Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689943

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689943

Satellite Bus - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 197 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

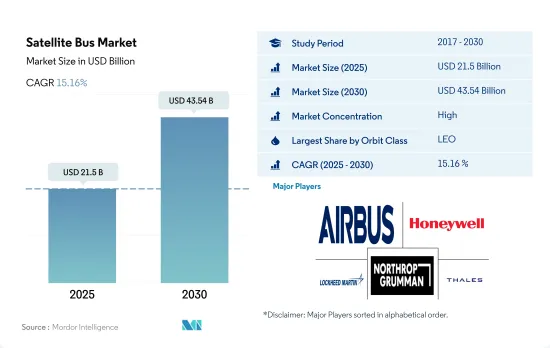

The Satellite Bus Market size is estimated at 21.5 billion USD in 2025, and is expected to reach 43.54 billion USD by 2030, growing at a CAGR of 15.16% during the forecast period (2025-2030).

Cost-effectiveness, faster deployment times, and advanced capabilities of LEO satellites aids the market growth

- The satellite bus market is driven by the increasing demand for satellite-based services, with applications ranging from communication and navigation to remote sensing and scientific research. The demand for cost-effective solutions, faster deployment times, and advanced capabilities is driving the development of innovative satellite bus solutions for LEO, MEO, and GEO satellites.

- LEO satellites are in demand for applications such as Earth observation, remote sensing, and scientific research. For LEO satellites, various companies offer a range of bus solutions, including the Boeing 502 Phoenix, the Lockheed Martin LM 400, and the Northrop Grumman GeoStar-3. These buses are designed to support a range of LEO applications, such as Earth observation, remote sensing, and scientific research.

- MEO satellites are used for applications such as communication and navigation. The demand for MEO satellites is driven by the need for improved navigation capabilities and advanced imaging technologies. Companies like Airbus Defence and Space, Boeing, and Lockheed Martin offer advanced solutions for communication and navigation missions, including the Airbus Eurostar Neo, the Boeing 702MP, and the Lockheed Martin LM 2100.

- The demand for GEO satellites is driven by the need for high-capacity data transmission, global coverage, and high-quality broadcasting capabilities. For GEO orbit, key players in the market include Boeing, Lockheed Martin, and Maxar Technologies. These companies offer innovative solutions for communication and broadcasting missions, including the Boeing 702, the Lockheed Martin A2100, and the Maxar Technologies 1300-class. These buses are designed to provide long-term, stable service for satellite-based services

The surge in the number of satellites manufactured and launched has positively impacted the market

- The global satellite manufacturing market is a dynamic and rapidly changing industry that plays an important role in modern society. This industry includes companies that design, manufacture, and launch a wide range of satellites, from small cubes to large Earth observation and communication satellites.

- The industry is driven by various factors, including growing demand for satellite services such as communications, navigation, and Earth observation, and increasing accessibility to space for public and private organizations. As a result, the industry has seen significant growth in recent years, with new players entering the market and established companies expanding their capabilities.

- Satellite manufacturing is a complex process with many technologies, including advanced materials, electronics, and software. Companies in this field must have a deep understanding of these technologies and be able to integrate them into sophisticated systems that can withstand the harsh conditions of space. Major satellite manufacturers include Airbus Defense and Space, The Boeing Company, Lockheed Martin, and Thales Alenia Space.

- North America and Europe are more established markets in the industry, while Asia-Pacific is a more lucrative market for growth opportunities. From 2017 to May 2022, around 4300 satellites were manufactured and launched globally. The global satellite manufacturing market is projected to grow and innovate as demand for satellite services grows and space access expands.

Global Satellite Bus Market Trends

Small satellites are poised to generate the demand in the market

- The classification of spacecraft by mass is one of the main metrics for determining the launch vehicle size and cost of launching satellites into orbit. In North America, during 2017-2022, around 45+ large satellites launched were owned by North American organizations. More than 80 medium-sized satellites launched were operated by North American organizations. Around 2900+ small satellites were manufactured and launched in this region.

- Europe has witnessed significant growth in recent years, primarily driven by the increasing demand for different satellite masses. Satellite mass is one of the most critical factors that influence the satellite manufacturing market in Europe. This is because different types of satellites require different masses, influencing the launch vehicle market. For instance, during 2017-2022, a total of 569 satellites were launched in the region. Of these 569 satellites, minisatellites accounted for the largest share, with 451 satellites launched into orbit, followed by 44 nanosatellites, 37 large satellites, 16 medium size satellites, and seven microsatellites.

- Satellite manufacturing has become an increasingly important industry in Asia-Pacific in recent years, driven by the need to meet the growing demand for advanced satellite capabilities. The range of satellite mass that is being manufactured in Asia-Pacific varies significantly, and this has a significant impact on the growth of the market. For instance, during 2017-2022, a total of 370 satellites were launched in the region. Of that, microsatellites accounted for the largest share, with 130 satellites launched into orbit, followed by 75 large satellites, 63 nanosatellites, 60 medium size satellites, and 42 minisatellites.

Investment opportunities in the market are increasing spending on space programs

- In North America, government expenditure for space programs hit a record of approximately 103 billion in 2021. The region is the epicenter of space innovation and research, with the presence of the world's biggest space agency, NASA. In 2022, the US government spent nearly USD 62 billion on its space programs, making it the highest spender on space in the world. For instance, till February 2023, NASA distributed USD 333 million as research grants. In 2022, the US government spent nearly USD 62 billion on its space programs.

- European countries are recognizing the importance of various investments in the space domain and are increasing their spending on space activities and innovation to stay competitive and innovative in the global space industry. On this note, in November 2022, ESA announced that it proposed a 25% boost in space funding over the next three years designed to maintain Europe's lead in Earth observation, expand navigation services and remain a partner in exploration with the United States. The European Space Agency (ESA) is asking its 22 nations to back a budget of EUR 18.5 billion for 2023-2025. Germany, France, and Italy are the major contributors.

- Considering the increase in space-related activities in the Asia-Pacific region, in 2022, according to the draft budget of Japan, the space budget of the country was over USD 1.4 billion, which includes the development of the H3 rocket, Engineering Test Satellite-9, and the nation's Information Gathering Satellite (IGS) program. Similarly, the proposed budget for India's space programs for FY22 is USD 1.83 billion. In 2022, South Korea's Ministry of Science and ICT announced a space budget of USD 619 million for manufacturing satellites, rockets, and other key space equipment.

Satellite Bus Industry Overview

The Satellite Bus Market is fairly consolidated, with the top five companies occupying 71%. The major players in this market are Airbus SE, Honeywell International Inc., Lockheed Martin Corporation, Northrop Grumman Corporation and Thales (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 69450

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Miniaturization

- 4.2 Satellite Mass

- 4.3 Spending On Space Programs

- 4.4 Regulatory Framework

- 4.4.1 Global

- 4.4.2 Australia

- 4.4.3 Brazil

- 4.4.4 Canada

- 4.4.5 China

- 4.4.6 France

- 4.4.7 Germany

- 4.4.8 India

- 4.4.9 Iran

- 4.4.10 Japan

- 4.4.11 New Zealand

- 4.4.12 Russia

- 4.4.13 Singapore

- 4.4.14 South Korea

- 4.4.15 United Arab Emirates

- 4.4.16 United Kingdom

- 4.4.17 United States

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application

- 5.1.1 Communication

- 5.1.2 Earth Observation

- 5.1.3 Navigation

- 5.1.4 Space Observation

- 5.1.5 Others

- 5.2 Satellite Mass

- 5.2.1 10-100kg

- 5.2.2 100-500kg

- 5.2.3 500-1000kg

- 5.2.4 Below 10 Kg

- 5.2.5 above 1000kg

- 5.3 Orbit Class

- 5.3.1 GEO

- 5.3.2 LEO

- 5.3.3 MEO

- 5.4 End User

- 5.4.1 Commercial

- 5.4.2 Military & Government

- 5.4.3 Other

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Airbus SE

- 6.4.2 Ball Corporation

- 6.4.3 Honeywell International Inc.

- 6.4.4 Lockheed Martin Corporation

- 6.4.5 Nano Avionics

- 6.4.6 NEC

- 6.4.7 Northrop Grumman Corporation

- 6.4.8 OHB SE

- 6.4.9 Sierra Nevada Corporation

- 6.4.10 Thales

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.