PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687983

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687983

Global Cleaning Robot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

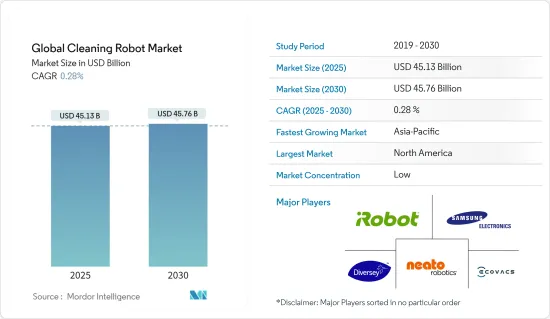

The Global Cleaning Robot Market size is estimated at USD 45.13 billion in 2025, and is expected to reach USD 45.76 billion by 2030, at a CAGR of 0.28% during the forecast period (2025-2030).

The key forces driving the expansion of robots for diverse applications are electronic progress, technology, and changing human lifestyles. Cleaning robotics for household and industrial usage is expanding because of the increased adoption of smart home appliances.

Key Highlights

- Some key factors propelling the development of the market under study include the rising demand for domestic consumer robots and the increasing investment in R&D of personal service robots for assistance in various home applications.

- Additionally, rising labor costs and safety concerns have accelerated the market expansion. Cleaning robots have several uses, including cleaning windows, floors, and swimming pools. Robotic cleaning reduces the amount of labor required from humans and saves money, time, and electricity.

- Hospitals used autonomous cleaning and disinfection robots extensively due to the pandemic. The UV light they use can eradicate bacteria. While the medical personnel evaluates whether a patient has a highly infectious disease, simple diagnostics like taking a patient's temperature are carried out by AMRs with robotic arms to minimize touch.

- However, for most people, a big barrier to the market's expansion is the expense of deploying cleaning robots. Since cleaning robots automate human labor and save electricity, they are predicted to displace the conventional vacuum cleaner. The adoption of cleaning robots is anticipated to be hampered by the higher costs incurred compared to a vacuum cleaner.

- Due to lockdowns and the closing of numerous manufacturing facilities worldwide during the first phase of COVID-19, the supply chain in the industry experienced study interruption. However, during COVID-19, the market began to experience a recovery in demand and output; the market under study reflected the direction of the semiconductor industry. To address the reduced working hours brought on by the lockdowns, end-user sectors such as automotive, defense and aerospace, industrial, and electrical started using autonomous robots.

Cleaning Robot Market Trends

Use of Pool Cleaning Robot in Commercial and Domestic Sectors Expected to Grow Significantly

- Due to the demand for automation in pool cleaning across the home and domestic sectors, the pool cleaning robot market is anticipated to expand significantly during the forecast period. People's evolving urban lifestyles are a key factor fueling the market's expansion. People have more money to spend, and maintaining luxury requires residential pools. However, keeping a collection clean and maintained is laborious; thus, people are searching for an automated solution to these problems.

- Robotic cleaners for pools can scour the surface and remove dirt and debris. They also have automated features. Pool cleaning by hand is labor-intensive and time-consuming. The invention of pool cleaning robots has made the cleaning procedure simpler.

- Pool cleaning robots are a more modern, effective, and affordable alternative to conventional pool cleaning tools. They do so with little human assistance, collecting debris and silt from pools. Therefore, it is anticipated that the advantages provided by these robots would fuel the expansion of the cleaning robot market in domestic sectors.

- The Domestic residential construction business has continued to recover in the United States, European nations, India, China, and others worldwide. The need for pool cleaning robots is rising globally due to increasing disposable income and the desire for large facilities in residential and domestic areas with swimming pools.

- Robotic pool cleaner usage is anticipated to rise in residential and commercial settings. The market usage of pool cleaning robots is expected to increase due to the expansion of the upscale hotel sector and the rise in the number of swimming pools used for training.

Asia-Pacific Expected to Exhibit Maximum Adoption

- Cleaning robot adoption is anticipated to be highest in the Asia-Pacific region over the projected period. The progressive increase in customers' disposable income and the quick shift in their lifestyles are the main drivers of market expansion in the area.

- China's rapid expansion of cleaning robots was fueled by technological progress, concerns about sustainability, and alluring economics. Additionally, customers are increasingly willing to pay more for specific product features that cleaning robots have improved. China's rapid economic growth and rising standard of living have increased demand for the industry under study.

- Additionally, the top players are increasing their footprint in new nations to capture the largest possible market share. For example, in December 2021, Uoni, a Chinese start-up that creates and produces robotic vacuum cleaners for homes, unveiled its most recent model, the V980 plus+, which can sweep and mop for lengthy periods without requiring human intervention.

- To increase their market share and reach, businesses in the area are introducing brand-new, technologically advanced cleaning robots. The adoption of cleaning robots in the region is still in its early stages, so vendors should have access to several possible chances.

- Chinese producers of robotic vacuum cleaners are making an effort to go abroad in response to rising worldwide demand. For instance, Beijing Roborock Technology Co. Ltd.'s export revenue climbed by 124% yearly to CNY 1.26 billion in the first half of 2021. This source accounts for around half of the company's total revenue.

- Additionally, in March 2021, the robotic vacuum cleaner business Roborock, which Xiaomi owns, announced its new T7S lineup, which consists of three vacuum cleaners: the T7S, T7S Plus, and T7S with Automatic Dust Collection and Charging Dock. The Roborock T7S uses the RR Mason algorithm, which improves the zigzag algorithm by cutting down on repetition and increasing efficiency. Such advancements in product design will boost demand for the cleaning robots industry and allow them to gain market share in the area.

Cleaning Robot Industry Overview

Due to the existence of various vendors in the industry, as well as new competitors entering the market with new products and solutions and gaining market share, the competitive environment of the cleaning robot market is significant. Even though the cleaning robot is still in development, some established businesses and start-ups have started doing research and teaming up with different suppliers of electronic components to offer effective cleaning equipment that is integrated with all the key technologies.

- August 2022 - Smart home robotics company and makers of the DEEBOT vacuuming and mopping in-one-go robots, ECOVACS, has launched the newest member of their T8 series of robots - the DEEBOT OZMO T8. The DEEBOT T8 joins the T8 family following the launch of the T8 AIVI in March and is the latest in ECOVACS home cleaning robotics to leverage advanced technology for object detection. I

- March 2021 - Xiaomi introduced the 'Robot' Vacuum Cleaner in Indonesia. The device comes with a smart control that connects to the MI Home app. Users might control the product directly from their smartphones using the app.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Incentive to Maintain High Hygiene Standards in Professional Environments

- 5.1.2 High Demand from Professional Services in Healthcare

- 5.2 Market Challenges

- 5.2.1 High Cost of Ownership Paired with a Lower Efficiency Compared to Traditional Manual Equipment

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Domestic/Household Robots

- 6.1.1.1 Vacuum Floor Cleaner

- 6.1.1.2 Pool Cleaning

- 6.1.1.3 Other Cleaning

- 6.1.2 Professional Robots

- 6.1.2.1 Floor Cleaning

- 6.1.2.2 Tank, Tube, and Pipe Cleaning

- 6.1.2.3 Other Applications

- 6.1.1 Domestic/Household Robots

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.2 Europe, Middle East & Africa

- 6.2.3 Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Domestic Robot Cleaners

- 7.1.1.1 Ecovacs Robotics Co. Ltd

- 7.1.1.2 Roborock Technology Co. Ltd

- 7.1.1.3 LG Electronics Inc.

- 7.1.1.4 iRobot Corporation

- 7.1.1.5 Cecotec Innovaciones SL

- 7.1.1.6 Neato Robotics Inc.

- 7.1.1.7 Electrolux AB

- 7.1.1.8 SharkNinja Operating LLC

- 7.1.1.9 Panasonic Corporation

- 7.1.1.10 Haier Group Corporation

- 7.1.1.11 Hitachi Ltd

- 7.1.1.12 Samsung Electronics Co. Ltd

- 7.1.1.13 Xiaomi Group

- 7.1.2 Professional Robot Cleaners

- 7.1.2.1 AzioBot BV

- 7.1.2.2 Softbank Robotics

- 7.1.2.3 Karcher

- 7.1.2.4 Avidbots Corp.

- 7.1.2.5 Minuteman International

- 7.1.2.6 Diversey Holdings

- 7.1.2.7 Tennant Company

- 7.1.2.8 Nilfisk A/S

- 7.1.2.9 ICE Cobotics

- 7.1.1 Domestic Robot Cleaners

8 INVESTMENT ANALYSIS

9 FUTURE TRENDS