Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687363

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687363

Banana - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 90 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

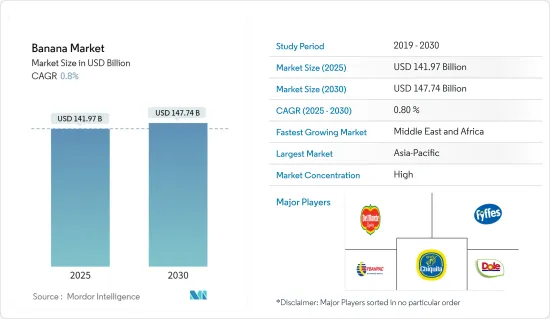

The Banana Market size is estimated at USD 141.97 billion in 2025, and is expected to reach USD 147.74 billion by 2030, at a CAGR of 0.8% during the forecast period (2025-2030).

Key Highlights

- Banana is a tropical fruit that is grown in many warmer areas around the world. According to Food and Agriculture Organization Statistics (FAOSTAT), India is the world's leading producer of bananas, accounting for nearly 26.3% of the total production in 2020. In recent years, after the COVID-19 pandemic, most countries and players in the market have been focusing on developing sustainable marketing and processing lines for bananas across the world in order to prevent damage caused by trade disruptions and disasters affecting the growth of the market.

- Bananas are the fourth most important food crop after wheat, rice, and maize in terms of production and are the world's favorite fruit in terms of consumption quantity. Bananas are one of the major globally exported fruits and also an important source of livelihood and food. According to ITC Trademap, global banana exports were valued at over USD 13,049 million in 2021. Ecuador is the largest exporter of bananas, accounting for 26% of global exports. The Philippines, Costa Rica, and Colombia are the other leading banana-exporting countries in the world. The United States is the leading importer of bananas, with a 16.7% share in the world's imports in 2021.

Banana Market Trends

Increasing Health Consciousness is Driving the Banana Market

- The increasing advancements in food and beverages and growing health awareness have led to a shift in the focus of consumers on hygienic and healthy food products.

- Bananas are considered a rich source of vitamin B6, vitamin C, manganese, potassium, dietary fibers, and protein. Bananas contribute to the proper functioning of the metabolism and the nervous system and aid in digestion.

- Bananas are also used in a wide variety of food products, such as breakfast cereals, ice creams, and other desserts, apart from raw consumption. Bananas have been considered a staple, inexpensive, and easily available food for decades. This has led to the constant development in production to satisfy the economic, environmental, and social well-being consciousness of consumers.

- The use of bananas for replenishing energy and electrolytes replacing sports drinks has increased recently. This demand is even higher in developed countries such as China and European nations as banana imports have increased gradually over the past few years.

- According to the ITC trade map, banana imports in Germany have increased by over 150,000 metric tons during the period 2018-2021, reaching 1.41 million metric tons in 2021.

- The demand for bananas is anticipated to grow further during the forecast period due to the increasing health consciousness among consumers.

Asia-Pacific Dominates the Banana Market

- Asia-Pacific leads the banana market with a 55.4% share of global production in 2020. Within Asia-Pacific, India is the largest producer of bananas in the world, with a production of 31,504,000 metric tons from an area of 878,000 hectares in 2020, followed by China and Indonesia.

- India's export of bananas was valued at USD 142,899 thousand in 2021, representing only 1% of the world's exports since most of the bananas grown in the country are used for local consumption. However, the per capita consumption is increasing in the Asia-Pacific region owing to the increase in population. The growing consumption is leading producers across the region to increase production levels.

- Due to the structure of landholdings in India, there are certain limits on land usage. Thus, the contract-farming model is used, which allows agribusiness producers to produce bananas in larger areas by overcoming legal constraints within the country.

- Banana production and export are supported by governments in the region due to their high export potential in the global market. In April 2022, the National Horticulture Board in India announced the development of the production and export of bananas in three districts, Kurnool, Anantapur, and Kadapa of Andhra Pradesh state as part of its Cluster Development Project (CDP). The project aims to export over 75,000 metric tons of bananas by improving export infrastructure facilities in the cluster.

- The increasing production of bananas in the region fueled by the increasing domestic consumption and export potential is one of the factors expected to drive the growth of the banana market in the coming years.

Banana Industry Overview

The banana market is consolidated, with a few major players dominating the market. The key players in the market are Fresh Del Monte, Chiquita Brands International Sarl, Fyffes, Dole Food Company, and Reybanpac. Partnership and production expansion are the prime strategies being followed by these companies to increase their market share and consolidate their position in the banana market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 61890

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain Analysis

5 MARKET SEGMENTATION

- 5.1 Geography (Production Analysis, Consumption Analysis by Value and Volume, Import Analysis by Value and Volume, Export Analysis by Value and Volume, and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Costa Rica

- 5.1.1.3 Mexico

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 Netherlands

- 5.1.3 Asia-Pacific

- 5.1.3.1 India

- 5.1.3.2 China

- 5.1.3.3 Indonesia

- 5.1.3.4 Philippines

- 5.1.4 South America

- 5.1.4.1 Equador

- 5.1.4.2 Columbia

- 5.1.4.3 Brazil

- 5.1.5 Africa

- 5.1.5.1 Angola

- 5.1.5.2 Egypt

- 5.1.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Fresh Del Monte

- 6.3.2 Chiquita Brands International Sarl

- 6.3.3 Fyffes

- 6.3.4 Dole Food Company

- 6.3.5 Reybanpac

- 6.3.6 One Banana

- 6.3.7 Bonita Banana (Noboa Group)

- 6.3.8 Global banana

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.