PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850394

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850394

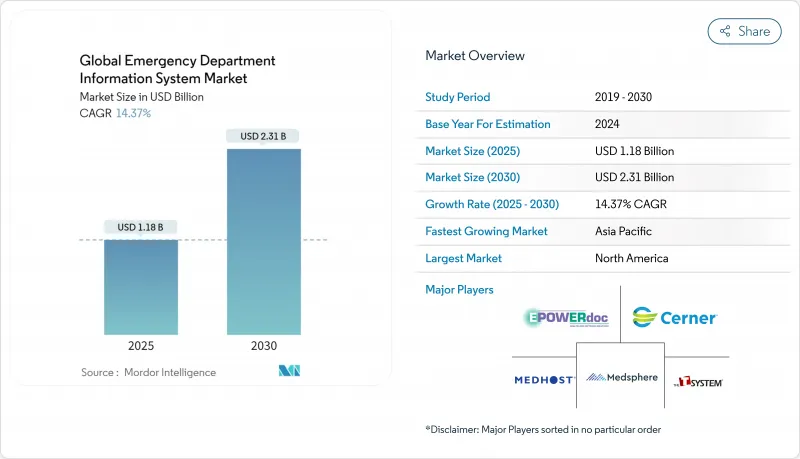

Global Emergency Department Information System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Emergency Department Information System market size stood at USD 1.18 billion in 2025 and is forecast to reach USD 2.31 billion by 2030, advancing at a 14.37% CAGR.

Wider adoption is driven by mandatory time-to-treatment indicators, the integration of AI-enabled clinical decision support, and a swift shift toward SaaS deployment in community hospitals. Providers are deploying these systems to cut overcrowding, comply with quality mandates, and secure reimbursement tied to patient-centric metrics cms.gov. Tighter cybersecurity expectations, meanwhile, push vendors to embed zero-trust architectures without slowing clinical workflows. Competitive dynamics are evolving quickly after Oracle's acquisition of Cerner, which opened white-space for specialist vendors and widened Epic's installed-base lead.

Global Emergency Department Information System Market Trends and Insights

AI-enabled clinical decision support integration

AI tools now match human acuity classification accuracy at 89% and have cut emergency cardiovascular time-to-treatment by 205.4 minutes, proving value in real-world triage . Large providers such as HCA Healthcare run ambient documentation across 184 departments with 99% patient acceptance. Equally important, predictive models outperform traditional scoring with AUROC readings above 0.92, positioning AI as a core differentiator in both outcomes and operational efficiency.

Increasing patient-centric quality-metric reimbursement models

Medicare's Value-Based Purchasing ties hospital payment to throughput and experience scores, making emergency department performance a direct revenue lever. Declining commercial reimbursements heighten the urgency to streamline workflows, while new equity measures rolling out in 2024 embed social determinants into emergency metrics. Hospitals that adapt early can safeguard margins and mitigate the 3.8% revenue erosion documented from 2018 to 2022.

Cyber-security breach liabilities and insurance premiums

Average breach cost climbed to USD 9.77 million in 2024 and hospitals can lose USD 2 million daily during attacks, prompting CFOs to delay non-essential IT rollouts. Rising cyber-insurance loss ratios are pushing premiums up, particularly for cloud-dependent workflows.

Other drivers and restraints analyzed in the detailed report include:

- Rapid growth of SaaS-based EDIS in community hospitals

- Mandatory time-to-treatment key performance indicators

- Surge in real-time health-data exchange frameworks (FHIR, TEFCA)

- Edge analytics & 5G deployment in ambulance-to-ED data flow

- Clinician burnout linked to complex EHR interfaces

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Patient Tracking & Triage captured 36.19% of Emergency Department Information System market share in 2024 as hospitals prioritized real-time bed status and acuity dashboards. The segment's dominance is reinforced by regulatory focus on door-to-doctor benchmarks and by AI tools that flag sepsis and stroke earlier than manual checks. E-Prescribing is the fastest riser at a 14.82% CAGR, fueled by opioid-risk monitoring that mandates electronic scripts across many US states. Clinical Documentation holds significant weight as large providers deploy ambient voice capture to trim physician screen time. CPOE adoption remains steady because medication safety protocols demand closed-loop orders. Emerging analytics that fold predictive acuity scoring into triage modules hint at future convergence where a single workflow covers initial assessment through documentation.

Looking forward, patient-tracking modules will integrate with 5G telemetry to ingest ambulance vitals long before arrival, while triage engines will layer natural-language queries on top of machine-learning recommendations. Hospitals continuing to run siloed tracking boards risk missing capacity triggers that AI can surface minutes sooner. As quality-metric reimbursement deepens, even smaller facilities will adopt advanced triage dashboards that now sit only in academic centers. The Emergency Department Information System market will therefore see rising license penetration for multi-module suites that merge tracking, prescribing, and documentation into a unified record.

SaaS delivery held 65.27% share of the Emergency Department Information System market size in 2024. Providers cite lower up-front capital, faster go-live timelines, and automatic regulatory updates as key reasons. Community hospitals with lean IT teams offload maintenance to vendors, freeing budgets for analytics add-ons. Large health systems still expand cloud footprints but also maintain on-premise clusters for latency-sensitive imaging, which explains the segment's 15.12% CAGR outlook. The post-pandemic workforce crunch accelerates cloud uptake because remote upgrades need fewer in-house engineers.

Hybrid patterns will deepen as edge gateways process high-frequency vitals locally while archiving summary data to a central cloud. Cyber-insurance stipulations now require explicit disaster-recovery run-books, favoring SaaS vendors with audited redundancy. International expansion highlights bandwidth challenges yet multi-zone architectures and offline sync mitigate outages. As regulatory audits increasingly ask for immutable log trails, cloud providers offering real-time compliance dashboards gain mind-share. Growth in the Emergency Department Information System market will therefore pivot on vendor ability to mix cloud economics with hospital-grade resilience.

The Emergency Department Information System Market Report Segments the Industry Into by Application (Computerized Physician Order Entry (CPOE), Clinical Documentation, Patient Tracking & Triage, and More), by Deployment (On-Premise EDIS, Software-As-A-Services (SaaS)), by Software Type (Enterprise Solutions, Best of Breed (B. O. B. ) Solutions), by End User (Small Hospitals, Medium-Sized Hospitals, Large Hospitals), and Geography.

Geography Analysis

North America retained 45.25% of Emergency Department Information System market revenue in 2024. CMS quality reporting and Joint Commission accreditation oblige hospitals to document admit-decision-to-departure metrics, and over 130 million annual ED visits intensify the need for precise patient tracking. Medicare payment declines recorded between 2018 and 2022 add financial urgency to efficiency drives. TEFCA rollout and FHIR incentives further compel platform upgrades that guarantee real-time interoperability. Large networks such as Providence Health & Services pursue aggressive cost containment, underscoring technology's role in offsetting reimbursement stress.

Asia-Pacific is the fastest-growing region at a 15.94% CAGR to 2030. Governments fund hospital modernization and private chains forecast high profit margins from digital expansion. 5G medical command centers in China extend rescue reach and cut cross-district transfer times, proving the value of advanced connectivity. Yet rising bankruptcies among Chinese hospitals highlight uneven financial health, requiring modular pricing that scales with volume. In Southeast Asia, directors prioritize diagnostic imaging and primary care investments which naturally link to emergency-department digital tools.

Europe posts steady uptake shaped by national health-service structures and interoperability regulations. Germany's Hospital Future Act channels more than EUR 4 billion into digital projects, and audits reveal hospitals excel in infrastructure yet lag in telehealth penetration. The European Health Data Space will standardize record formats, aiding cross-border patient flows. Projects such as eCREAM aim to harmonize emergency documentation, while Italian studies show that larger, teaching hospitals digitize fastest, especially where emergency rooms act as transformation anchors. Eastern European systems seek coordinated funding to bridge their maturity gaps.

- Oracle Health (Cerner)

- Epic Systems

- MEDHOST Inc.

- Meditech

- Allscripts

- Mckesson

- UnitedHealth Group (Optum Insight)

- EPOWERdoc Inc.

- T-Systems International

- Evident (CPSI)

- Logibec Inc.

- Medsphere Systems

- Picis Clinical Solutions

- Wellsoft Corporation

- Dedalus Group

- Koninklijke Philips

- Ascom

- Cantata Health

- VitalHub Corp.

- Global Health Ltd (MasterCare)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-enabled clinical decision-support integration

- 4.2.2 Increasing patient-centric quality-metric reimbursement models

- 4.2.3 Rapid growth of SaaS-based EDIS in community hospitals

- 4.2.4 Mandatory time-to-treatment key performance indicators

- 4.2.5 Surge in real-time health-data exchange frameworks (FHIR, TEFCA)

- 4.2.6 Edge analytics & 5G deployment in ambulance-to-ED data flow

- 4.3 Market Restraints

- 4.3.1 Cyber-security breach liabilities & insurance premiums

- 4.3.2 Clinician burnout linked to complex EHR user-interfaces

- 4.3.3 Fragmented middleware standards for device integration

- 4.3.4 Budget freezes in public hospitals post-pandemic

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Application

- 5.1.1 Computerized Physician Order Entry (CPOE)

- 5.1.2 Clinical Documentation

- 5.1.3 Patient Tracking & Triage

- 5.1.4 E-Prescribing

- 5.1.5 Others

- 5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Software-as-a-Service (SaaS)

- 5.3 By Software Type

- 5.3.1 Enterprise Solutions

- 5.3.2 Best-of-Breed (BoB) Solutions

- 5.4 By End User

- 5.4.1 Small Hospitals (<=100 beds)

- 5.4.2 Medium-Sized Hospitals (101-299 beds)

- 5.4.3 Large Hospitals (>=300 beds)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 APAC

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of APAC

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Oracle Health (Cerner)

- 6.3.2 Epic Systems Corporation

- 6.3.3 MEDHOST Inc.

- 6.3.4 MEDITECH

- 6.3.5 Allscripts Healthcare Solutions

- 6.3.6 McKesson Corporation

- 6.3.7 UnitedHealth Group (Optum Insight)

- 6.3.8 EPOWERdoc Inc.

- 6.3.9 T-Systems International

- 6.3.10 Evident (CPSI)

- 6.3.11 Logibec Inc.

- 6.3.12 Medsphere Systems

- 6.3.13 Picis Clinical Solutions

- 6.3.14 Wellsoft Corporation

- 6.3.15 Dedalus Group

- 6.3.16 Philips Healthcare

- 6.3.17 Ascom Holding AG

- 6.3.18 Cantata Health

- 6.3.19 VitalHub Corp.

- 6.3.20 Global Health Ltd (MasterCare)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment