PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437369

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437369

Italy Mammography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

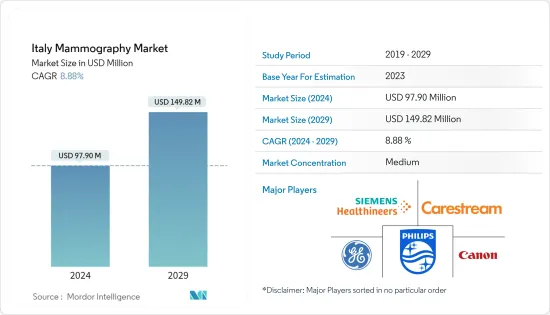

The Italy Mammography Market size is estimated at USD 97.90 million in 2024, and is expected to reach USD 149.82 million by 2029, growing at a CAGR of 8.88% during the forecast period (2024-2029).

The COVID pandemic had an adverse effect on market growth. The COVID-19 pandemic imposed clinicians with a special set of challenges in the management of women needing periodic screening mammography, imaging, and needle biopsy for suspect breast cancer, according to the article titled "Breast imaging and cancer diagnosis during the COVID-19 pandemic: recommendations from the Italian College of Breast Radiologists by SIRM" published in Springer Nature in July 2020. Routine outpatient breast imaging activity has frequently been severely decreased as a result of the lockdown, the requirement for social isolation, and diminished hospital resources. Determining which women can wait until the pandemic is gone, can wait a fair amount of time, or need immediate or non-reschedulable care is critical. In this situation, the Italian College of Breast Radiologists by the Italian Society of Medical Radiology (SIRM) has defined the following recommendations for patients during a lockdown: patients having a scheduled or upcoming appointment for detailed diagnostic breast imaging or needle biopsy should confirm the appointment or obtain a new one; patients who have suspect breast cancer symptoms should request non-deferrable tests at radiology services; asymptomatic women performing annual mammographic follow-up after menopause should request non-deferrable tests at radiology services. Asymptomatic women should schedule the check, ideally within 3 months of the date the check was not performed, in accordance with local organisational requirements, if they have not responded to the invitation for screening mammography after the start of the pandemic or have been informed that the screening activity has been suspended. Despite having experienced an economic collapse during the first wave of the coronavirus, the aforementioned causes are predicted to increase the demand for mammography in Italy.

Factors, such as the growing prevalence of breast cancer, technological advancements in the field of breast imaging, and the investment from various organizations in breast cancer screening campaigns. For instance, according to information from EUROPA DONNA, the European Breast Cancer Coalition, in Italy the expected number of women diagnosed with breast cancer in 2020 was approximately 55,133, and there were approximately 12,633 breast cancer-related deaths. 2020 saw an approximate 87.0 and 13.4 age-standardized incidence and mortality rate per 100,000 women. Breast density measured using a new fully automated method is positively associated with BC risk and is comparable to radiologists' visual assessment, according to Paolo Giorgi Rossi's article from 2021 titled "Validation of a new fully automated software for 2D digital mammographic breast density evaluation in predicting breast cancer risk." It is a stronger indicator of interval cancer and confirms that breast density has a discernible masking effect that lowers mammography sensitivity. These devices' cutting-edge software contributes to the segment's growth. Thus, the abovementioned factors are expected to increase market growth.

However, the risk of adverse effects from radiation exposure, and reduction in reimbursement are expected to hinder the market growth.

Italy Mammography Market Trends

Breast Tomosynthesis Segment is Expected to Hold a Significant Market Share Over the Forecast Period

Factors such as the increasing prevalence of breast cancer coupled with increasing research studies are expected to increase the market growth. A new method called breast tomosynthesis, commonly known as digital breast tomosynthesis (DBT)/3D mammography, aids in the radiologists' capacity to detect breast cancer. These mammography techniques combine several two-dimensional images to create a three-dimensional representation of the breast. Italy has been working to create cutting-edge mammography technologies. Tomosynthesis and 3D mammography were initially combined in Italy within Europe. The most recent figures released by the International Agency for Research on Cancer issued GLOBOCAN 2020 report help to explain the high incidence of breast cancer. It estimates that in Italy, the five-year prevalence of breast cancer will be 223,090 in 2020. The high burden of cancer is anticipated to increase the number of women seeking mammography treatments since breast cancer can be checked in clinics. This will increase these clinics' demand for mammography equipment. This should accelerate market growth during the course of the forecast. The use of breast tomosynthesis technology greatly improves cancer detection rates while lowering false-positive rates. In the article "Repeat Screening Outcomes with Digital Breast Tomosynthesis Plus Synthetic Mammography for Breast Cancer Detection: Results from the Prospective Verona Pilot Study," written by Francesca Caumo and published in 2020, it was noted that when used in conjunction with repeat screening, digital breast tomosynthesis plus synthetic mammography revealed more cancers than full-field digital mammography (FFDM) and fewer stage II cancers than FFDM. These studies demonstrate that tomosynthesis is more effective than digital screening technologies in detecting breast tumors, fueling the market's expansion in the nation. Thus, the abovementioned factors are expected to increase market growth.

Italy Mammography Industry Overview

Italy mammography market is moderately competitive and consists of several major players. Some of the companies that are currently dominating the market are GE Healthcare, Fujifilm Holdings Corporation, Siemens Healthineers AG, Carestream Health Inc., and Koninklijke Philips NV among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden of Breast Cancer

- 4.2.2 Technological Advancements in the Field of Breast Imaging

- 4.2.3 Investment from Various Organizations in Breast Cancer Screening Campaigns

- 4.3 Market Restraints

- 4.3.1 Risk of Adverse Effects from Radiation Exposure

- 4.3.2 Reduction in Reimbursement

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Digital Systems

- 5.1.2 Analog Systems

- 5.1.3 Breast Tomosynthesis

- 5.1.4 Other Product Types

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Specialty Clinics

- 5.2.3 Diagnostic Centers

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Carestream Health Inc.

- 6.1.2 Planmed Oy

- 6.1.3 Koninklijke Philips NV

- 6.1.4 Fujifilm Holdings Corporation

- 6.1.5 Canon Inc. (Canon Medical Systems Corporation)

- 6.1.6 GE Healthcare

- 6.1.7 General Medical Merate SpA

- 6.1.8 Hologic Inc.

- 6.1.9 CMR NAVISCAN

- 6.1.10 Siemens Healthineers AG

- 6.1.11 Metaltronica SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS