PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851219

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851219

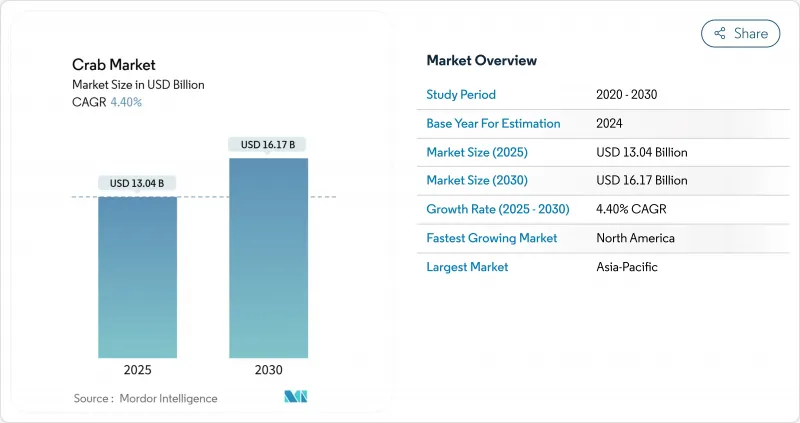

Crab - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Crab Market size is estimated at USD 13.04 billion in 2025 and is projected to reach USD 16.17 billion by 2030, at a CAGR of 4.40% during the forecast period.

Strong consumer demand in both retail and food-service channels, widening acceptance of premium species, and sustained price premiums for certified sustainable catch underpin this growth. Asia-Pacific's integrated processing networks and rising domestic aquaculture volumes secure the region's leadership, while sanctions-driven supply rerouting toward China has reshaped global trade lanes. North American producers benefit from constrained wild-catch quotas that elevate prices, and technology investments such as automated sorting improve yields and margins. Climate variability remains the overarching structural challenge, but diversified sourcing, aquaculture fattening, and upgraded cold-chain infrastructure help the crab market maintain momentum.

Global Crab Market Trends and Insights

Mainstream Export Demand from Food-Service Rebound

Food-service recovery has expanded the crab market well beyond pre-pandemic consumption levels, with retail king-crab sales jumping more than 60% even as prices touched USD 28 per pound. Newly acquired household familiarity complements restaurant demand, creating a dual-channel revenue base that cushions suppliers against cyclical shocks. Exporters gain pricing leverage because distributors now view premium crab as a "luxury staple" rather than an occasional indulgence. This evolution dampens price elasticity, supporting long-run volume commitments from processors and vessel owners. Growth stays particularly strong in North America and Western Europe, where menu engineering positions premium crab above lobster on profitability metrics.

Growing Appetite for Premium King and Snow Crab

King crab's luxury status has surged as limited Alaska quotas intensify rarity value, while the US buyers outbid Asian importers for Norwegian supply. Despite a 7% drop in global king- and snow-crab landings to 7.7 million lb in 2024, retail velocities rose, indicating pent-up demand. Shoppers routinely accept double-digit price increases, reflecting a shift from species substitution to species loyalty. For producers, securing verified provenance bolsters brand equity, and supply-side scarcity amplifies marketing narratives that reinforce premium positioning. The trend feeds directly into the crab market's margin growth, especially among vertically integrated fleets with certification and traceability in place.

Sanctions-Driven Trade-Route Volatility

Expanded US restrictions on Russian seafood, including third-country reprocessing, halved direct imports from 48.8 million kg in 2021 to 23 million kg in 2022. Oversupply slashed king-crab prices in Japan from JPY 10,000 (USD 69.30) to JPY 6,000 (USD 41.60) per kg, and snow-crab quotes dove to JPY 2,500 (USD 17.30). While Chinese buyers absorbed some excess, Canadian and US producers face 25% retaliatory tariffs that threaten 56,000 metric tons of annual cross-border flows. These gyrations complicate procurement planning and elevate working capital requirements across the crab market.

Other drivers and restraints analyzed in the detailed report include:

- Price Premium for Sustainably Certified Wild Fisheries

- Accelerating Shift Toward Aquaculture Fattening

- Climate-Driven Changes Disrupt Marine Life in Northern Seas

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Opilio generated 17.5% of the crab market share in 2024 and is forecast to expand at a 5.3% CAGR by 2030, giving the segment the highest contribution to crab market size growth over the outlook period. Its cold-tolerant biology supports stable recruitment even as temperature bands migrate northward, and processors favor Opilio for its uniform cluster size that simplifies automated grading. The reopening of select quotas in the Barents Sea offers additional headroom for harvesters that meet traceability standards.

Premium Red King Crab remains scarce; Alaska's 2024-25 quota of 2.1 million lb, less than half the 2018 harvest, locks in scarcity premiums that exceed USD 50 per lb at wholesale. Blue King Crab and Tanner crab occupy niche food service channels, while Dungeness faces tightening supply after record 108 million lb landings in 2023 drove 2025 spot prices to USD 4 lb. Adoption of CrabScan360 image-analysis reduces defect rates across all species, improving yield by up to 7% and lowering rework expenses. Collectively, technology infusion and targeted quota management underpin resilience across the crab market.

The Crab Market Report is Segmented by Type (Red King Crab, Blue King Crab, and More) and by Geography (North America, Europe, Asia-Pacific, and More). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Asia-Pacific held 61.8% of the 2024 consumption value, cementing its status as the anchor of the global crab market. China imported USD 1.3 billion in crab alongside domestic mitten-crab output of 1.18 million metric tons, leveraging vertically integrated slaughter, processing, and e-commerce channels to internalize value. Russian rerouting of 17,000 million metric tons in Q1 2025 further consolidated regional supplies, while Japanese retail benefited from steep price drops that spurred volume growth. AIoT deployment in pond culture and factory settings points to continued productivity gains.

North America records the fastest expansion at 4.6% CAGR through 2030. The Bristol Bay red-king-crab fishery reopened with a 1,048 million metric tons TAC in 2025, demonstrating cautious resource stewardship. Yet the Bering Sea snow-crab fishery stays shut, compelling import substitution and bolstering domestic premiums. Proposed 25% US tariffs on Canadian crab could upend supply for processors reliant on 50,000 metric tons annual inflows, injecting volatility that favors vertically integrated fleets.

Europe sustains modest growth on the back of record Norwegian snow and king-crab exports worth NOK 300 million (USD 28 million) to the US in March 2025, reflecting agile trade rerouting. Certification uptake surpasses other regions, with MSC-approved volumes capturing shelf space in premium retailers. Meanwhile, Middle Eastern processors in the UAE commit USD 1.5 billion to local seafood capacity, signaling new downstream demand. Africa remains nascent yet benefits from UNCTAD-tracked USD 39 billion South-South fish trade, opening corridors for artisanal crab.

- Market Overview

- Market Drivers

- Market Restraints

- Value / Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Key Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream export demand from food-service rebound

- 4.2.2 Growing appetite for premium king and snow crab

- 4.2.3 Price premium for sustainably certified wild fisheries

- 4.2.4 Accelerating shift toward aquaculture fattening

- 4.2.5 Automation and AI adoption in processing facilities

- 4.2.6 Cold-chain infrastructure upgrades

- 4.3 Market Restraints

- 4.3.1 Sanctions-driven trade-route volatility

- 4.3.2 Climate-Driven Changes Disrupt Marine Life in Northern Seas

- 4.3.3 Rising plant-based and imitation-crab penetration

- 4.3.4 Increasing tariff uncertainty on processed crustaceans

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Type

- 5.1.1 Red King Crab

- 5.1.2 Blue King Crab

- 5.1.3 Opilio

- 5.1.4 Tanner

- 5.1.5 Other Types (Dungeness Crab, Gazami, etc.)

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 France

- 5.2.2.2 Belgium

- 5.2.2.3 Germany

- 5.2.2.4 Netherlands

- 5.2.2.5 United Kingdom

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Indonesia

- 5.2.3.3 Philippines

- 5.2.3.4 Vietnam

- 5.2.3.5 India

- 5.2.3.6 Japan

- 5.2.3.7 Australia

- 5.2.4 South America

- 5.2.4.1 Argentina

- 5.2.4.2 Brazil

- 5.2.5 Middle East

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.6 Africa

- 5.2.6.1 South Africa

- 5.2.1 North America

6 Competitive Landscape

- 6.1 List of Key Stakeholders

7 Market Opportunities and Future Outlook