PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852096

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852096

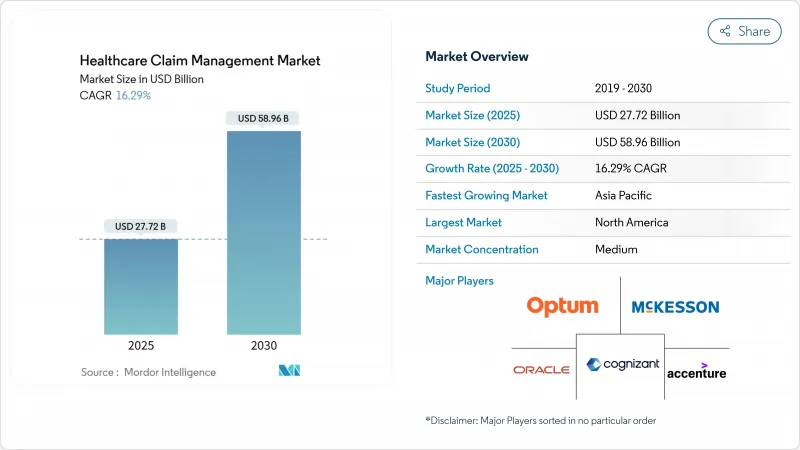

Healthcare Claim Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The healthcare claims management market size generated USD 27.72 billion in 2025 and is forecast to reach USD 58.98 billion by 2030, advancing at a 16.29% CAGR.

Rapid digitalization, rising claim-denial expenses, and mounting pressure to improve payment accuracy encourage payers and providers to replace manual workflows with AI-driven platforms. Hospitals now spend USD 19.7 billion annually overturning denied claims, underscoring the urgency for automation. Cloud deployment gains momentum as organizations favor real-time analytics at scale, while integrated revenue-cycle suites and payment-integrity modules converge to minimize revenue leakage. Moderate consolidation continues as established vendors acquire niche innovators to accelerate time-to-market for generative AI tools that offset an expected 100,000-worker shortfall in healthcare administration by 2028.

Global Healthcare Claim Management Market Trends and Insights

Expansion Of Public and Private Health-Insurance Coverage

Wider insurance adoption adds millions of newly covered lives, increasing claims volume and complexity. Emerging Asia-Pacific markets accelerate digital reforms, illustrated by Thailand's AI-enabled universal-coverage roadmap and India's push to integrate national health records with payer systems. In the United States, the Medicare Shared Savings Program continues to migrate providers into accountable-care contracts, driving demand for analytics-rich platforms that reconcile shared-savings payments.

Escalating Financial Impact of Claim Denials

Denial rates reached 11.8% in 2024, costing hospitals USD 19.7 billion in rework and lost revenue. The average denied claim costs USD 25-181 to remediate, and 65% of denied cases are never resubmitted, making proactive denial avoidance essential. Intermountain Health used advanced analytics to recoup USD 20 million and projected USD 35 million in future savings by restructuring its denial-management workflow.

Stringent Patient Data Privacy and Cybersecurity Regulations

Global frameworks such as GDPR and HIPAA impose stiff penalties for data breaches, compelling vendors to invest in zero-trust architectures and end-to-end encryption. Frequent ransomware attacks on healthcare facilities heighten executive focus on security certifications and continuous monitoring.

Other drivers and restraints analyzed in the detailed report include:

- Growing Geriatric and Chronic Disease Population

- Adoption Of AI-Enabled Payment Integrity Platforms

- High Upfront Implementation and Migration Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Integrated platforms dominated 2024 with a 42.56% revenue share as organizations adopted enterprise-wide suites that merge eligibility, prior authorization, and revenue-cycle tools into a single workspace. The healthcare claims management market continues to prize all-in-one ecosystems that lower vendor sprawl and simplify compliance audits. AI-based denial-management modules, however, are set to grow at an 18.54% CAGR through 2030 as administrators target denial rates above 10%. These apps mine claims, coding, and clinical notes to flag high-risk submissions before they reach payers, reducing rework costs.

Standalone payment-integrity engines remain attractive to mid-size payers that want rapid fraud-detection gains without replacing core adjudicators. Optum's Integrity One recorded more than 20% coder-productivity gains during beta testing, while one regional health plan using Cognizant's analytics stack cut pending inventory fifteen-fold. The healthcare claims management market therefore shows a clear pivot from retrospective auditing to concurrent and prospective risk scoring.

Software licenses represented 63.24% of 2024 spending, reflecting large investments in AI rule sets, API libraries, and workflow orchestration engines that anchor modern platforms. Yet the services category is advancing at a 10.21% CAGR as hospitals, payers, and TPAs contract for implementation, configuration, and ongoing optimization support. Outsourced claims-processing units fill critical labor gaps, and managed-service deals guarantee SLAs that internal teams struggle to match.

Consulting engagements often revolve around privacy-impact assessments, TEFCA readiness, and value-based-contract modeling. As legacy COBOL systems sunset, providers rely on service partners to migrate millions of records without downtime. Consequently, the healthcare claims management market size for advisory and managed-services lines is forecast to outpace license revenue growth over the next five years.

The Healthcare Claims Management Market Report is Segmented by Solution Type (Integrated Claims Management Platforms, and More), Component (Software and Services), Delivery Mode (Cloud-Based and On-Premise/Private Cloud), End-User (Healthcare Payers, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 46.34% of 2024 revenue, underpinned by Medicare, Medicaid, and commercial insurers that together adjudicate billions of claims annually. Federal mandates such as the 21st Century Cures Act and TEFCA enforce FHIR interoperability, prompting continuous platform upgrades. Canada's single-payer model drives provincial initiatives to automate eligibility verification, while Mexico's insurance-expansion programs fuel new deployments among social-security institutes.

Asia-Pacific is the fastest-growing region with a 17.56% CAGR, propelled by compulsory insurance schemes, rapid private-payer expansion, and governmental AI roadmaps. China encourages AI-based claim verification within its national-reimbursement-drug list to curb fraud, and Japan embraces chronic-care registries to manage an expanding elder population. India integrates health-identity numbers with payer databases to streamline e-claims, and Australia's shared health-record platform accelerates real-time adjudication for tele-consults.

Europe maintains steady adoption as GDPR compliance and e-prescription mandates shape purchasing priorities. Germany promotes semantic interoperability standards in the Krankenhauszukunftsgesetz funding program, while the United Kingdom's NHS upgrades spine services to support centralized prior-authorization workflows. Southern European countries invest European Recovery funds to modernize claims portals that enable cross-border treatment billing. Collectively, these initiatives ensure the healthcare claims management market continues its expansion across the continent.

- Optum

- Mckesson

- Cognizant (Trizetto)

- Oracle

- Accenture Plc

- Ibm Corporation

- Conduent

- Genpact

- R1 Rcm Inc.

- Cotiviti

- Athenahealth

- Allscripts

- Vee Technologies

- Zelis Healthcare

- Change Healthcare (Legacy)

- Aspirion

- Wns Global Services

- Firstsource Solutions

- Pch Global

- Enablecomp

- Experian Health

- Osp Labs

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Public and Private Health-Insurance Coverage

- 4.2.2 Escalating Financial Impact of Claim Denials

- 4.2.3 Growing Geriatric and Chronic Disease Population

- 4.2.4 Adoption of Ai-Enabled Payment Integrity Platforms

- 4.2.5 Deployment of Robotic Process Automation in Claims Adjudication

- 4.2.6 Shift Toward Value-Based and Real-Time Reimbursement Models

- 4.3 Market Restraints

- 4.3.1 Stringent Patient Data Privacy and Cybersecurity Regulations

- 4.3.2 High Upfront Implementation and Migration Costs

- 4.3.3 Interoperability Challenges Across Legacy Core Systems

- 4.3.4 Shortage of Analytics and Ai-Skilled Workforce

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers / Consumers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitute Products

- 4.5.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Solution Type

- 5.1.1 Integrated Claims Management Platforms

- 5.1.2 Stand-Alone Claims Management Platforms

- 5.1.3 Ai-Based Denial Management Modules

- 5.1.4 Payment Integrity Solutions

- 5.2 By Component

- 5.2.1 Software

- 5.2.2 Services (Bpo, Consulting, Managed)

- 5.3 By Delivery Mode

- 5.3.1 Cloud-Based

- 5.3.2 On-Premise / Private Cloud

- 5.4 By End-User

- 5.4.1 Healthcare Payers (Public And Private)

- 5.4.2 Healthcare Providers

- 5.4.3 Third-Party Administrators (Tpas)

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Optum, Inc.

- 6.3.2 Mckesson Corporation

- 6.3.3 Cognizant (Trizetto)

- 6.3.4 Oracle

- 6.3.5 Accenture Plc

- 6.3.6 Ibm Corporation

- 6.3.7 Conduent Inc.

- 6.3.8 Genpact Limited

- 6.3.9 R1 Rcm Inc.

- 6.3.10 Cotiviti Inc.

- 6.3.11 Athenahealth Inc.

- 6.3.12 Allscripts Healthcare Solutions

- 6.3.13 Vee Technologies

- 6.3.14 Zelis Healthcare

- 6.3.15 Change Healthcare (Legacy)

- 6.3.16 Aspirion

- 6.3.17 Wns Global Services

- 6.3.18 Firstsource Solutions

- 6.3.19 Pch Global

- 6.3.20 Enablecomp

- 6.3.21 Experian Health

- 6.3.22 Osp Labs

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment