PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643240

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643240

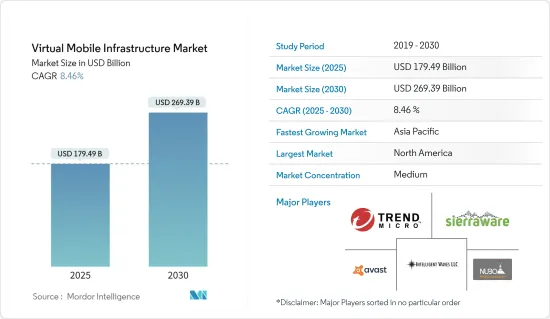

Virtual Mobile Infrastructure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Virtual Mobile Infrastructure Market size is estimated at USD 179.49 billion in 2025, and is expected to reach USD 269.39 billion by 2030, at a CAGR of 8.46% during the forecast period (2025-2030).

The market for virtual mobile infrastructure is expected to expand in popularity due to the rapid rise of mobile phones around the world and the expansion of associated and smart frameworks. Furthermore, the virtual mobile infrastructure provides capabilities such as app network consumption, app blocking, and compliance reporting tools, all contributing to the market's growth.

Key Highlights

- The rise in smartphone penetration is driving the virtual mobile infrastructure market. Enterprises can use virtual mobile infrastructure to host their mobile applications on servers and provide customizable remote access from any device. Deploying high-density virtual mobile infrastructure, the virtual mobile infrastructure helps to cut hardware and operating costs. Furthermore, many businesses focus on developing a single app that supports all types of mobile devices. Virtual mobile infrastructure provides advantages to companies, which is expected to drive the market.

- Electronic subscriber identification modules (e-SIMs) will provide out-of-the-box connection, making it available to all regional customers without needing particular installation, resulting in greater simplicity of use. NFV and SDN will offer new levels of rapid time-to-market (TTM) for new services and additional benefits, such as better managing wholesale data costs by lowering video traffic on the host network via traffic shaping on a virtualized packet gateway (PGW).

- In the context of the EU Roaming Regulation review, which would be extended until 2032, MVNO Europe, the group representing Mobile Virtual Network Operators active in the European Union, fought for reduced maximum wholesale rates and roaming access for IoT purposes. Although MVNO Europe welcomes the extension of the Roam-Like-At-Home regime until 2032, the association believes that more ambition could have been demonstrated by further lowering caps and expanding the Roam-Like-At-Home regime's application to IoT applications.

- To ensure business continuity, owing to the COVID-19 outbreak, business organizations, especially in highly affected countries, are allowing their employees to work from home (WFH). The increase in people working from home has led to increased demand for downloading, online video viewing, and communication through video conferencing, all leading to increased network traffic and data usage. Moreover, Vodafone UK has witnessed a 50% increase in internet traffic. Orange Espana is offering customers access to the free data bundles. Pre-paid customers can now access an additional 15 GB, while customers on postpaid plans can access an additional 30 GB.

- Moreover, security risks are also likely to concern the organizations. A third-party company may govern its work. To date, the third-party managers have handled services with utmost care. However, the threat of data breaches is always on, which also challenges market growth.The increasing activities of cyber criminals becoming successful at penetrating and moving laterally within the security perimeter are expected to increase privacy concerns. Organizations relying solely on on-premises firewalls and VPNs lack the visibility solution integration and agility to deliver timely end-to-end security coverage. As evidence, large-scale, multi-vector mega attacks are growing, wreaking havoc on organizations and individuals worldwide.

Virtual Mobile Infrastructure Market Trends

Cloud Segment is Expected to Grow Significantly

- As businesses attempt to run their IT infrastructure more efficiently, they discover new ways to operate and manage their networks. Traditional IT approaches based on commodity hardware, such as computing, storage, and networking, are being modernized by enterprises in order to embrace cloud technologies that enable the quick development and deployment of new network services. Cloud-based services are getting increasingly popular as the number of cloud-based apps in organizations grows. Cloud computing use is increasing as a result of increased investment from small and medium-sized businesses (SMEs). Scalability, increased effectiveness, faster deployment, mobility, and disaster recovery are the primary reasons for switching to the cloud.

- The continuous evolution of cloud computing, combined with increased use, increases the mobile cloud. The mobile cloud provides access to cloud-based apps and services via portable devices. The mobile cloud industry is expanding due to increased internet speed and cloud-based technology. This technology enables applications to be produced more quickly, flexibly, consistently, and instantly. It provides users with a solution to their storage and backup issues. It protects mobile devices from dangerous viral attacks and gives them a sense of security and privacy. Smart gadgets benefit from the progress of this technology.

- The rapid rise of smartphones and internet usage will almost certainly open up new channels and opportunities for cloud service providers and application developers to enter the market. Many enabling technologies, such as 5G, HTML5, CSS3, Hypervisor, Cloudlets, and Web 5.0, are expected to propel the mobile cloud business forward. These advancements will pave the way for offline support specifications, enable web applications to run on any smartphone without being aware of the underlying architecture, and reduce latency with faster response. Businesses are using mobile cloud solutions to meet real-time and high-end smartphone applications' heavy processing and storage requirements.

- According to Turbonomic, in 2022, 56 % of respondents said they use Microsoft Azure for cloud services. Furthermore, the percentage of respondents who do not use any type of cloud increased from 4% in 2021 to 8% in 2022. Companies can better utilize networking resources with the mobile cloud. The mobile cloud market will benefit industries by enabling them to employ cloud computing to optimize information technology. Mobile networking hardware manufacturers, such as 5G equipment manufacturers and mobile telephony software providers, can package their products with mobile cloud data center orchestration capabilities and sell them as full solutions to CSPs in regional markets.

- In July 2022, a strategic partnership between Vodafone Spain and Kyndrylwas established to support corporate customers (private and public entities) adopting hybrid multi-cloud strategies to accelerate their digitization. Based on a cloud infrastructure supporting the development of technologies like the Internet of Things or 5G, the agreement strengthens the long-standing relationship between Kyndryland Vodafone Business. It will allow both businesses to provide the best ecosystem of services and technologies to help organizations accelerate their digitization.

North America is Expected to be the Largest Market

- North America is anticipated to hold a significant proportion of the virtual mobile infrastructure market due to the region's increased technological developments and enterprise mobility. The use of cloud technology and services by businesses is another factor boosting the market in the area. Employers now seek to give their employees a free and flexible workspace, and work cultures have evolved, enabling market growth in the region.

- The players in the market are developing new solutions to capture the market share in the market. For instance, in November 2022, in celebration of Veterans Day, Healthy Together is announcing the debut of a new mobile application connected with the U.S. Department of Veterans Affairs (VA) to offer veterans nationwide with easily accessible health records. The partnership between Healthy Together and the VA is part of the VA's Lighthouse's current commitment to enable more options for veterans to securely access and use their health records and data. The Department of Veterans Affairs API platform is part of their Digital Modernization agenda. It is used to securely access VA data to build innovative tools for Veterans.

- Further, in March 2022, T-Mobile, Applied Information, and Temple, Inc. are introducing 5G-connected vehicle technology that allows traffic signals to communicate with any vehicle on the road via a revolutionary mobile app to Peachtree Corners, one of the nation's first smart city environments powered by real-world connected infrastructure and 5G. This technology enables two-way communication between traffic signals and devices such as smartphones, tablets, and automobiles equipped with onboard units on T-largest Mobile and the fastest nationwide 5G network. The TravelSafely smartphone software delivers audible warnings about potential red light running and reminders to prepare for green light running.

- Moreover, mobile banking apps have evolved to make it easier to manage money. For example, the Ally Bank app provides checking account customers with a function that allows them to digitally arrange their money and maximize how much money they can save. The US Bank app notifies consumers when its algorithms detect money-saving opportunities or circumstances in which an account is about to be overdrawn. Varo, a challenger bank with a federal bank charter, also provides automatic savings tools and ApexEdge, a third-party service that assists consumers in negotiating reduced bill payments.

- Developers of smartphone applications are attempting to make it more convenient for employees to use the same device for personal and work purposes. For example, Microsoft has partnered with BlackBerry to make Microsoft mobile apps available on BlackBerry smart devices, allowing employees to access files at any time and from any location. Improved internet services and speeds have resulted in increased file accessibility, which is expected to boost industry growth.

Virtual Mobile Infrastructure Industry Overview

The virtual mobile infrastructure is semi-consolidated as the players in the market are adopting strategies like product innovation, mergers, and acquisitions in order to expand their product portfolio and expand their geographic reach and primarily to stay competitive in the market.

In June 2023, Nokia and Red Hat Announce Partnership for Telecommunications Solutions Based on Red Hat Infrastructure Platforms and Nokia's Core Network Applications. Service providers would benefit from Nokia's aim to develop and leadership in future-ready core network software together with Red Hat's deployment options for bare-metal, virtualized and public cloud.

In November 2022, Crunchfish joined a new critical alliance to enable mobile operations and services in Africa by providing financing, telecom network infrastructure, and disruptive technologies through an Anything-as-a-service approach. Crunchfish AB signed a Memorandum of Agreement today with Socio ApS, the Danish management and investment firm driving the cooperation, for prospective Crunchfish financing. This collaboration aims to overcome crucial gaps in Africa's digital infrastructure by enabling mobile services to employ telecom infrastructure and disruptive technologies to provide much better cost structures, use cases, and quality.

In March 2022, Nokia announced that it had expanded its relationship with T-Mobile Polska to encompass the modernization of the operator's existing radio network infrastructure and the deployment of 5G services. T-Mobile Poland's aim of maintaining technological leadership in the country and providing best-in-class services to their clients will be supported by this move. Under the ten-year agreement, Nokia will grow its network share in T-Mobile to 50%, with implementation already beginning.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment on the Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Smartphone Penetration

- 5.1.2 Need to Increase the Productivity of Employees

- 5.1.3 Reduced Hardware and Operating Cost Using VMI

- 5.2 Market Restraints

- 5.2.1 Android Application Compatibility and Technical Issues

6 EMERGING TECHNOLOGY TRENDS

7 MARKET SEGMENTATION

- 7.1 By Deployment Mode

- 7.1.1 On-Premise

- 7.1.2 Cloud

- 7.2 By End-user Vertical

- 7.2.1 BFSi

- 7.2.2 Healthcare

- 7.2.3 Government and Defense

- 7.2.4 Telecommunications and IT

- 7.2.5 Manufacturing

- 7.2.6 Other End-User Verticals

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia-Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East & Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Trend Micro Inc.

- 8.1.2 Avast Software Inc.

- 8.1.3 Sierraware LLC

- 8.1.4 Nubo Software Limited

- 8.1.5 Intelligent Waves LLC

- 8.1.6 Pulse Secure LLC

- 8.1.7 Raytheon Corporation

- 8.1.8 Prescient Solutions Group Inc.

- 8.1.9 Fortinet Inc,

- 8.1.10 Genymobile SAS

9 INVESTMENT ANALYSIS

10 MARKET OPPORTUNITIES AND FUTURE TRENDS