PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431727

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431727

Germany EV Charging Infrastructure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

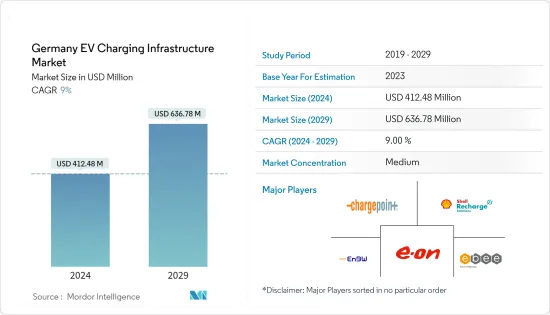

The Germany EV Charging Infrastructure Market size is estimated at USD 412.48 million in 2024, and is expected to reach USD 636.78 million by 2029, growing at a CAGR of 9% during the forecast period (2024-2029).

Germany EV charging infrastructure market has generated revenue of USD 378.42 million in the current year and is poised to register a CAGR of 9.01% for the forecast period.

The German EV charging infrastructure is driven by the increase in the market share of EVs and the rising government's efforts to build EV charging station infrastructure.

Key Highlights

- Electric vehicles are booming in Germany, with them the required demand for public charging stations. In 2022, sales of passenger electric vehicles in Germany reached 833,500 units, up by 22% from 2021, as per data from the German Association of the Automotive Industry or VDA. To support this growing number of EV sales in the region, the Federal Ministry for Digital Affairs and Transport has announced a charging infrastructure master plan. The master plan aims to expand the public and private charging infrastructure in Germany.

- In addition, Germany is highly focused on the transition to renewable energies. The growth of EV charging infrastructure is in phase with this transition as these vehicles help in reducing greenhouse gas emissions, promote sustainable transportation, and allow the use of renewable energy sources like wind or solar for charging. Moreover, the growth of EV Charging infrastructure is accelerated by Germany's concepts of urban planning and smart city development.

- Germany ranks in first place when it comes to the number of charging station facilities in Europe. There were around 70,000 charging stations in the country in 2022, according to the data from the National Control Centre for Charging Infrastructure of Germany. Bayern, Nordrhein-Westfalen, and Baden-Wurttemberg are the leading states with higher numbers of electric vehicle charging infrastructures in Germany.

- However, the high price of building EV charging stations and the expertise required in building them are some of the key restraining factors for the Germany EV charging infrastructure market over the forecast period. On the other hand, factors like smart charging solutions, energy management, and software solutions, and a growing number of charging services are providing tremendous opportunities for the growth of the market studied.

Germany EV Charging Infrastructure Market Trends

Increase in the market share of EVs

- The demand for full-electric cars surged in Germany in the last few years. The electric vehicles share in Germany has grown to 14.6% of all newly registered automobiles, according to figures released by the country's motor vehicle authority.

- The new passenger car registrations increased about 13% Y-O-Y to 202,947 in April 2023. During the first four months of 2023, a total of 869,765 cars were registered. The electric car sales volume increased by 34% Y-O-Y to 29,740 new registrations.

- On the Contrary, plug-in hybrid car sales in Germany have decreased. In April 2023, only 11,787 units were registered (down 46 per cent year-over-year). Supply chain disruptions and cost inflation are largely responsible for the poor performance. On the other hand, in 2022, the German auto market saw plugin electric vehicles take a 24.3% share in April 2022, up from 22.1% YoY.

- According to an industry association, the major electric EV brands had registered strong growth, with Polestar's sales up 166%, Mercedes Benz by 8.3%, and Tesla's by 76% in 2022.

Rising Government's Efforts to Build EV Charging Station Infrastructure

- The German Government is aiming to have around one million EV charging points in the country by 2030, up from the current 70,000. To achieve this number, the Government has made a "Master plan" that aims to transition the economy from fossil-fuel-driven cars to electric ones as user-friendly as possible by enabling electric vehicles to be charged more easily and faster. The estimated cost of the plan is around EUR 6.6 billion (USD 6.17 billion).

- This plan mainly focuses on reducing the existing gap between the charging infrastructure available and demand and, at the same time, creating the much-needed consumer confidence in reliable and sufficient charging infrastructure. Also, The plan foresees the availability of real estate where new charging stations can be built, especially alongside highways.

- The federal Government has decided on a target for medium-duty and heavy-duty trucks that by 2030, their electric mileage should account for more than 30% of total mileage. As of now, the development of a truck charging network needs to be improved. The Federal Government expects that there will be around 30,000 electric trucks in Europe by 2025 and 200,000 electric trucks by 2030.

- In June 2023, the Transport Ministry revealed that Germany is going to invest up to EUR 900 million (USD 983 million) in subsidies to expand electric vehicle charging stations for households and companies. Germany had around 1.2 million fully electric vehicles on its roads by the end of April 2023, well below its goal of 15 million by 2030, according to the data from the Federal Motor Authority.

Germany EV Charging Infrastructure Industry Overview

The Germany EV charging infrastructure market needs to be more cohesive. Some of the key players include EnBW Baden Wurttemberg AG, Charge Point, Allego GmbH, E on Energie, Shell Recharge Solutions, etc. Several players in the market are partnering with the government to develop charging infrastructure. The companies are entering strategic partnerships, acquisitions, and product development to expand their brand portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Recent Trends and Developments

- 4.7 Government Policies and Regulations

- 4.8 Impact of COVID- 19 on the Market

5 MARKET SEGMENTATION

- 5.1 Commercial Charging Stations

- 5.1.1 Destination Charging Stations

- 5.1.2 Highway Charging Stations

- 5.1.3 Bus Charging Stations

- 5.1.4 Fleet Charging Stations

- 5.1.5 Other Commercial Charging Stations

- 5.2 Residential Charging Stations

- 5.2.1 Private Houses

- 5.2.2 Apartments

- 5.3 By Type

- 5.3.1 DC High Power

- 5.3.2 DC Low Power

- 5.3.3 AC

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 EnBW Baden Wurttemberg AG

- 6.2.2 Charge Point

- 6.2.3 Allego GmbH

- 6.2.4 E.On Energie

- 6.2.5 Shell recharge solutions

- 6.2.6 ABB

- 6.2.7 Evbox (ENGIE)

- 6.2.8 Siemens AG

- 6.2.9 Leviton Manufacturing Co. Inc.

- 6.2.10 EV Solutions (Webasto)*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX