PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435855

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435855

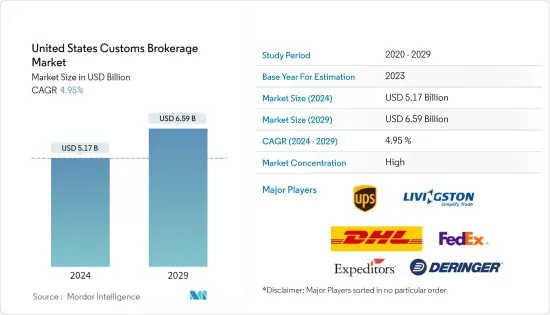

United States Customs Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The United States Customs Brokerage Market size is estimated at USD 5.17 billion in 2024, and is expected to reach USD 6.59 billion by 2029, growing at a CAGR of 4.95% during the forecast period (2024-2029).

Key Highlights

- The Market for customs brokerage in United States has been growing steadily and the growth is expected to continue through the forecast period. The number of entries processed by US Customs and Border Protection (CBP) has been increasing steadily with increasing imports.

- In 2019, USD 2.7 trillion of imports were processed, equating to 35.5 million entries and more than 28.7 million imported cargo containers at the US ports of entry.

- The continuously changing trade environment and increasing complexity of compliance are driving the demand for customs brokerage services, especially with section 301.

- The US CBP has collected approximately USD 80.7 billion in duties, taxes, and other fees in 2019, which includes USD 71.9 billion in duties. The total duties collected in 2019 has increased by more than 70% when compared to 2018.

- The market for customs brokerage is highly competitive with large number of brokers operating, especially along the borders. However, the major players account for significant market share.

- The companies providing customs brokerage services are investing in research and development activities to gain competitive edge in the market. As the demand for streamlined and more effective customs clearance process in short turnaround times is growing, R&D spending is expected to increase through the forecast period.

- The logistics players across the world, including customs brokers are exploring the application of blockchain technology. For instance, Blockchain In Transport Alliance (BiTA) is an alliance formed by logistics and other players to drive the adoption of blockchain.

- In Mar 2019, Livingston announced its membership in the Blockchain in Transport Alliance (BiTA). The membership allows the company to provide input into an evolving set of industry standards for rapidly developing blockchain technology that will serve as the core of digitized business transactions in the world of international freight.

US Customs Brokerage Market Trends

Growth in Imports Driving the US Customs Brokerage Market:

Freight transportation arrangements are more influenced by the volume of imports into the United States, which increases demand for industry services regarding customs regulations for finished consumer goods and semi-finished inputs to domestic production. The growth in imports is a prime driving factor for customs brokerage market. The imports of the country remained steady in 2019 when compared to 2018, while there is growth of more than 9% in 2018. The slowdown in 2019 can be attributed to US-China trade war.

The manufacturing sector depends on timely and reliable deliveries of raw materials, or semi-finished products as inputs to further processing. It also requires finished products to be transported to warehouses or distribution centers. The major determinant of manufacturing demand is consumer spending. The trend toward just-in-time (JIT) inventories has also created increased demand for transportation services, as manufacturers seek smaller and more frequent deliveries. JIT allows companies to improve profitability by purchasing materials only as needed, thereby reducing inventory costs. For such timely delivery needs, efficient customs clearance is of high importance driving the need for customs brokers.

Sea Transportation Dominates the US Customs Brokerage Market:

Maritime freight transport is the major mode of transport of international transport of goods. The number of customs entries by mode is highest in case of Sea transport and so, the revenue of customs brokerage market. The demand for air freight transport is increasing with growing demand for perishables, chemicals & valuables, and the rising demand for just-in-time production of goods. The US Customs Brokerage Market for Air freight transport is expected to witness faster growth over the forecast period when compared to other modes of transport.

The road freight movement of goods is the dominant mode of transportation in the United States and is an important factor for the economic growth. The cross-border land transport, including road, rail, and pipeline transport between US and North American partners Canada and Mexico is increasing steadily and is expected to grow in future driven by USMCA. The customs brokerage services for cross-border land transport is highly fragmented with many number of small brokers operating at each border portof entry.

US Customs Brokerage Industry Overview

The market for Customs Brokerage in United States is fairly fragmented. With many number of customs brokers operating in the market, the competition is high. The top players in the market include United Parcel Service, and FedEx Corporation. Some other significant players include Livingston International, Expeditors, A.N. Deringer, and C.H. Robinson. Based on number of entries, it was estimated that FedEx and UPS together account for almost 35% of the total market. Although the top five to ten players take up more than 50% of the market, the companies that account for the remaining market share are more in number with very less market shares.

Apart from these players, the major global freight forwarding companies such as DB Schenker, and Kuehne + Nagel also have good service offering in the US customs brokerage market. A lot of acquisitions have occurred in the past decade such as Carmichael by APL Logistics, and Livingston acquiring FPA Customs brokers and many others, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Government Regulations

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Insights on Imports and Custom Brokerage Services by State

- 4.6 Brief on Customs Brokerage as a Freight Forwarding Function

- 4.7 Insights on Standalone or Predominant Customs Brokerage Operations-only Firm - Penetration in the Market

- 4.8 Review of Customs Brokerage Costs as Percentage of Total Logistics Spend

- 4.9 Shipper Insourcing vs. Outsourcing Trends in Customs Brokerage Related Tasks

- 4.10 Overview of Customs Pricing

- 4.11 Insights on Customs Brokerage Services by End-user Industry

- 4.12 Insights from Industrial Surveys

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Mode of Transport

- 6.1.1 Sea

- 6.1.2 Air

- 6.1.3 Cross-border Land Transport

7 MARKET OVERVIEW FOR SOLUTIONS ALLIED TO CUSTOMS BROKERAGE SERVICE

- 7.1 Software

- 7.2 Consulting

- 7.3 Contract Logistics-based Customs Brokerage

- 7.4 Other Related Value-added Services

8 COMPETITIVE LANDSCAPE

- 8.1 Overview (Market Share and Major Players)

- 8.2 Company Profiles

- 8.2.1 United Parcel Service Inc.

- 8.2.2 FedEx Corporation

- 8.2.3 Deutsche Post DHL group

- 8.2.4 Expeditors International

- 8.2.5 Livingston International

- 8.2.6 A.N. Deringer

- 8.2.7 C.H. Robinson

- 8.2.8 Carmichael International

- 8.2.9 Charter Brokerage LLC

- 8.2.10 CH Powell Company*

- 8.3 Other Companies (Key Information/Overview)

- 8.3.1 Trans American Customhouse Brokers Inc., GHY International, Flexport Inc. Purolator International, Samuel Shapiro & Company, Inc., Scarbrough International, Ltd.*

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

10 APPENDIX

- 10.1 GDP Distribution, by Activity and Region

- 10.2 Insights on Capital Flows

- 10.3 E-commerce and Consumer Spending-related Statistics

- 10.4 Exports and Imports Statistics of the United States