PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431737

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1431737

Latin America Pharmaceutical Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

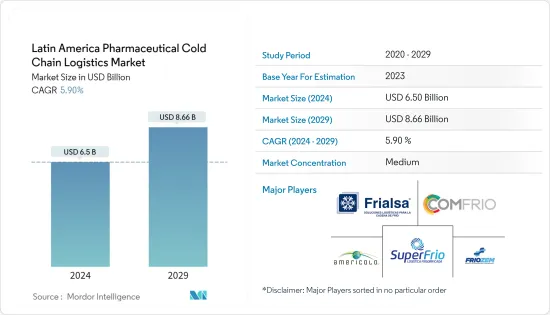

The Latin America Pharmaceutical Cold Chain Logistics Market size is estimated at USD 6.5 billion in 2024, and is expected to reach USD 8.66 billion by 2029, growing at a CAGR of 5.90% during the forecast period (2024-2029).

Key Highlights

- In Latin America, demand for cold chain logistics services surged as a result of the COVID-19 pandemic's increased demand for pharmaceuticals, especially vaccinations. The pandemic has also brought to light the significance of preserving the cold chain's integrity while transporting and storing vaccines and other medicinal items.

- The Latin American pharmaceutical cold chain logistics market is expanding quickly and is anticipated to do so over the next few years. The expanding need for temperature-controlled logistics, the rising demand for pharmaceutical products, and the pharmaceutical industry's increased emphasis on quality and safety are some of the drivers driving the market.

- Due to the rising demand for vaccinations in the area, the vaccine segment is anticipated to account for a sizeable portion of the market. Due to the growing number of biopharmaceutical products being developed and manufactured in the area, the biopharmaceutical segment is also anticipated to expand.

- Due to the growing demand for pharmaceutical items to be transported in a temperature-controlled environment, the transportation sector is anticipated to account for a sizeable portion of the market. Due to the growing demand for pharmaceutical products to be stored under temperature control, the warehousing industry is also anticipated to expand.

- It is anticipated that nations like Brazil, Mexico, and Argentina will dominate the industry. The demand for pharmaceutical cold chain logistics services in the region is anticipated to be driven by the huge populations of these nations and their expanding pharmaceutical industries.

Latin America Pharmaceutical Cold Chain Logistics Market Trends

Demand for pharmaceutical products in Latin America

Due to the region's rising need for pharmaceutical products, Latin America's pharmaceutical sector is expanding significantly. In the upcoming years, the market values of the pharmaceutical sector in Latin America are anticipated to rise due to a number of causes.

The rising incidence of chronic diseases in the region is one of the major drivers boosting the pharmaceutical business in Latin America. The World Health Organisation estimates that chronic diseases cause 71% of all fatalities in Latin America. This has increased the need for pharmaceutical medicines to treat various chronic illnesses, such as cancer, diabetes, and cardiovascular disorders.

The region's expanding population is another element boosting Latin America's pharmaceutical business. The United Nations projects that 780 million people will live in Latin America by the year 2050. To address the needs of the expanding population's healthcare, this has increased the demand for pharmaceutical items.

The region's pharmaceutical business is expanding as a result of Latin America's growing emphasis on healthcare. Governments in many Latin American nations are taking steps to expand the pharmaceutical business as part of their efforts to strengthen the healthcare infrastructure. As a result, there is now more demand in the area for pharmaceutical goods.

Another element boosting the development of the pharmaceutical sector in Latin America is the rising demand for generic medications. Because they are less expensive than name-brand medications, generic medicines are more readily available to patients in the area. As a result, there is now a higher demand for generic medications, which has helped the pharmaceutical business in the area expand.

The growing use of digital technologies in the healthcare field benefits the pharmaceutical industry in Latin America as well. Access to healthcare services is becoming more readily available in the area because of digital technology like telemedicine and electronic health records. Support for these digital healthcare services has increased the demand for pharmaceutical products.

Growth of biopharmaceutical industry in Latin America

The rising need for healthcare services, particularly in developing nations like Brazil, Mexico, and Argentina, is one of the major factors driving expansion in the Latin American biopharmaceutical sector. There is a higher need for healthcare services and treatments for chronic diseases, including cancer, diabetes, and cardiovascular disease, as the population in these countries continues to age and grow. As a result, there is an increasing need for biopharmaceutical goods and services, such as biologic medicines, vaccines, and diagnostic testing.

Increased government and private sector investment in healthcare infrastructure is another element boosting the biopharmaceutical industry's development in Latin America. Numerous nations in the region have started comprehensive healthcare reform initiatives with the goal of enhancing access to treatments and boosting coverage.

Increased funding for healthcare infrastructure, as well as the development of new hospitals, clinics, and research institutions, have resulted from this. In addition, many nations in the area have put in place regulations designed to encourage innovation in the biopharmaceutical sector, such as tax breaks for R&D and faster regulatory procedures for new drug approvals.

Last but not least, Latin America's biopharmaceutical sector has benefited from an expanding pool of highly qualified workers, including researchers, scientists, and medical specialists. Many nations in the area have made significant investments in healthcare professional education and training programs, and there are an increasing number of universities and research centers devoted to biopharmaceutical R&D. In order to promote innovation and hasten the creation of new biopharmaceutical goods and services, numerous regional businesses have also formed alliances with foreign businesses and research organizations.

The Latin American biopharmaceutical industry is expected to be worth USD 29.56 billion in 2022. By 2025, the amount was predicted to rise to USD 38.99 billion, and by 2028, it would reach USD 46.89 billion. Neurology, infectious disorders, diabetes, cancer, cardiovascular, and other therapeutic fields are all included in biopharmaceuticals.

Latin America Pharmaceutical Cold Chain Logistics Industry Overview

The Latin American pharmaceutical cold chain logistics market is the biggest market in this area in Brazil, which Mexico, Argentina, and Columbia follow. The existence of both domestic and foreign businesses has caused the market to be fragmented.

The largest players in the LATAM region's cold storage market continue to grow as a result of mergers and consolidation. Many businesses in developed markets keep growing and buying up rival businesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends and Automation

- 4.3 Spotlight on Ambient/Temperature-controlled Storage

- 4.4 Impact of Emission Standards and Regulations on Cold Chain Industry

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Government Regulations and Initiatives

- 4.7 Trends in Intermodal Transportation in Europe

- 4.8 Impact of the COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Increasing demand for temperature - sensitive drugs

- 5.1.2 The growing pharmaceutical industry

- 5.2 Restraints

- 5.2.1 High cost of cold chain logistics

- 5.2.2 The limited availability of skilled personnel

- 5.3 Opportunities

- 5.3.1 Increasing demand for biologics and biosimilars

- 5.3.2 The development of new technologies to improve cold chain logistics

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Storage

- 6.1.2 Transportation

- 6.1.3 Value-Added Services

- 6.2 By Destination

- 6.2.1 Domestic

- 6.2.2 International

- 6.3 By Geography

- 6.3.1 Mexico

- 6.3.2 Brazil

- 6.3.3 Colombia

- 6.3.4 Rest Of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Frialsa Frigorificos SA.

- 7.2.2 Comfrio SoluCoes LogIsticas.

- 7.2.3 Friozem Armazens Frigorificos.

- 7.2.4 Superfrio Armazens Gerais.

- 7.2.5 Americold Logistics.

- 7.2.6 Brasfrigo

- 7.2.7 Arfrio Armazens Gerais Frigorificos

- 7.2.8 Ransa Comercial SA

- 7.2.9 Localfrio

- 7.2.10 Qualianz*

8 FUTURE OF THE MARKET

9 APPENDIX