PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910601

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910601

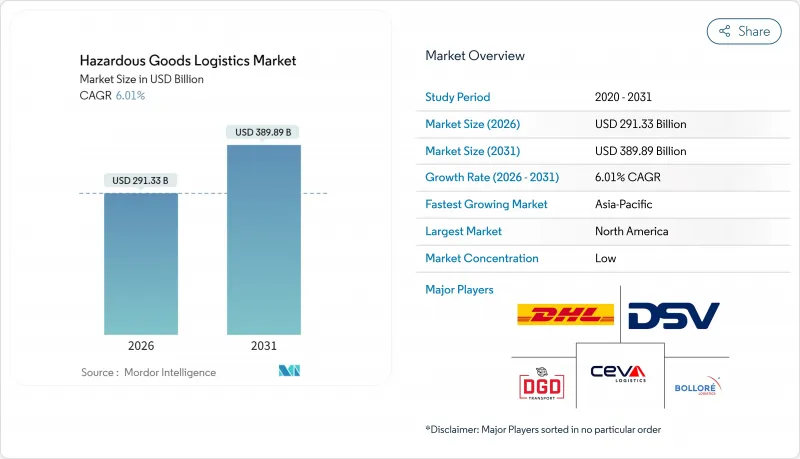

Hazardous Goods Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Hazardous Goods Logistics market is expected to grow from USD 274.80 billion in 2025 to USD 291.33 billion in 2026 and is forecast to reach USD 389.89 billion by 2031 at 6.01% CAGR over 2026-2031.

The upward trajectory is underpinned by expanding chemical and petrochemical trade flows, growing lithium-ion battery volumes, and the need for temperature-controlled biologics that demand specialized handling across road, rail, air, and maritime networks. Progressive digitalization-chiefly IoT sensors, blockchain-enabled chain-of-custody tools, and AI-driven routing-reinforces operational visibility while helping operators navigate tightening global safety mandates. Regulatory bodies in North America, the European Union, and Asia-Pacific are synchronizing standards around packaging, labeling, and real-time data sharing, which is prompting carriers to modernize fleets with Euro VI or zero-emission powertrains and fire-suppression technologies. Meanwhile, persistent pressure from rising insurance premiums and cross-border compliance costs is encouraging consolidation as large providers pursue economies of scale.

Global Hazardous Goods Logistics Market Trends and Insights

Expansion of Global Chemical & Petro-Product Trade

Global manufacturers now move larger volumes of specialty chemicals, fertilizers, and refined products that require class-specific packaging, ventilation, and segregation. The United States alone handled 1.2 million daily hazmat consignments in 2024, equal to 12% of all freight ton-miles . Chemicals represented 36% of overall 2024 revenues inside the Hazardous Goods Logistics market, demonstrating the need for scale assets such as pressurized tank cars and ISO tank containers. Class 3 flammable liquids and Class 8 corrosives dominate rail traffic, and carriers cite a 99.99% incident-free delivery rate that helps maintain public and regulatory confidence. Pipeline, terminal, and rail operators are accelerating load-sensor adoption that cuts loading cycles to 45 minutes, facilitating greater throughput without compromising safety. Capacity upgrades across Gulf Coast and Asia-Pacific ports continue, encouraging shippers to bundle hazardous liquid bulk with containerized dangerous goods inside value-added service contracts. These combined forces collectively expand addressable demand inside the Hazardous Goods Logistics market.

Tightening Multi-Modal Safety Regulations & Audits

Governments are elevating penalties for non-compliance, which compels logistics providers to invest in certified equipment and staff training. PHMSA raised civil fines above USD 100,000 per day in 2025, and railroads must now deliver electronic consist data to first responders under FAST Act mandates, a ten-year outlay estimated at USD 17.7 million. Cross-border harmonization with UN Model Regulations saves shippers USD 50-130 million annually in avoided paperwork while shrinking clearance times for Class 7 radioactive materials. Europe's ADR 2023 added stricter provisions for tetramethylammonium hydroxide and recycled-plastic IBCs, forcing fleets to upgrade container linings and gaskets. Compliance is further supported by satellite tracking and ATEX-certified sensors rolled out by major producers, ensuring continuous temperature and pressure logging on 700 tank containers. As oversight deepens, companies that embed risk-management protocols gain a competitive edge across the Hazardous Goods Logistics market.

Compliance Complexity Across Jurisdictions

A patchwork of national regulations compels carriers to master multiple documentation regimes, training schedules, and packaging codes. The United States aligns with UN standards yet retains country-specific tank car specifications that add retrofit costs for foreign fleets. China's GB 6944-2012 classification diverges from ADR, necessitating packaging conversions when shipments transit from Shenzhen to Rotterdam. Europe's pending PFAS restrictions could interrupt semiconductor and PCB supply chains as firms scramble for substitute chemistries. Varying driver-hazmat endorsement hours, document language rules, and emergency-contact protocols lead to detention fees and higher buffer inventories. Logistics providers therefore maintain parallel compliance teams, which inflates overhead and slows onboarding of new trade lanes inside the Hazardous Goods Logistics market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Growth of B2B E-Commerce Platforms for Hazmat

- Blockchain-Enabled Chain-of-Custody Solutions Gain Traction

- Escalating Insurance & Liability Premiums

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation remains the backbone, responsible for 66.42% of 2025 revenues inside the Hazardous Goods Logistics market. Operators run dedicated road tankers, stainless ISO tanks, pressure-rated railcars, and specialized cargo aircraft that together guarantee arrival of Class 1 explosives, Class 2 gases, and Class 3 flammables with near-perfect safety statistics. While transport volume growth is steady, shippers increasingly request integrated services that extend beyond point-to-point haulage. This shift explains why the value-added segment posts a 7.56% CAGR to 2031, reflecting demand for on-site labeling, kit assembly, customs brokerage, and regulatory consulting. Healthcare firms, for example, require end-to-end cold chain pathways, complete with data-logger archiving that satisfies GDP inspections. Chemical producers similarly outsource SDS updates and multi-language hazard documentation, allowing them to focus on core production tasks. IoT sensor packages, blockchain timestamping, and AI risk-scoring engines are embedded into premium contracts, conferring enhanced visibility and proactive exception management. Investment in specialized warehouses equipped with segregated bays, explosion-proof HVAC, and inert-gas fire suppression supports longer dwell times for reactive cargoes. Together, these capabilities broaden customer stickiness and underpin sustained revenue momentum inside the Hazardous Goods Logistics market.

Warehouse and distribution services complement transportation by providing compliant storage for incompatible classes under one roof. Facilities now feature robotic pallet movers fitted with LIDAR to avoid spark generation, while real-time gas detectors trigger automated ventilation when vapor thresholds near OSHA limits. Regional distribution models shorten final-mile distances, which is essential for biologics requiring narrow temperature tolerances. Carriers tap predictive analytics to place inventory closer to demand clusters, thus lowering spoilage risks and shrinking lead times. Railroads promote bulk transload hubs that connect tank-car arrivals to intermediate bulk container refills, eliminating redundant long-haul road legs. As clients pursue scope 3 carbon-reduction targets, logistics providers roll out lifecycle assessment dashboards that quantify embedded emissions from cradle-to-gate. Those metrics feed sustainability reports and influence vendor selection criteria. All these trends collectively sustain growth in value-added offerings, ensuring the Hazardous Goods Logistics market continues to evolve from transactional hauling toward high-margin, data-rich solutions.

The Hazardous Goods Logistics Market is Segmented by Service (Transportation, Warehousing & Distribution and More), by Destination (Domestic and Cross-border/International), by End User Industry (Oil & Gas, Mining & Metals, Energy & Utilities, Manufacturing (Electronics, Automotive, Etc. ), and More), by Geography (North America, South America, Asia Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America constitutes the largest share of the Hazardous Goods Logistics market, benefiting from 3.3 million miles of regulated pipelines, an integrated rail network, and sophisticated emergency-response infrastructure. Major railroads such as BNSF and Union Pacific continue to record 99.999% incident-free hazmat deliveries, underlining a culture of safety investment and proactive maintenance. The US-Canada corridor leverages harmonized placard codes and shared data portals that expedite customs clearance, while the US-Mexico lane earns priority upgrades under trilateral trade facilitation programs. Carriers allocate automation budgets to wayside defect detectors, predictive maintenance AI, and FRA-approved brake-health analytics that collectively reduce downtime. Legislators channel grants toward zero-emission drayage trucks at ports, helping shippers shrink carbon footprints without sacrificing compliant power for hazardous cargo.

Europe follows as the second-largest region, shaped by stringent ADR provisions and a policy push toward low-carbon multimodal corridors. Rail freight operators capitalize on Single European Railway Area initiatives that enable cross-border locomotive shifts without extensive administrative stops. Ports such as Rotterdam and Antwerp offer dedicated Class-7 isotope bunkers, while inland waterways handle Class 3 liquids on double-hulled barges fitted with vapor-recovery units. The European Green Deal incentivizes modal shifts from road to rail and inland waterway, and carriers respond by investing in 45-foot swap bodies compatible with both platforms. DSV's EUR 14.3 billion (USD 15.78 billion) acquisition of Schenker bolsters network density across 90 countries, ensuring broad service coverage for multinational shippers. Operators also trial hydrogen-powered line-haul trucks to comply with Euro VII proposals, demonstrating Europe's role as a technology incubator within the Hazardous Goods Logistics market.

Asia-Pacific delivers the fastest growth pace, propelled by industrial expansion in China, Southeast Asia, and India. China continues modernizing its regulatory regime, rolling out compulsory telematics on Class 2 cylinder trucks and constructing segregated service areas along hazardous routes. India invests in dedicated freight corridors that accommodate hazmat trains with reduced dwell times and electrified traction. Japanese ports host automated guided vehicles equipped with explosion-proof batteries, shortening vessel turnaround. Manufacturers diversify supply bases, redirecting some electronics and battery production toward Vietnam and Thailand, which in turn accelerates regional demand for compliant logistics. Australia and South Korea upgrade chemical parks with on-premise firefighting brigades and digital twin simulations that enhance preparedness. Collectively, these initiatives strengthen the competitive positioning of Asia-Pacific participants, expanding overall revenue contributions to the Hazardous Goods Logistics market.

- Deutsche Post DHL Group

- DSV

- CEVA Logistics

- Bollore Logistics

- DGD Transport

- Toll Group

- YRC Worldwide (USF HazMat)

- Hellmann Worldwide Logistics

- Kuehne + Nagel

- XPO Logistics

- GEODIS

- Rhenus Logistics

- FedEx Custom Critical

- UPS Healthcare / Hazmat

- C.H. Robinson

- Nippon Express

- Sinotrans

- Kintetsu World Express

- GXO Logistics

- SNCF Geodis Rail Freight*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of global chemical & petro-product trade

- 4.2.2 Tightening multi-modal safety regulations & audits

- 4.2.3 Rapid growth of B2B e-commerce platforms for hazmat

- 4.2.4 Blockchain-enabled chain-of-custody solutions gain traction

- 4.2.5 Low-carbon intermodal rail-water corridors for hazmat shipments

- 4.2.6 Reverse-logistics demand from on-site industrial recycling

- 4.3 Market Restraints

- 4.3.1 Compliance complexity across jurisdictions

- 4.3.2 Escalating insurance & liability premiums

- 4.3.3 Shortage of Euro VI / zero-emission hazmat vehicles

- 4.3.4 Cyber-vulnerabilities in e-Dangerous Goods Declaration systems

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Stakeholder Mapping (3PLs, GHA, Carriers, Advisors)

- 4.8 Documentation & Permit Requirements

- 4.9 Equipment & Accessories (IBC, UN drums, track-&-trace sensors)

- 4.10 Risk Assessment in Hazmat Shipments

- 4.11 Packaging Insights

- 4.12 Impact of Geo-Political Events in the Market

- 4.13 Porter's Five Forces

- 4.13.1 Bargaining Power of Suppliers

- 4.13.2 Bargaining Power of Buyers

- 4.13.3 Threat of New Entrants

- 4.13.4 Threat of Substitutes

- 4.13.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service (Value)

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea and Inland Waterways

- 5.1.2 Warehousing & Distribution

- 5.1.3 Value-added Services (Labelling, Kitting, Consulting)

- 5.1.1 Transportation

- 5.2 By Destination (Value)

- 5.2.1 Domestic

- 5.2.2 International / Cross-border

- 5.3 By End-use Industry (Value)

- 5.3.1 Oil & Gas

- 5.3.2 Chemicals & Petrochemicals

- 5.3.3 Healthcare & Pharma

- 5.3.4 Agriculture & Fertilizers

- 5.3.5 Mining & Metals

- 5.3.6 Energy & Utilities

- 5.3.7 Manufacturing (Electronics, Automotive, etc.)

- 5.3.8 Waste Management & Recycling

- 5.3.9 Others

- 5.4 Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 Europe

- 5.4.4.1 United Kingdom

- 5.4.4.2 Germany

- 5.4.4.3 France

- 5.4.4.4 Spain

- 5.4.4.5 Italy

- 5.4.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.4.8 Rest of Europe

- 5.4.5 Middle East And Africa

- 5.4.5.1 United Arab of Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East And Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Deutsche Post DHL Group

- 6.4.2 DSV

- 6.4.3 CEVA Logistics

- 6.4.4 Bollore Logistics

- 6.4.5 DGD Transport

- 6.4.6 Toll Group

- 6.4.7 YRC Worldwide (USF HazMat)

- 6.4.8 Hellmann Worldwide Logistics

- 6.4.9 Kuehne + Nagel

- 6.4.10 XPO Logistics

- 6.4.11 GEODIS

- 6.4.12 Rhenus Logistics

- 6.4.13 FedEx Custom Critical

- 6.4.14 UPS Healthcare / Hazmat

- 6.4.15 C.H. Robinson

- 6.4.16 Nippon Express

- 6.4.17 Sinotrans

- 6.4.18 Kintetsu World Express

- 6.4.19 GXO Logistics

- 6.4.20 SNCF Geodis Rail Freight*

7 Market Opportunities & Future Outlook