PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433839

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1433839

Vietnam Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

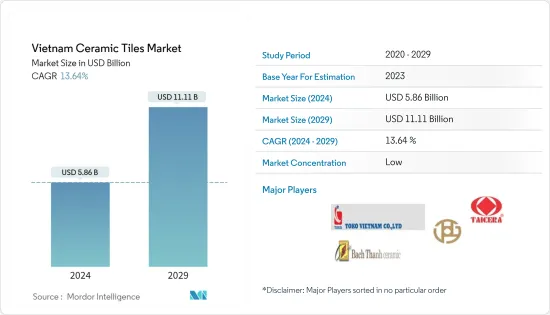

The Vietnam Ceramic Tiles Market size is estimated at USD 5.86 billion in 2024, and is expected to reach USD 11.11 billion by 2029, growing at a CAGR of 13.64% during the forecast period (2024-2029).

Vietnam exports ceramic products majorly to Taiwan, Japan, Thailand, Cambodia, Malaysia, Indonesia, the United States, and Australia. In Vietnam, most of the imports of ceramic products are from China. Ceramics tile is very popular in Vietnam and has been used for many years, along with granite and porcelain tiles. Increasing construction spending is a key factor, which is driving the ceramic tiles market. The advancements in digital printing technology are being increased by the vendors to provide ceramic tiles with a wide range of design aesthetics. Ceramic tiles are widely used in residential and commercial buildings, owing to their durability and crack resistance nature. Protective coatings on ceramic tiles offer high water resistance and stain protection. Vietnam is one of the leading countries in Asia, in terms of tiles manufacturing. Tile products are not only used for domestic consumption, but also for export purposes. Vietnam is one among the top tile exporters in the world. In 2018, Argentina's Ministry of Production issued an order to apply an anti-dumping duty of 31.15% on ceramic tiles imported from Vietnam.

Vietnam Ceramic Tiles Market Trends

Production of Ceramic Tiles in Vietnam

Vietnam ranks fifth in the list of top ceramic tiles producing countries in the world. The fierce competition in both the domestic and export markets is forcing ceramic producers to improve their production process and product quality. Vietnam has developed a significant advantage in exporting ceramic products. To enhance the value of Vietnamese ceramic products, many businesses have intensified the application of new technologies in production to create high-quality products at reasonable costs. Diversifying products by mixing traditional Vietnamese or Asian features with western ones is the basic trend in many countries.

Consumption of Ceramic Tiles in Vietnam

Vietnam is one of the fastest growing countries, in terms of consumption of ceramic tiles. Home decoration tiles are mainly used in the living room, kitchen and bathroom walls, and other spaces, with strong decoration, and therefore, they have conspicuous consumption attributes. In addition to their functions, consumers also focus on external factors, such as brand, appearance, and taste. The replacement of the product structure caused by the changing trend of tiles consumption will not only accelerate the expansion of the mid- and high-end market capacity, but also accelerate the formation of the industry leaders. These new consumption trends have greatly enhanced the competitive barriers of manufacturers in product development, terminal image, user services, and supply chain capabilities.

Vietnam Ceramic Tiles Industry Overview

The report covers major international players operating in the Vietnamese ceramic tiles market. In terms of market share, few of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints/Challenges

- 4.4 Industry Supply Chain/Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.6 Recent Developments in the Market

- 4.7 Technological Trends

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Glazed

- 5.1.2 Porcelain

- 5.1.3 Scratch Free

- 5.1.4 Other Products

- 5.2 By Application

- 5.2.1 Floor Tiles

- 5.2.2 Wall Tiles

- 5.2.3 Other Applications

- 5.3 By Construction Type

- 5.3.1 New Construction

- 5.3.2 Replacement and Renovation

- 5.4 By End-User

- 5.4.1 Residential

- 5.4.2 Commercial

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Toko Vietnam Co. Ltd

- 6.2.2 Prime Group

- 6.2.3 VIGLACERA Corporation

- 6.2.4 Dong Tam Tile

- 6.2.5 Taicera Ceramic

- 6.2.6 TASA Ceramic Joint Stock Company

- 6.2.7 Catalan JSC

- 6.2.8 AMY GRUPO

- 6.2.9 Thachban Group Joint Stock Company

- 6.2.10 Bach Thanh Ceramic

7 FUTURE OF THE MARKET

8 DISCLAIMER