the logistics industry towards low-emission solutions, such as electric vehicles and alternative fuels. Reports from the European Commission in March 2024 revealed that logistics operations account for over 25% of freight-related greenhouse gas emissions, highlighting the pressing need for sustainable practices. Leading the charge, countries like France and Sweden are making significant strides, with France unveiling a EUR 2 billion (USD 2.2 billion) investment in green logistics infrastructure in January 2024.

Among the notable initiatives is the shift towards electrified last-mile delivery solutions. The Netherlands marked a significant achievement in February 2024, rolling out over 10,000 electric delivery vehicles across the country. Furthermore, there's a growing momentum for rail transport, known for its lower greenhouse gas emissions compared to road transport. As of March 2024, Austria reported a 20% year-on-year surge in pharmaceutical goods transported via rail. These initiatives not only curtail the carbon footprint of pharmaceutical logistics but also resonate with Europe's overarching sustainability ambitions.

Europe Pharmaceutical Warehousing Industry Overview

The Europe Pharmaceutical Warehousing market is fragmented in nature, with a mix of global and local players. Most of the imports and exports products need to be monitored in refrigerated transports. Vendors are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. Major Players include Bio Pharma Logistics, Rhenus SE and Co. KG, GEODIS SA, and United Parcel Service Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in demand for outsourcing pharmaceutical warehousing services

- 4.2.2 Demand for efficiency, visibility, and product safety from pharmaceutical companies

- 4.3 Market Restraints

- 4.3.1 Lack of efficient logistics support in emerging economies

- 4.4 Market Oppurtunites

- 4.4.1 Rise in government initiatives to enhance Pharmaceutical Warehousing

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Cold Chain Warehouse

- 5.1.2 Non-Cold Chain Warehouse

- 5.2 By Application

- 5.2.1 Pharmaceutical Factory

- 5.2.2 Pharmacy

- 5.2.3 Hospital

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 Europe

- 5.3.1.1 Germany

- 5.3.1.2 UK

- 5.3.1.3 France

- 5.3.1.4 Russia

- 5.3.1.5 Spain

- 5.3.1.6 Rest of Europe

- 5.3.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Alloga

- 6.2.2 Bio Pharma Logistics

- 6.2.3 Rhenus SE and Co. KG

- 6.2.4 DB Schenker

- 6.2.5 FedEx Corp.

- 6.2.6 GEODIS SA

- 6.2.7 Hellmann Worldwide Logistics SE and Co KG

- 6.2.8 KRC Logistics

- 6.2.9 Kuehne Nagel Management AG

- 6.2.10 United Parcel Service Inc.

- 6.2.11 XPO Logistics Inc.*

7 FUTURE OUTLOOK OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin