PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435990

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435990

North America Jam, Jelly, and Preserve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

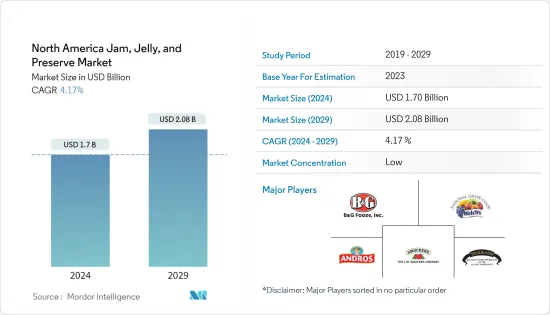

The North America Jam, Jelly, and Preserve Market size is estimated at USD 1.7 billion in 2024, and is expected to reach USD 2.08 billion by 2029, growing at a CAGR of 4.17% during the forecast period (2024-2029).

The COVID-19 pandemic has disturbed the way the supply chain operates with the jam, jelly, marmalades, and preserves market in odd ways. As the previously ready supply of raw materials like jars, fruits, and sugar, among others, for production has become an unsteady supply. For instance, according to the FAO, the agricultural products that faced a severe hit are cereals, groundnut, castor oils, jams and jellies, sugar, etc., due to international borders canceled flights and disruptions in shipping activity and Canada, which imported CAD 135.045860 million worth jams, fruit jellies, and marmalades in 2019.

In the United States, small companies, like Sqirl, have been experimenting with berries to give their jams a touch of wine flavor. This makes their products stand out in the market, beyond the usual delicacies offered by established brands. Thus, product innovation is one of the key drivers for new brands, which gives tough competition to the existing brands in the spread market.

Most consumers in the developed countries have been looking for food spreads without any inclusion of artificial additives, owing to the associated long-term adverse health effects. Manufacturers are inclined toward the usage of natural flavoring agents, preservatives, and sweeteners, as they are the key ingredients used in sweet spreads to extended the shelf-life of the product. Thus, in 2018, Polaner debuted Polaner Fruit & Maple fruit, and the product is sweetened with golden maple grove farms' pure maple syrup and is available in four flavors: strawberry, raspberry, peach, and blueberry.

North America Jam, Jelly, and Preserve Market Trends

Demand for Clean-label and Reduced Sugar/Fat Spreads

With low carb and low-fat diets trending, consumers are incessantly opting for healthier and tastier convenient food options, like reduced sugar and fat jams, jellies, marmalades, and preserves. Moreover, a majority of consumers are looking for fruit spreads without any artificial preservatives or additives, as the continuous use of these artificial flavours and additives gradually leads to long-term adverse health effects. Thus, this is creating a growth opportunity for the players to establish their presence in the market with their high-quality products infused with zero-calorie sweeteners and natural preservatives. The aim of clean labels is to drive the sustainability of the product and provide great taste. The prominent player of the market studied, JM Smucker, has expanded its spread product range with the launch of honey- and fruit-based spreads with natural ingredients.

United States Holds the Largest Market Share

In the United States, consumers eat food spreads mainly as a breakfast item in combination with bread. According to Agri Canada, about 77% of American consumers prefer to use jam, jellies, and marmalades at breakfast, while 67% of consumers like to consume peanut butter and other seed spreads. Apart from the well-established brands, there has been a significant rise in the number of country-specific local brands offering similar products at a more competitive price. The availability of regional products at a reasonable price is creating competition in the market. The greater the number of private-label brands, the greater is the price competition in the market. The competition is forcing many established international brands to differentiate their products from their local producers, leading to product innovation in the market.

North America Jam, Jelly, and Preserve Industry Overview

The North American jam, jelly, and preserve market is highly competitive, owing to numerous local and international players capturing the market. Some of the leading players, including The J.M. Smucker Company, B&G Foods Inc., and National Grape Cooperative Association Inc., are holding significant market share. The North American jam, jelly, and preserve market is highly competitive, owing to numerous local and international players capturing the market. Some of the leading players, including The J.M. Smucker Company, B&G Foods Inc., and National Grape Cooperative Association Inc., are holding significant market share. International brands with specialized product offerings continued to dominate the jam, jelly, and preserves market in North America. Higher prominence of brands, such as Crofters Food Ltd and Trailblazer Foods, was witnessed in the review year.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Jam and Jellies

- 5.1.2 Marmalades

- 5.1.3 Preserves

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Online Stores

- 5.2.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 B&G Foods Inc.

- 6.4.2 Andros Group

- 6.4.3 The J.M. Smucker Company

- 6.4.4 Wilkin & Sons Ltd

- 6.4.5 National Grape Cooperative Association Inc. (Welch's)

- 6.4.6 Hawaiian Sun

- 6.4.7 Trailblazer Foods

- 6.4.8 TreeHouse Foods Inc.

- 6.4.9 Crofters Food Ltd

- 6.4.10 Fomento Economico Mexicano SAB de CV

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 IMPACT OF COVID-19 ON THE MARKET