Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687923

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687923

MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 365 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

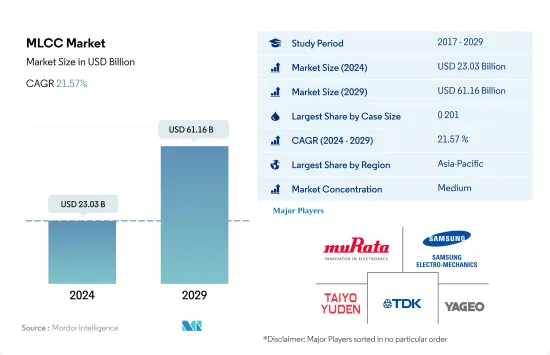

The MLCC Market size is estimated at 23.03 billion USD in 2024, and is expected to reach 61.16 billion USD by 2029, growing at a CAGR of 21.57% during the forecast period (2024-2029).

The government's increasing investments in military equipment, the rapid expansion of telecommunications sector, and the increasing usage of wearable devices are driving the MLCC demand

- The 0 201 case size sub-segment emerged as the frontrunner, capturing the largest market share of 71.35%, followed by the 0 402 case size with 11.79% and the 0 603 case size with 7.65% in terms of volume in 2022.

- The 0 201 case size is one of the smallest available options, which allows for a higher component density on the circuit boards. In Asia-Pacific countries like Japan, India, South Korea, and China, the capabilities of mobile communication devices are increasing, and the demand for smaller modules and wearable devices, smartphones, PCs, and gaming consoles is increasing. There is an increasing demand for MLCCs of 0 201 case size.

- The demand for 0 402 MLCCs is driven by the power and utilities sector. Factors such as the increased investment and the deployment of smart grid technologies such as smart meters, EV chargers, and other associated smart grid infrastructure technologies in the United Kingdom are expected to drive the market in the coming years. The UK government is increasingly considering smart grid technology as a strategic infrastructure investment that will contribute to the country's economic growth in the long term and enable the achievement of its carbon emission reduction objectives.

Asia-Pacific expected to dominate the market owing to the population's increasing demand for consumer electronics

- Asia-Pacific held the largest market share of 62.01% in terms of value in 2020, owing to the presence of major players such as Murata Manufacturing Co. Ltd, and Yageo Corporation. Countries such as Japan, China, South Korea, and Taiwan possess advanced manufacturing capabilities and expertise, allowing for the efficient and cost-effective production of MLCCs in large volumes. The electronics industry has been the largest user of MLCCs in the past and is expected to hold a significant share in the future. China holds a prominent position in the consumer electronics manufacturing industry. With several companies developing MLCCs, approximately 61% of Chinese mobile phone users were expected to transition to smartphones by 2023, signifying a considerable shift in consumer preferences.

- Europe held a market share of 15.49% in 2020 and continues to generate significant demand for MLCCs in electronics equipment and systems due to the region's powerful industrial base, most of which is related to the automotive industry. Germany is known for its advanced technologies in the automotive industry, and the country plans to increase its charging station infrastructure to 1 million by 2030, supported by a significant investment of EUR 6.3 billion. The number of EVs in Germany is expected to reach 15 million by 2030.

- North America held a market share of 13.90% in 2020 in terms of value. The growing adoption of EVs in the region is expected to fuel the demand for MLCCs. In 2022, the Canadian government announced a sales mandate for zero-emission vehicles, with the aim that at least 20% of new passenger vehicles sold in Canada must be zero-emission vehicles by 2026, which is expected to increase to 60% by 2030 and jump to 100% by 2035.

Global MLCC Market Trends

The ongoing trend of miniaturization is propelling the demand

- The lead time data for 01005 MLCCs highlights a stable and consistent demand for these components over the analyzed period. The lead time variations within a relatively narrow range of 15-18 weeks suggest a consistent availability and delivery of 01005 MLCCs. This stability in lead times indicates that suppliers have effectively managed the demand, ensuring a smooth supply chain for manufacturers relying on these components.

- The usage of 01005 MLCCs spans diverse applications, particularly in compact electronic devices such as smartphones, wearables, and IoT devices. Their small form factor and high capacitance make them ideal for space-constrained designs. The demand for these MLCCs is driven by the ongoing trend of miniaturization and the need for higher component density. The usage of 01005 MLCCs extends to a wide range of applications in various industries. In the consumer electronics sector, these MLCCs are vital components in the production of smartphones, wearables, and IoT devices, enabling manufacturers to achieve sleek and compact designs without compromising performance. The automotive industry heavily relies on 01005 MLCCs for advanced driver assistance systems (ADAS), infotainment systems, and engine control units (ECUs), contributing to the overall functionality and connectivity of vehicles. Overall, the widespread usage of 01005 MLCCs across multiple industries underscores their significance in powering and enabling various electronic devices and systems.

- The stability in lead times for 01005 MLCCs helps suppliers meet the demands and ensure a continuous flow of production for electronic devices that rely on these components. This, in turn, prevents potential delays in manufacturing and delivery timelines.

Stringent government regulations increase the penetration of electric vehicles

- Electric vehicles are either partially or fully powered by electric power. MLCCs have emerged as a perfect component for EV electronics and subsystems, offering high-temperature resistance and an easy surface-mount form factor. Approximately 8,000-10,000 MLCCs are used in an electric vehicle. MLCCs in EVs are commonly used in battery management systems, onboard chargers, and DC/DC converters. In addition to meeting the general specifications required for these EV subsystems, plus having the ability to function reliably in harsh environments inside an EV, component manufacturers should also be IATF 16949-certified and compliant with AEC-Q200.

- Electric vehicle shipment amounted to 15.39 million units in 2022 and is expected to increase to 23.76 million units in 2029, registering a CAGR of 9.93% during the forecast period 2023- 2029. Several countries have implemented strict environmental regulations to reduce greenhouse gas emissions and combat climate change. As a result, automakers are under increasing pressure to produce more electric vehicles and reduce their reliance on fossil fuels. Consumers are becoming more environmentally conscious and are looking for more sustainable alternatives to traditional gasoline-powered vehicles.

- The COVID-19 pandemic and the Russia-Ukraine War disrupted global supply chains and heavily impacted the automotive industry. However, in the longer term, the market is witnessing sales growth in some regions of the world as government and corporate efforts to support the deployment of publicly available charging infrastructure provide a solid basis for the increase in EV sales. Publicly accessible chargers worldwide approached 1.8 million, with nearly 500,000 chargers installed in 2021, of which a third were fast chargers.

MLCC Industry Overview

The MLCC Market is moderately consolidated, with the top five companies occupying 62.12%. The major players in this market are Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd, TDK Corporation and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 66905

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Price Trend

- 4.1.1 Copper Price Trend

- 4.1.2 Nickel Price Trend

- 4.1.3 Oil Price Trend

- 4.1.4 Palladium Price Trend

- 4.1.5 Silver Price Trend

- 4.1.6 Zinc Price Trend

- 4.2 Mlcc Lead Times

- 4.2.1 01005 MLCC

- 4.2.2 0201 MLCC

- 4.2.3 0201/0402 MLCC-HI CV

- 4.2.4 0402 MLCC

- 4.2.5 0603 MLCC

- 4.2.6 0603 MLCC - HI CV

- 4.2.7 0603 MLCC - HI VOLT

- 4.2.8 0805 MLCC

- 4.2.9 0805 MLCC - HI CV

- 4.2.10 0805 MLCC - HI VOLT

- 4.2.11 1206 MLCC

- 4.2.12 1206 MLCC - HI CV

- 4.2.13 1206 MLCC - HI VOLT

- 4.2.14 1210 TO 1825 - HI CV

- 4.2.15 1210 TO 1825 MLCC

- 4.2.16 1210+ MLCC - HI VOLT

- 4.2.17 2220+ MLCC

- 4.2.18 2220+ MLCC - HI CV

- 4.3 Automotive Sales

- 4.3.1 Global BEV (Battery Electric Vehicle) Production

- 4.3.2 Global Electric Vehicles Sales

- 4.3.3 Global FCEV (Fuel Cell Electric Vehicle) Production

- 4.3.4 Global HEV (Hybrid Electric Vehicle) Production

- 4.3.5 Global Heavy Commercial Vehicles Sales

- 4.3.6 Global ICEV (Internal Combustion Engine Vehicle) Production

- 4.3.7 Global Light Commercial Vehicles Sales

- 4.3.8 Global Non-Electric Vehicle Sales

- 4.3.9 Global PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.3.10 Global Passenger Vehicles Sales

- 4.3.11 Global Two-Wheeler Sales

- 4.4 Consumer Electronics Sales

- 4.4.1 Air Conditioner Sales

- 4.4.2 Desktop PC's Sales

- 4.4.3 Gaming Console Sales

- 4.4.4 HDDs and SSDs Sales

- 4.4.5 Laptops Sales

- 4.4.6 Printers Sales

- 4.4.7 Refrigerator Sales

- 4.4.8 Smartphones Sales

- 4.4.9 Smartwatches Sales

- 4.4.10 Tablets Sales

- 4.4.11 Television Sales

- 4.5 Ev Sales

- 4.5.1 Global BEV (Battery Electric Vehicle) Production

- 4.5.2 Global FCEV (Fuel Cell Electric Vehicle) Production

- 4.5.3 Global HEV (Hybrid Electric Vehicle) Production

- 4.5.4 Global ICEV (Internal Combustion Engine Vehicle) Production

- 4.5.5 Global PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.6 Regulatory Framework

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 High-Range Voltage (More than 1000V)

- 5.3.2 Low-Range Voltage (Less than 500V)

- 5.3.3 Mid-Range Voltage (500V to 1000V)

- 5.4 Capacitance

- 5.4.1 High-Range Capacitance (More than 1000µF)

- 5.4.2 Low-Range Capacitance (Less than 100µF)

- 5.4.3 Mid-Range Capacitance (100µF to 1000µF)

- 5.5 Mlcc Mounting Type

- 5.5.1 Metal Cap

- 5.5.2 Radial Lead

- 5.5.3 Surface Mount

- 5.6 End User

- 5.6.1 Aerospace and Defence

- 5.6.2 Automotive

- 5.6.3 Consumer Electronics

- 5.6.4 Industrial

- 5.6.5 Medical Devices

- 5.6.6 Power and Utilities

- 5.6.7 Telecommunication

- 5.6.8 Others

- 5.7 Region

- 5.7.1 Asia-Pacific

- 5.7.2 Europe

- 5.7.3 North America

- 5.7.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.