PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1436132

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1436132

Europe Household Refrigerator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

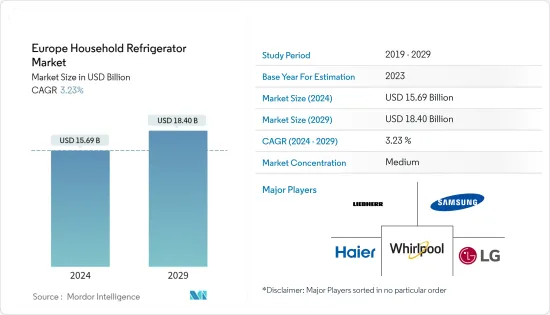

The Europe Household Refrigerator Market size is estimated at USD 15.69 billion in 2024, and is expected to reach USD 18.40 billion by 2029, growing at a CAGR of 3.23% during the forecast period (2024-2029).

During the review period, sales of home refrigerators through specialty channels like electronics and appliance specialty stores and home and garden specialty stores have tended to go down, while sales through e-commerce are quickly gaining retail volume shares. When it comes to refrigeration appliances, consumers can easily look at models online or in stores and then buy them through e-commerce. This is especially true for freestanding items. Due to modernization and urbanization.

In 2020, the number of refrigerators sold in stores went down for the first time in a long time. COVID-19 was a shock to the economy that made people less confident, which made some people put off buying big-ticket items. Freestanding freezers were by far the best-selling refrigeration appliances. Their rate of growth in retail volume sales sped up slightly from the previous year. The fact that some households sought to stockpile food during the early stages of the pandemic due to the perceived risk of shortages increased demand for these appliances. Liebherr-Hausgerate Ochsenhausen GmbH continued to lead refrigeration appliances in countries in Europe. It enjoyed a strong reputation as a specialist offering an extremely wide array of high-quality, durable refrigeration appliances of all types at good value for money, with its frost-free fridge freezers particularly popular.

Europe Household Refrigerator Market Trends

Growth of Urbanization Creates Demand for Household Appliances

The revenue of household appliance purchases increased compared to the previous year. User penetration was 21.9% in the previous and is expected to hit 33% by the forecasted period. Furthermore, with a population that is more concentrated in urban regions, people are spending more on lifestyle changes, which are fueling the growth of the market. With 95%, 85%, and 82% of the total population living in cities and urban areas of Europe's most urbanized cities, Malta, the United Kingdom, and the Netherlands, there is a surplus demand for household appliance accessories.

Growth of Household Ownership Rate of Refrigerators in Europe

Major appliances such as ovens, dishwashing machines, freezers, microwaves, refrigerators, vacuum cleaners, and washing machines are owned by many households across the Europe. Each one has different requirements when it comes to our fridges and freezers: as much storage space as possible, long-lasting food freshness, innovative yet timeless design, and the use of high-quality materials that ensure an appliance has a long service life. Romania, Portugal, and Italy are the countries with the highest household ownership rate of refrigerators amongst the European countries shown in the breakdown in 2022. Belgium and Sweden have the highest household ownership rate of freezers with more than Sixty percent respectively, according to the Statista Global Consumer Survey.

Europe Household Refrigerator Industry Overview

Adoption of smart household refrigerators and upgrading to new technology lead to increased competition within the company. Innovation and technological advancement are taking pace as COVID-19 and urbanization strike the general population, leading to the adoption of new refrigerators and household appliances. Companies across the world have huge investments in this segment of the market. In Europe, the household refrigerator market has many companies fragmented over minor shares. Liebherr-Hausgerate Ochsenhausen GmbH, Samsung, Whirlpool, LG, Haier, Bosch, Midea, and Electrolux are among the household refrigerators, fixtures, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Insights on impact of technology in the Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Chest Freezers

- 5.1.2 Bottom Freezers Refrigerator

- 5.1.3 Top Freezers Refrigerator

- 5.1.4 Side-By-Side Freezers Refrigerator

- 5.1.5 Refrigerators

- 5.2 By Application

- 5.2.1 Frozen Vegetables and Fruits

- 5.2.2 Frozen Meat

- 5.2.3 Other Applications

- 5.3 By Distribution

- 5.3.1 Speciality Stores

- 5.3.2 Supermarkets/ Hypermarkets

- 5.3.3 Online Stores

- 5.3.4 Other Distribution Channels

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 France

- 5.4.3 Italy

- 5.4.4 Germany

- 5.4.5 Spain

- 5.4.6 Other European Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Liebherr-Hausger te Ochsenhausen GmbH

- 6.2.2 Samsung

- 6.2.3 Whirlpool

- 6.2.4 LG

- 6.2.5 Haier

- 6.2.6 Bosch

- 6.2.7 Midea

- 6.2.8 Electrolux

- 6.2.9 Miele

- 6.2.10 Brandt*

7 MARKET OPPORTUNTIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US