PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687858

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687858

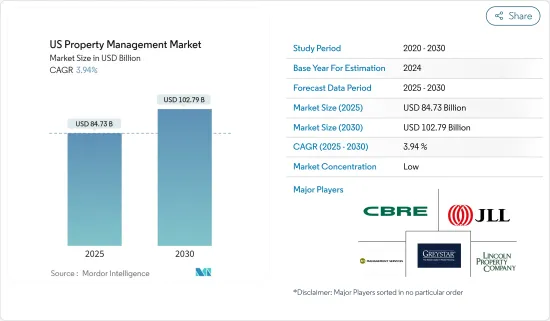

US Property Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US Property Management Market size is estimated at USD 84.73 billion in 2025, and is expected to reach USD 102.79 billion by 2030, at a CAGR of 3.94% during the forecast period (2025-2030).

The United States is rapidly progressing with newer infrastructures and technologies frequently developed, which also gradually boosts the overall economic statistics in this part of the world. Businesses are overwhelmingly growing with many stimulating product launches and supportive management and statistical techniques.

The property management industry is one of the fastest-growing industries in the United States. With the increasing number of new apartments being built in major cities across the United States, there is an increasing need for effective real estate management solutions.

SaaS models are becoming a strategic necessity for property management companies that want to stay ahead of the competition and stay agile in the ever-changing real estate environment. In addition, the changing landscape of workplace mobility presents a huge growth opportunity for real estate professionals in the United States. There were 296,477 property management businesses in the United States as of 2023, an increase of 2.1% from 2022. The US property management industry is labor intensive, which means businesses are more reliant on labor than capital. The highest costs for business in the US property management industry as a percentage of revenue are wages (42.9%), purchases (2.7%), and rent and utilities (2.7%).

US Property Management Market Trends

Demand from the Residential Sector is Supporting the Market

House prices continued to increase in most states despite economic uncertainty, inflation, and rising interest rates. The strongest home appreciation was in the state of Arizona, as well as in Maine, Connecticut, and New Hampshire. In Q2 of 2023, prices decreased in eight states and in the District of Columbia, including California, Washington, and Colorado.

In California, the median home value was significantly above the average sales price for both new and existing homes. California is one of the most sought-after housing markets in the United States.

Property management software company RealPage predicts that the number of apartment units completed in 2024 will be 671,953, which is the highest number since 1974.

The apartment supply in the United States exploded in 2023, reaching its highest level since 1987, with over 439,000 new units being built. This increase in supply has provided renters with more options and significantly slowed rent growth, resulting in outright apartment rent decreases in many markets.

As the demand in the residential segment increased, there was also a simultaneous demand for property management. Managing all these tasks comes with a lot of paperwork. That's the reason property managers are using software to manage all these tasks.

Demand for Smart Homes is Driving the Market

Implementing IoT technology and smart devices is expected to witness an increase in penetration in various aspects of the real estate business. The need for IoT is continuously increasing in the real estate business in order to improve customer serviceability.

Software providers have begun to integrate technology with software to improve communication between the property and its administrators, owners, investors, and others. For example, Capstone Partners, a Texas-based developer, teamed with IOTAS, an IoT solution provider, to create a linked smart home environment for tenants. As a result, the increasing penetration of smart homes is likely to drive property management software solutions.

The massive amount of data created by all linked devices, platforms, and appliances may be used to improve software functions. Furthermore, with data analysis, the adoption of IoT is projected to assist property owners in recognizing connected device performance and taking appropriate action to deliver better services to renters. According to Johnson Controls' building efficiency panel poll, 70% of respondents feel that introducing IoT to anticipate and diagnose trends will fuel demand for the software.

US Property Management Industry Overview

Leading players in the US property management market focus on obtaining knowledge in revenue management, payment services, communication solutions, facility management, and lease management to improve their software capabilities and product applicability. This technique assists organizations in increasing their corporate footprint in the United States.

Along with the acquisition, a significant emphasis on partnership and cooperation assists major stakeholders in providing new goods and experiences. Furthermore, the development and growth of the existing product range are assisting suppliers in improving their market position. Some of the major players in the market are Greystar Real Estate Partners, JLL, Lincoln Property Company, and CBRE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand from the Commercial Segment is Driving the Market

- 4.2.2 Increasing Disposable Income of Consumers is Driving the market

- 4.3 Market Restraints

- 4.3.1 Economic Uncertainties are Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 Rapid Development of Apartments is Driving the Market

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

- 4.8 Impact of the COVID-19 pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Commercial

- 5.1.2 Residential

- 5.2 Service

- 5.2.1 Marketing

- 5.2.2 Property Evaluation

- 5.2.3 Tenant Services

- 5.2.4 Maintenance

- 5.2.5 Other Services

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Greystar Real Estate Partners

- 6.2.2 Lincoln Property Company

- 6.2.3 CBRE Group

- 6.2.4 Jones Lang LaSalle Incorporated

- 6.2.5 CoStar Group Inc.

- 6.2.6 Pinnacle Property Management

- 6.2.7 Equity Residential

- 6.2.8 FPI Management

- 6.2.9 AvalonBay Communities

- 6.2.10 WinnCompanies*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX