PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637796

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637796

North America Medical Imaging Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

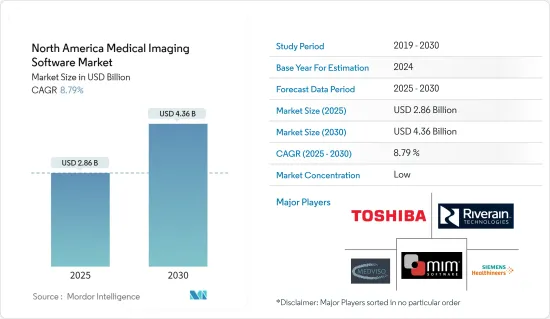

The North America Medical Imaging Software Market size is estimated at USD 2.86 billion in 2025, and is expected to reach USD 4.36 billion by 2030, at a CAGR of 8.79% during the forecast period (2025-2030).

The growing demand for medical imaging devices is one of the major factors driving the development and adoption of medical imaging software. Medical imaging devices such as X-rays, CT scanners, MRI machines, and ultrasound machines produce vast data in digital images. Medical imaging software processes, analyzes and manages this data, allowing healthcare professionals to make accurate diagnoses and develop effective treatment plans.

Key Highlights

- The increasing prevalence of an chronic diseases such as cancer, , neurological disorders and cardiovascular disease is fueling the demand for medical imaging devices and software. Moreover, medical imaging software is able to deliver more accurate and precision diagnosis thanks to the development of technologies like machine learning and AI.

- Medical imaging is also increasing due to the growing aging population in North America. As the population ages, there is a higher incidence of chronic diseases and conditions that require medical imaging for diagnosis and treatment. The increased competition among players in the market is leading to a greater focus on patient care and outcomes, and medical imaging is a critical component of this. Medical imaging provides healthcare providers valuable information to make accurate diagnoses, develop treatment plans, and monitor patient progress.

- Market growth is anticipated has been driven by the growing incidence of lifestyle disorders, increasing demand for timely detection tools, technical advances in reducing time periods, enhanced government investment and reimbursement initiatives as well as new facilities being added by market players in developing countries.

- Security issues are a primary factor restraining the growth of the medical imaging software market. Medical imaging software stores and manages sensitive patient data, including medical images, personal information, and medical records. As such, there is a significant risk of this data being compromised or stolen, which can severely affect patient privacy and safety.

- The COVID-19 pandemic significantly impacted the North American medical imaging software market. With the outbreak of the pandemic, healthcare providers in North America faced unprecedented challenges in delivering patient care, and medical imaging software played a critical role in managing and analyzing patient data remotely. The post-COVID-19 period will likely see continued demand for medical imaging software. The focus on telemedicine and remote patient care is expected to persist, and medical imaging software will play a critical role in enabling remote consultations and diagnoses.

North America Medical Imaging Software Market Trends

Dental Application Segment is Expected to Hold Significant Market Share

- Medical imaging software is commonly used in dental applications to assist with the diagnosis and treatment planning of various dental conditions. There are several types of imaging software used in dentistry.

- The software analyzes digital images of the patient's teeth and surrounding structures. It can be used to measure the size and shape of teeth, detect cavities or other dental issues, and track changes over time. According to the US Department of Veterans Affairs, In 2013, approximately 4.18 million people in dental care were visited or treated by the Department of Veterans Affairs, United States. Some veterans may seek dental care outside of the VA system due to long wait times or limited availability of dental services at VA clinics. The number of Dental care at the Department of Veteran Affairs in the United States is expected to drop to around 3.51 million by 2025.

- The software lets dentists capture high-quality digital X-ray images of a patient's teeth and surrounding structures. The images can be easily manipulated to enhance the details and provide a clearer view of dental issues.

- The software uses cone beam computed tomography (CBCT) technology to capture 3D images of the patient's teeth and jaw. This type of imaging provides detailed information about the teeth, bone, and soft tissue structures, which is especially useful in implant planning and orthodontic treatment.

- Medical imaging software plays a major crucial role in dental applications by providing dentists with the detailed information they need to accurately diagnose and treat various dental conditions.

United States is Expected to Hold a Significant Market Share

- The medical imaging software market in the United States is one of the largest and most mature markets globally. The country has a well-established healthcare infrastructure and high adoption rates of advanced medical imaging technologies, which has driven the growth of the medical imaging software market.

- The medical imaging software market in the United States is expected to grow, driven by technological advancements, increasing demand for diagnostic procedures, and the need for faster and more accurate diagnostic results. Several medical imaging software tools are used to diagnose and manage lung and bronchus cancer. According to the American Cancer Society, it is estimated such that in 2023 there will be approximately 2,38,340 new lung and bronchus cancer cases in the United States. The maximum number of these cases is estimated to be in Florida.

- The United States medical imaging software market is also expected to benefit from the increasing investment in research and development activities to develop more advanced medical imaging technologies. Additionally, the growing adoption of artificial intelligence and machine learning in medical imaging software is expected to drive market growth in the coming years.

- Moreover, in April 2023, Annalise.ai, a global Medical Imaging and radiology artificial intelligence (AI) startup, announced that it gained FDA 510(k) approvals for an additional seven results as part of the firm's AI-assisted triage and notification (CADt) solutions. The clearance builds on the development plan of Annalise and momentum in the US market, which includes a set of timesensitive stroke results and an extension to chest Xray findings.

North America Medical Imaging Software Industry Overview

North America Medical Imaging Software Market is highly fragmented, with major players like Toshiba, Riverain Technologies, Siemens Healthineers, Medviso, and MIM Software. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In November 2023 - Siemens Healthineers has anoounced Potential of Generative AI in Medical Technology, Where the company not only focuses on image or text applications - it combines them. A chat system loads, links, and prepares the appropriate answers, reports, and images.

- In August 2023 - Riverain Technologies has announced that Dayton VA Medical Center has been usded ClearRead CT with CVI for faster and reliable detection of lung cancer in veteran patients, where Clear Read CT with Visual Intelligence is the only and proven solution that has been shown to substantially improve lung nodule diagnosis.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of COVID-19 on the Market.

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Medical Imaging Devices

- 5.1.2 Increasing Number of Players in Healthcare

- 5.2 Market Restraints

- 5.2.1 Security Issues

6 MARKET SEGMENTATION

- 6.1 By Imaging Type

- 6.1.1 2D Imaging

- 6.1.2 3D Imaging

- 6.1.3 4D Imaging

- 6.2 By Application

- 6.2.1 Dental

- 6.2.2 Orthopedic

- 6.2.3 Cardiology

- 6.2.4 Obstetrics and Gynecology

- 6.2.5 Mammography

- 6.2.6 Urology and Nephrology

- 6.2.7 Other Applications

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Toshiba

- 7.1.2 Riverain Technologies

- 7.1.3 Siemens Healthineers

- 7.1.4 Medviso

- 7.1.5 MIM Software

- 7.1.6 Philips

- 7.1.7 QI Imaging

- 7.1.8 General Electric Healthcare

- 7.1.9 Amirsys

- 7.1.10 Brain Innovation

- 7.1.11 McKesson

- 7.1.12 VidiStar LLC

- 7.1.13 Carestream Health

- 7.1.14 Claron Technology

- 7.1.15 Esaote

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET