PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435200

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435200

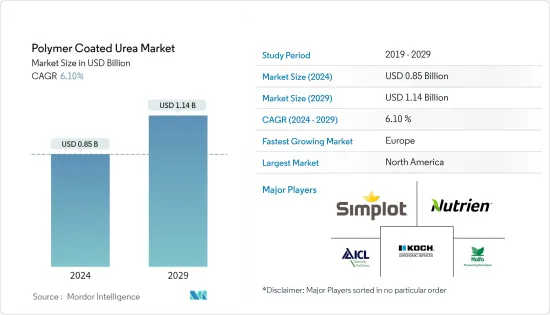

Polymer Coated Urea - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Polymer Coated Urea Market size is estimated at USD 0.85 billion in 2024, and is expected to reach USD 1.14 billion by 2029, growing at a CAGR of 6.10% during the forecast period (2024-2029).

Key Highlights

- North America occupied the largest share in the market in 2019, reaching a total value of USD 260.0 million during the year. Nitrogen losses from soybean cultivation are a major threat to the environment in the country, which has further augmented the demand for polymer-coated urea fertilizer. Additionally, the increasing number of golf courses across North America, which were at 19,826 in 2019, as compared to 18,145 in 2017, has driven the demand for the same in recent years.

- Europe was the fastest-emerging market in 2019. The European Commission launched a Circular Economy Action Plan in early 2018, which proposed to restrict the usage of microplastics in products such as artificial turfs. This, in turn, will push forward the demand for natural grass, and subsequently, the demand for polymer-coated urea fertilizers in the region, as the fertilizer variety helps maintain grass color and vigor.

- The market share analysis market share analysis indicated a consolidated polymer-coated urea market with global leaders occupying a larger market share. Nutrien Ltd, J.R.Simplot Company, Koch Agronomic Service, Haifa Group, ICL Specialty Fertilizers, and DeltaChem GmbH, are some of the major players in the market.

Polymer Coated Urea Market Trends

North America Dominates the Market

According to USDA-NASS, 2019, despite the weather conditions being unfavorable (wet spring followed by cool June), the American corn farmers increased the area harvested under maize to 91.7 million in 2019, which was up by 3% from the previous year. This was owing to the increased adoption rate of cutting-edge fertilizers like poly-coated fertilizers, which are even biodegradable. The demand for cotton is on the rise in North America, as cotton is one of the major commercial crops, where fertilization plays a vital role in improving the quality of fiber. In accordance with 4R nutrient stewardship, which includes the right fertilizer source, at the right time, right place, and with right rate, poly-coated fertilizers have been noted to enhance nutrient-use efficiency in cotton. Further in 2019, Agriculture and Agri-Food Canada (AAFC) stated that wheat and canola production in the country is on the rise. This increase in the production of the majorly grown crops is further expected to the market for polymer-coated urea fertilizers in the country.

Europe is the Fastest-growing Market for Polymer-coated Urea Fertilizers

According to a research conducted in Finland in 2018, controlled release or slow-release fertilizers ensure nitrogen availability for the entire crop cycle. It was also noticed that due to low grain protein content, wheat lots were not suitable for milling in the region. This can be overcome by the application of biodegradable polymer-coated urea fertilizers. According to a research article published by PLOS UK in 2015, the use of controlled-release fertilizers has reduced ammonia volatilization by 51.3% in the country, and also enhanced the photosynthetic rate of maize. This is likely to boost the use of controlled-release fertilizers, including biodegradable polymer-coated urea fertilizers in the future. Furthermore, apple production is highly labor-intensive with operations involving growing (also includes fertilizer application to soil), pruning, and harvesting. There is a shortage of farm labor in the Western Europe region and labor costs are high. Hence, there is a need to replace conventional fertilizers with biodegradable polymer-coated urea fertilizers owing to fewer labor requirements due to reduced fertilizer application cycles.

Polymer Coated Urea Industry Overview

The polymer-coated urea fertilizer market is consolidated, resulting in the dominance of the global players over the market. Nutrien Ltd, J.R.Simplot Company, Koch Agronomic Service, Haifa Group, ICL Specialty Fertilizers, and DeltaChem GmbH, are some of the major players in the market. Mergers and acquisitions are one of the prime strategies followed by some companies, along with adopted partnership strategies for R&D support, and financial and marketing support. For instance, in 2018, Grupa Azoty acquired Compo Expert, which is the largest chemical company in Poland. With this acquisition, Grupa Azoty planned to increase its production and market outreach. An increase in the production capacity is also one of the key approaches observed among the fertilizer companies to meet the growing demand. Haifa Group started its CRF production facility at Savannah in 2016. This unit is expected to produce 20,000 metric ton of Multicote and Cote fertilizer, annually.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 PRODUCT OVERVIEW

- 4.1 Broad Acre Segment

- 4.2 Horticulture Segment

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

6 MARKET SEGMENTATION

- 6.1 Crop Type

- 6.1.1 Grains and Cereals

- 6.1.2 Pulses and Oilseeds

- 6.1.3 Commercial Crops

- 6.1.4 Fruits and Vegetables

- 6.1.5 Turf and Ornamentals

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Mexico

- 6.2.1.4 Rest of North America

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Netherlands

- 6.2.2.5 Russia

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Australia

- 6.2.3.4 Rest of Asia-Pacific

- 6.2.4 South America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Rest of South America

- 6.2.5 Africa

- 6.2.5.1 South Africa

- 6.2.5.2 Rest of Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Most Adopted Strategies

- 7.2 Market Share Analysis

- 7.3 Company Profiles

- 7.3.1 Nutrien Ltd

- 7.3.2 J.R.Simplot Company

- 7.3.3 Koch Agronomic Service

- 7.3.4 Haifa Group

- 7.3.5 ICL Specialty Fertilizers

- 7.3.6 DeltaChem GmbH

- 7.3.7 Florikan ESA LLC

- 7.3.8 Pursell agritech

- 7.3.9 Ekompany International BV

- 7.3.10 Knox Fertilizer Company Inc.

- 7.3.11 Compo Expert

8 MARKET OPPORTUNITIES AND FUTURE TRENDS