PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1434284

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1434284

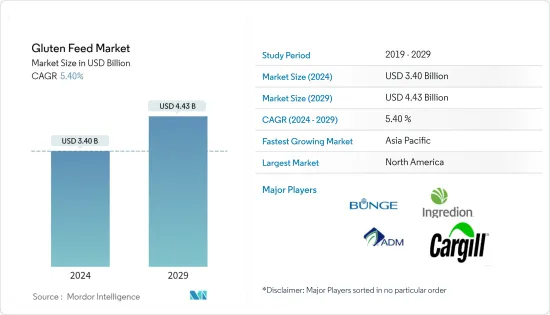

Gluten Feed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Gluten Feed Market size is estimated at USD 3.40 billion in 2024, and is expected to reach USD 4.43 billion by 2029, growing at a CAGR of 5.40% during the forecast period (2024-2029).

Rapid industrialization in the livestock sector, feed, and processed meat industry have necessitated the application of gluten feed that acts as a nutrient enhancer, which provides the animal with all required essential elements for optimum growth. With the increasing awareness regarding its nutritional benefits, the use of gluten feed is becoming a necessity for retaining animal health and growth.As a result of increasing issues regarding environmental impact and sustainability of byproducts has increased the demand for gluten feed products. The economic value of gluten feed is completely dependent on the prices of whole grain along with the protein feeds.

Gluten Feed Market Trends

Increasing Demand for Animal-Based Protein Sources

Increasing pressure on the livestock industry has intensified in the recent years, to meet the growing demand for meat and high-value animal protein. Population growth, rising incomes in developing nations, and urbanization has led to a surge in the global livestock consumption. The level of income and consumption of animal protein have been found to be directly correlated to the consumption of milk, meat, and eggs, which is increasing at the expense of staple foods. Due to the decline in prices of meat and meat products, developing countries are beginning to consume large quantities of meat, at much lower levels of gross domestic product than industrialized countries. Urbanization has led to higher demand for meat and milk products in cities compared to the rural areas, resulting in the rising per capita consumption from 42.13 kg in 2010 to 43.53 kg in 2014. Increasing life expectancy and limited availability of land and water resources for animal feed production coupled with the robust demand for animal-based protein sources is driving the market for global gluten feed.

Increasing Demand from Asia-Pacific Region

Worldwide, livestock production and demand has seen a surge over the past few decades specifically, due to the increasing market share of the Asia-Pacific countries. There has been a remarkable growth in the production and consumption of livestock products in countries, like China, India, and Japan. With the continuous economic growth of developing countries, consumer preference has been shifting towards more meat-based and animal-based products. Lifestyle changes and high purchasing power of consumers coupled with changing spending patterns are some of the reasons for high growth and demand. The Asia-Pacific region is poised to grow at a faster and impressive rate in the coming years, in both production and consumption of animal-based products. With the industrialization of the sector, the usage of feed probiotics will definitely increase. The developing countries of Asia are expected to present a major growth opportunity for the gluten feed industry.

Gluten Feed Industry Overview

The results of market share analysis indicate a fragmented market, with major companies accounting for only 45% of the market share, in spite of having diverse and increasing product portfolios. Three categories of players operate in the market, namely, research and development firms, manufacturing firms and sales companies, and brand owners. Furthermore, the market consists of a number of integrated players, i.e., those who are active in the entire B2B value chain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of Substitute Products

- 4.5.4 Threat of New Entrants

- 4.5.5 Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Wheat

- 5.1.2 Corn

- 5.1.3 Barley

- 5.1.4 Rye

- 5.1.5 Maize

- 5.1.6 Others

- 5.2 Application

- 5.2.1 Swine

- 5.2.2 Poultry

- 5.2.3 Cattle

- 5.2.4 Aquaculture

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Bunge Ltd.

- 6.3.2 Ingredion Incorporated

- 6.3.3 Archer Daniels Midland Company

- 6.3.4 Cargill Incorporated

- 6.3.5 Tate & Lyle Plc

- 6.3.6 The Roquette Group

- 6.3.7 AGRANA Beteiligungs-AG

- 6.3.8 Tereos

- 6.3.9 Commodity Specialists Company

- 6.3.10 Aemetis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS