PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910895

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910895

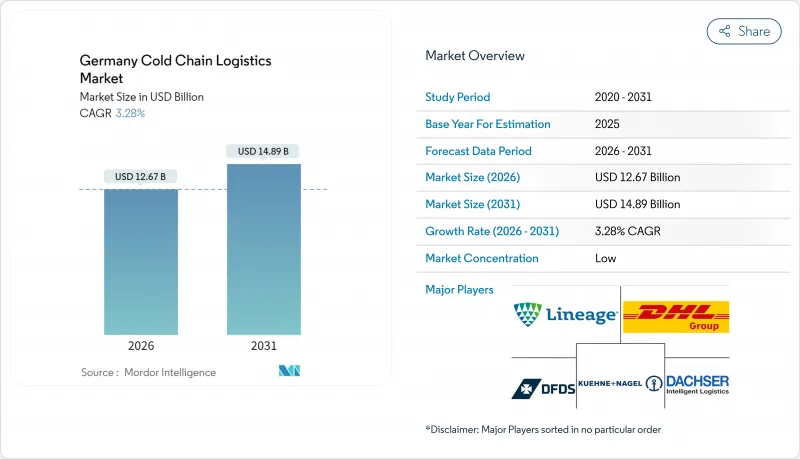

Germany Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Germany Cold Chain Logistics Market was valued at USD 12.27 billion in 2025 and estimated to grow from USD 12.67 billion in 2026 to reach USD 14.89 billion by 2031, at a CAGR of 3.28% during the forecast period (2026-2031).

Robust e-commerce grocery demand, sustained biologics export momentum, and retailer investments in automated freshness programs underpin near-term expansion, while natural-refrigerant retrofits and electrified transport fleets reinforce long-term efficiencies. Established third-party logistics providers are digitalizing networks with IoT tracking, predictive maintenance, and AI-driven route optimization to contain rising energy costs and comply with tightening environmental rules. Portfolio diversification into ultra-low-temperature storage and integrated value-added services is widening margins as clients look for end-to-end compliance solutions. The Germany cold chain logistics market continues to benefit from the country's geographic position at the heart of European trade lanes and from public incentives supporting sustainable infrastructure upgrades.

Germany Cold Chain Logistics Market Trends and Insights

E-commerce-led rise in B2C grocery fulfillment

Online fresh-food sales reached USD 3.2 billion in 2024 and are expected to climb a further 15-20% in 2025, prompting retailers and pure-play operators to build micro-fulfillment centers equipped with dual-zone automation that can process 1,000 orders per hour at 2°C and ambient temperatures. Electric-vehicle delivery fleets, as adopted by Aldi's "Mein Aldi" and Picnic's hub model, reduce emissions and meet strict urban noise caps. Smaller basket sizes and shorter delivery windows have shifted cost structures toward high-velocity, data-driven routing tools. Logistics providers now deploy predictive analytics to re-sequence drops by thermal sensitivity, trimming spoilage and last-mile mileage. These operational upgrades accelerate the Germany cold chain logistics market's service standard while enlarging its addressable consumer base.

Growth of biologics & mRNA-based pharma exports

Germany exported EUR 105.8 billion (USD 116.76 billion) in pharmaceuticals during 2024, with temperature-sensitive biologics providing the fastest lift. DHL Group alone is investing EUR 2 billion (USD 2.20 billion) by 2030 in GDP-certified hubs, sensing equipment, and multi-temperature fleets to safeguard biologics and cell-therapy shipments. Biotech corridors around Frankfurt and Munich now demand continuous -70 °C to +25 °C visibility, triggering upgrades in real-time tracking, chain-of-custody documentation, and AI-enabled cooling optimization. These capabilities cement Germany's role as the preferred European export gateway for novel therapies, boosting premium service revenue across the Germany cold chain logistics market.

Scarcity of licensed refrigeration technicians

More than 60% of open refrigeration jobs remained unfilled in 2024, reflecting an aging workforce and limited new entrants, particularly women. Shortfalls elevate maintenance lead times and service costs, compelling operators to deploy remote diagnostics and predictive maintenance. Apprenticeship reforms are in place, yet the Germany cold chain logistics industry faces at least a two-year skill-gap overhang.

Other drivers and restraints analyzed in the detailed report include:

- Retailer push for "Doppelte Frische" (Double-Fresh) private labels

- Surge in EV-Compatible multi-temp truck bodies

- Grid-Energy price volatility for large cold stores

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated transportation supplied 60.55% of 2025 revenue, underscoring Germany's status as a pan-European gateway where motorway, rail, sea, and air corridors interlock to move temperature-controlled cargo efficiently. Hegelmann Group's deployment of 200 telematics-enabled Thermo King units exemplifies the segment's technological edge. Over the forecast horizon, automation and EV adoption will continue to smooth cross-border flows and guarantee integrity for biologics and premium grocery lines.

Value-added services are forecast to expand at a 4.55% CAGR, the fastest within this classification. Rising regulatory burdens around GDP and HACCP compliance fuel demand for specialized packaging, batch-level monitoring, and documentation support. Storage operators such as Lineage Logistics are integrating automated pick-and-pack systems and real-time dashboards that merge warehousing, transport, and compliance activities into single-service agreements. The Germany cold chain logistics market size for value-added solutions is therefore primed for multi-year compound expansion as manufacturers outsource complexity and regulators tighten oversight.

The Germany Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, Deep-Frozen/Ultra-Low), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy & Frozen Desserts, Pharmaceuticals & Biologics and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Kuehne + Nagel International AG

- DHL Group

- Lineage Logistics LLC

- DFDS Logistics

- Dachser SE

- DSV

- Pfenning Logistics

- NewCold Advanced Logistics

- Heuer Logistics GmbH & Co. KG

- BLG Logistics

- Frigolanda Cold Logistics

- Scan Global Logistics

- Nordfrost GmbH & Co. KG

- Thermotraffic GmbH

- HAVI Logistics GmbH

- Fiege Logistik Stiftung & Co. KG

- CEVA Logistics

- Yusen Logistics

- Hellmann Worldwide Logistics

- Rhenus Logistics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-Commerce-led Rise in B2C Grocery Fulfilment

- 4.2.2 Growth of Biologics & mRNA-Based Pharma Exports

- 4.2.3 Retailer Push for "Doppelte Frische" (Double-Fresh) Private Labels

- 4.2.4 Surge in EV-Compatible Multi-Temp Truck Bodies

- 4.2.5 Near-Shoring of Seafood Processing to North Sea Ports

- 4.2.6 Tax Incentives for Ammonia/CO2 Natural-Refrigerant Retrofits

- 4.3 Market Restraints

- 4.3.1 Scarcity of Licensed Refrigeration Technicians

- 4.3.2 Grid-Energy Price Volatility for Large Cold Stores

- 4.3.3 Patchwork Municipal Noise-Emission Limits on Night-Time Deliveries

- 4.3.4 Lengthy Planning Approvals for Green-Field Warehouses

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5°C)

- 5.2.2 Frozen (-18 to 0°C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20°C)

- 5.3 By Application

- 5.3.1 Fruits and Vegetables

- 5.3.2 Meat and Poultry

- 5.3.3 Fish and Seafood

- 5.3.4 Dairy and Frozen Desserts

- 5.3.5 Bakery and Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals and Biologics

- 5.3.8 Vaccines and Clinical Trial Materials

- 5.3.9 Chemicals and Specialty Materials

- 5.3.10 Other Perishables

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Kuehne + Nagel International AG

- 6.4.2 DHL Group

- 6.4.3 Lineage Logistics LLC

- 6.4.4 DFDS Logistics

- 6.4.5 Dachser SE

- 6.4.6 DSV

- 6.4.7 Pfenning Logistics

- 6.4.8 NewCold Advanced Logistics

- 6.4.9 Heuer Logistics GmbH & Co. KG

- 6.4.10 BLG Logistics

- 6.4.11 Frigolanda Cold Logistics

- 6.4.12 Scan Global Logistics

- 6.4.13 Nordfrost GmbH & Co. KG

- 6.4.14 Thermotraffic GmbH

- 6.4.15 HAVI Logistics GmbH

- 6.4.16 Fiege Logistik Stiftung & Co. KG

- 6.4.17 CEVA Logistics

- 6.4.18 Yusen Logistics

- 6.4.19 Hellmann Worldwide Logistics

- 6.4.20 Rhenus Logistics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment