PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435227

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435227

Hospitality Industry in France - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

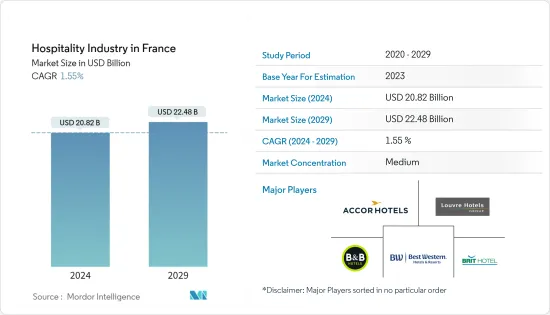

The Hospitality Industry in France Market size is estimated at USD 20.82 billion in 2024, and is expected to reach USD 22.48 billion by 2029, growing at a CAGR of 1.55% during the forecast period (2024-2029).

After an unprecedented year in 2020 due to COVID-19, 2021 marked the slow recovery of hotel industry performances toward their pre-crisis levels in France. Several phases were identified, with the first half of the year still very much affected by COVID restrictions, followed by the second period of clear improvement, driven by the coastal regions and the French province from the summer onwards, and finally, a gradual recovery in Paris at the end of the year. Overall, the French hotel industry closed in 2021 with a 43% drop in turnover compared to 2019.

The French hotel sector performance indicators continued to improve during 2022, confirming the positive trend observed for the entire first quarter of 2022. Although still down from the March 2019 performance, occupancy increased eight points compared to February 2022, reaching 56%. RevPAR also showed a slight increase during March 2022, but it remains down 3% from 2019 performance. Only the average revenue per room rented confirmed its increase compared to 2019, posting an 8% increase to EUR 95 (USD 101.3) in March 2022.

While encouraging for the coming months and the sector's recovery, this upward trend is likely to be impacted by continued inflation, rising wages, and energy prices due, in particular, to the war in Ukraine.

France has large leading international hotel groups such as Accor and Louvre. But unlike in many countries, 83 percent of the French hotels between one and four stars (60 percent in Paris) are independent with less financial backing and profitability. They belong either to individuals or to special-purpose vehicles, set up for individual tax exemption schemes. Ninety-three percent of the bookings go through online tourism agencies ('OTAs') and this system is favorable for both large groups and independent hotels.

France Hospitality Market Trends

Growing Occupancy Rate and RevPAR in Paris is Driving the Market

The overall Paris hotel market recorded a 4% compound annual growth rate in RevPAR between 2009 and 2019, mainly driven by an increase in average rates due to the increasing share of international guests and the move further upmarket of Paris's hotel supply.

Parisian hotels recorded an above-average occupancy rate compared to the regions and the French Riviera, reaching 71% during March 2022, but the gap to 2019 remained significant (-9%).

The average price also increased to EUR 164 (USD 175), up 7% compared to 2019. It was strongly boosted by Luxury and Palaces hotels, which recorded a 23% increase in their GCR. However, revenue remained down across all categories except Luxury and Palaces and stood at EUR 116 (USD 124).

Increasing Number of Tourists Boosting the Market

According to the latest Atout France business climate report, France did better than its European neighbors in 2021. The differences between the tourism numbers in France in 2019 and the present have been narrowing month by month. Regarding international revenues, France remains the European leader ahead of Spain and Italy. Cumulatively over the first 11 months of 2021, international tourism receipts amounted to EUR 31.4 billion (USD 33.5 billion), compared to EUR 26 billion (USD 27.7 billion) in Spain and EUR 20.6 billion (USD 22 billion) in Italy. The difference from 2019 is -40.4% in France, compared to -61.4% in Spain and -50.9% in Italy, reflecting better tourism resilience in France.

The volume of commercial tourist nights for domestic customers was up by 12.6% compared to 2020 (cumulative over the first 11 months) and down by only -7.5% compared to 2019. Compared to 2020, all destinations have seen an increase in domestic overnight stays, except mountain areas, due to the closure of the ski slopes.

France Hospitality Industry Overview

Domestic and other European brands largely dominate France's hospitality industry, which also has a high volume of international brands. AccorHotels is the leading player in the industry and holds a very diversified portfolio, from the budget segment to the luxury segment, followed by the Louvre Hotel Group and B&B Hotels. However, with technological advancement and service innovation, domestic to international companies are increasing their market presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.5 Leading Cities in France with Respect to the Number of Visitors

- 4.6 Investments (Real Estate, FDI, and Others) in the Hospitality Industry

- 4.7 Insights into the Revenue Flows from the Accommodation and Food and Beverage Sectors

- 4.8 Insights on Current Trends and Innovations in the Hospitality Industry

- 4.9 Insights into the Impact of Shared Living Spaces on the Hospitality Industry

- 4.10 Effects of Other Economic Contributors on the Hospitality Industry

- 4.11 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Chain Hotels

- 5.1.2 Independent Hotels

- 5.2 By Segment

- 5.2.1 Budget and Economy Hotels

- 5.2.2 Mid and Upper Mid-scale Hotels

- 5.2.3 Luxury Hotels

- 5.2.4 Service Apartments

6 COMPETITIVE INTELLIGENCE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 AccorHotels

- 6.2.2 Louvre Hotels Group

- 6.2.3 B&B Hotels

- 6.2.4 Brit Hotel Groupe

- 6.2.5 Oceania Hotels

- 6.2.6 Best Western Hotels & Resorts

- 6.2.7 Marriott/Starwood

- 6.2.8 IHG

- 6.2.9 Choice

- 6.2.10 Disneyland Hotels & Resorts*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US