PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1432864

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1432864

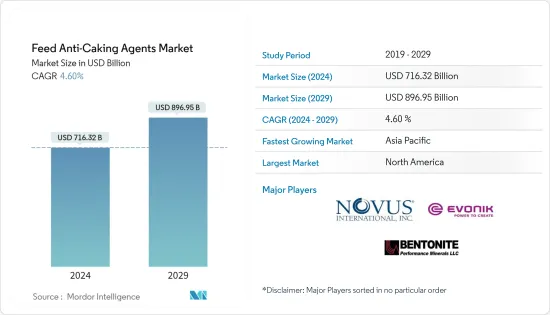

Feed Anti-Caking Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Feed Anti-Caking Agents Market size is estimated at USD 716.32 billion in 2024, and is expected to reach USD 896.95 billion by 2029, growing at a CAGR of 4.60% during the forecast period (2024-2029).

The expansion of the animal feed market is driving the growth of the market studied. Moreover, the rising need for a high-quality feed and an increase in the number of feed additives, especially in the compound feed industry, are the major growth drivers of the market studied.

Feed Anti-Caking Agents Market Trends

Expansion of the Compound Feed Industry is Driving the Market's Growth

The market studied is primarily driven by the expansion of the animal feed market. As the livestock industry registered a low growth rate, there is an increasing need for animal feed. This is expected to drive the demand for feed additives, particularly feed anti-caking agents. Moreover, silicates are widely used as anti-caking agents, as silicates can absorb, both, water and oil. Sodium and calcium products, such as sodium ferrocyanide and tricalcium phosphate are witnessing high demand, as they reduce individual adhesion of feed.

North America and Europe are the Major Regions in the Market

The North American region is the largest geographical segment in the global feed anti-caking agents market, closely followed by Europe. Poultry and swine accounted for 40% and 25% of the market share, respectively. The United States accounted for almost 70% of the regional market share, mainly due to its well-established livestock production industry. Additionally, the need for high-quality feed is driving the growth of the market studied.

Feed Anti-Caking Agents Industry Overview

The feed anti-caking agent market is highly fragmented, with the presence of various small and medium-sized companies and a few major players. Thus, there is high competition in the market studied. Furthermore, in the market studied, companies are not only competing on the basis of the quality of equipment and promotion but also are focusing on strategic moves, in order to account for the largest market share. New product launches, partnerships, and acquisitions are the major strategies adopted by the leading companies in the feed anti-caking agents market, globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Chemical Type

- 5.1.1 Silicon-based

- 5.1.2 Sodium-based

- 5.1.3 Calcium-based

- 5.1.4 Potassium-based

- 5.1.5 Other Chemical Types

- 5.2 Animal Type

- 5.2.1 Ruminant

- 5.2.2 Poultry

- 5.2.3 Swine

- 5.2.4 Aquaculture

- 5.2.5 Other Animal Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Thailand

- 5.3.3.5 Vietnam

- 5.3.3.6 Australia

- 5.3.3.7 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Novus International

- 6.3.2 BASF SE

- 6.3.3 Archer Daniels Midland Company

- 6.3.4 Evonik Industries

- 6.3.5 Bentonite Performance Minerals LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS