PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690079

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690079

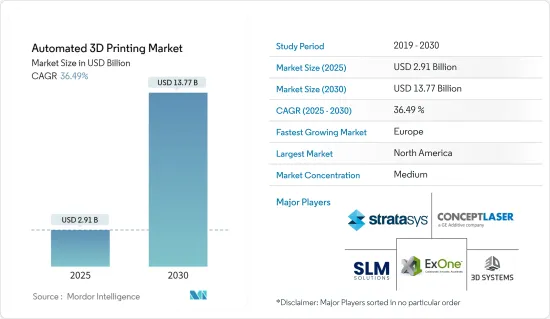

Automated 3D Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automated 3D Printing Market size is estimated at USD 2.91 billion in 2025, and is expected to reach USD 13.77 billion by 2030, at a CAGR of 36.49% during the forecast period (2025-2030).

The increasing investments in R&D and growth in the adoption of robotics for industrial automation are expected to propel market growth.

Key Highlights

- Over the last few years, 3D printing has constantly experienced a shift from the prototyping and small batches phase to mass production technology with a growing adoption rate across the industries, where the industrial and non-printer vendors have shifted their focus toward automation. Also, with the evolutionary trend for additive manufacturing, hardware growing beyond stand-alone systems that are used for prototyping, tooling, and single-part production to be used as core systems within integrated digital mass production lines is driving the number of opportunities in the emerging lights-out factories.

- Artificial Intelligence and machine learning technologies are finding their way through various applications in the additive manufacturing industry. For instance, researchers from MIT have applied the data-driven nature of machine learning to automate the process of discovering new 3D printing materials. With machine learning, material performance factors, such as toughness and compression strength, were optimized using an algorithm that quickly outperformed conventional methods of 3D printing material formulation. The researchers developed a free, open-source materials optimization platform called AutoOED, allowing other researchers to conduct their material optimization.

- Similarly, in January 2022, a group of organizations from Germany and Canada formed a new collaboration to use 3D printing and AI to automate the process of fixing parts. The Artificial Intelligence Enhancement of Process Sensing for Adaptive Laser Additive Manufacturing (AI-SLAM) project aims to create powerful AI-based software that can run directed energy deposition (DED) 3D printers automatically. To more successfully repair uneven surfaces on damaged components, the software will algorithmically regulate the printing process. The Fraunhofer Institute for Laser Technology (ILT) and a software company BCT are part of the German consortium. In Canada, the work will be overseen by the National Research Council of Canada (NRC). McGill University will coordinate the research, and machine learning firm Braintoy will help program the AI models.

- Furthermore, there have been various developments in the market by players to enhance their position in the market. For instance, in April 2021, Mosaic launched Array, an automated 3D printing platform, which loads and unloads materials for its four Element HT printers, starts prints, removes prints, and stores them so that the next prints can begin. The Array is designed for maximum flexibility with its vending machine-style robotic arm that removes prints, places them to the side, and loads a clean bed for the next print, ensuring maximum output.

- In October 2021, 3DQue, a Vancouver-based developer of automation technology for the 3D printing industry, announced the launch of two new Quinly automation kits for the Creality CR-10 and CR-6 SE. Quinly is a virtual 3D printer operator served by a Raspberry Pi, a hardware and software kit capable of running desktop 3D printers on its own. The technology is designed to make 3D printing more scalable by taking manual labor out of the equation. It is primarily aimed at print labs, on-demand manufacturers, educational institutions, and anyone else seeking automated mass part production.

- Additionally, due to the disruption of supply chains and new demands for treatments and materials, the COVID-19 pandemic has significantly accelerated technological advancements in the pharmaceutical, medical device, and manufacturing sectors. The supply chain shortages have made it hard for medical personnel to get the supplies they need, generating a shortage of personal protection equipment (PPE) and medical devices in hospitals for fighting off the virus. Owing to this, additive manufacturing (AM) (automated 3D printing) has emerged as one remarkable fabrication process because of its accessibility and flexibility to produce complex and monolithic parts or even mechanical systems quickly.

Automated 3D Printing Market Trends

The Automotive Segment is Expected to Drive the Market's Growth

- Automobiles are an essential part of human lives as the main mode of transportation today. Currently, there are over 1.3 billion motor vehicles on the road globally, with that number expected to rise to 1.8 billion by the year 2035. Passenger cars comprise roughly 74% of these statistics, while light commercial vehicles and heavy trucks, buses, coaches, and minibusses make up the remaining 26%.

- 3D printing can be used in making molds and thermoforming tools for the rapid manufacturing of grips, jigs, and fixtures. This allows automakers to produce samples and tools at low costs and eliminate future production losses when investing in high-cost tooling. The first-ever 3D-printed electric car was launched in 2014 by Local Motors. Subsequently, other established firms, like the BMW group, have also followed suit in terms of adopting automated 3D printing techniques. In several major US auto manufacturers, around 80%-90% of each initial prototype assembly has been 3D printed, with an increasing trend toward automation. Some of the popular components are parts of the exhaust, air intake, and ducting. These parts are designed digitally, 3D printed, and fitted on a car in short order, then tested through multiple iterations.

- Perhaps the most popular use of automated 3D printing in the automotive space is fabricating manufacturing aids like jigs and fixtures. Making manufacturing tools using traditional means is rather costly and time-consuming, and geometry limitations translate into less efficient manufacturing processes and more constraints on the geometry of end-use parts. Manufacturing tools that are 3D printed are lighter and more ergonomic, making it easier and safer for factory workers to perform their duties.

- Furthermore, the production volumes associated with automotive manufacturing are very high, tallying to hundreds of thousands of runs for every part. That would be difficult for most 3D printing technologies to keep up with (for now). But many high-end automobile manufacturers limit the production runs of their cars to only a few thousand units, which makes automated 3d printing a viable option.

- According to the World Economic Forum, more than 12 million fully autonomous cars are expected to be sold per year-on-year 2035, covering 25% of the global automotive market. Also, several initiatives taken by the electric motor manufacturers are leading to the growth of the market. In March 2020, UK-based engineering company Equipmake developed a power-dense permanent magnet electric motor. The motor was designed in collaboration with Hieta, a 3D printing specialist. Equipmake's Ampere motor will weigh near to 10kg but provide an output of 295bhp.

- Furthermore, Brackets are small and rather mundane parts, which were very difficult to optimize in the past time when engineers were constrained by the traditional manufacturing methods. Currently, engineers can design optimized brackets and bring these designs to life with the help of 3D printing. Rolls Royce recently showcased the capabilities of 3D printing for brackets. The company showed off a large batch of DfAM-optimized and 3D-printed automotive metal parts, many of which look to be bracketed. While prototyping remains the primary application of 3D printing within the automotive industry, using the technology for tooling is rapidly catching on. One major example of this is Volkswagen, which has been using 3D printing in-house for a number of years. Their binder jetting technology is also in use to construct the component. Also, in July 2021, Volkswagen stated that it is partnering with Siemens and HP to industrialize 3D printing of structural parts, which can be significantly lighter than equivalent components made of sheet steel.

North America is Expected to Hold a Major Market Share

- North America is one of the significant markets for Automated 3D printing globally, with the United States accounting for a significant share in the region. The country's rising demand can be attributed to the vast presence of small and big vendors. For instance, Forecast 3D in Carlsbad, CA, offers 3D printing services in a variety of materials to the healthcare, automotive, aerospace, consumer products, and design industries.

- Closed-loop control systems have long been a fundamental aim for additive manufacturing engineers due to the rapid development of powerful AI applications. For instance, Researchers at GE's Niskayuna Additive Research Lab, New York, created a proprietary machine-learning platform that uses high-resolution cameras to monitor the printing process layer by layer and detect streaks, pits, holes, and other problems that are typically invisible to the naked eye. Further, The data is compared in real-time to a pre-recorded flaws database utilizing computer tomography (CT) imaging. The AI system will be trained to forecast difficulties and detect flaws throughout the printing process using the high-resolution image and CT scan data.

- Furthermore, the market is witnessed with various technology patents for polymer 3D printing. For instance, in August 2020, PostProcess Technologies Inc., one of the providers of automated and intelligent post-printing solutions for industrial 3D printing, received a patent for automated post-printing technology for polymer 3D printing. The SVC technology is part of PostProcess's additive manufacturing family of 3D printed polymer support removal and resin removal solutions. This patented method uses patent-pending detergents and proprietary algorithms to ensure that 3D printed components are exposed to detergent and cavitation uniformly, consistently, and reliably during post-printing.

- Also, various vendors are expanding facilities into the region, primarily to address the supply chain challenges and growing demand in various end-user verticals. For instance, in February 2021, Roboze announced the opening of its US headquarters in Houston, Texas, to facilitate the reshoring of domestic production and address supply chain issues. Roboze will be able to increase its engineering and production capacity in the United States with plans to hire over 100 employees in the next two years and address a growing demand for 3D printing technology in industries such as aerospace, oil and gas, and mobility.

- Similarly, in April 2021, Roboze announced the launch of Roboze Automate, the industrial automation system to bring customized 3D printing with super polymers and composites into the production workflow for extreme end-user applications. The United States is experiencing a metals deficit that is affecting each of the industry areas as it begins an infrastructure push that spans from energy to transportation to manufacturing. Roboze combined its novel polymer platform technology, PEEK, an ideal metals replacement technology, with a PLC industrial automation system developed in partnership with B&R.

Automated 3D Printing Industry Overview

The automated 3D printing market is competitive and consists of several major players who are trying to gain a larger share, but top players have gained a major proportion of consumers and also investing in R&D and partnerships with hardware vendors for more developments and innovations. Some of the key players include Stratasys Ltd, 3D Systems Corporation, and The ExOne Company, among others.

- February 2022 - Viaccess-Orca, ShipParts.com, along with SLM Solutions, announced a new technology solution that enables direct Cloud-to-Print for additive manufacturing (AM). This fully automated software execution protects the manufacturer's intellectual property (IP) associated with part data by controlling the quantity, duration, and parameters of acceptable prints. Based on the native integration of VO's SMP software library and SLM Solutions machine firmware, this Cloud-to-Print solution allows manufacturers to be fully confident that their IP will be protected when printing is licensed.

- January 2022 - Materialise NV, a renowned provider of additive manufacturing (AM) software and services, Sigma Labs, Inc., a provider of quality assurance software, and Materialise, together have developed a technology to enhance the scalability of metal AM applications. The new platform combines Sigma Labs' PrintRite3D sensor technology to Materialise Control Platform to enable the users to identify and correct metal build issues in real-time.

- January 2022 - PostProcess Technologies announced the addition of a new solution lineup of automated, intelligent post-printing solutions for additive manufacturing (AM) to its portfolio. The new VORSA 500 leverages PostProcess technology for consistent, hands-free support structure removal on 3D printed FDM parts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assestment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in R&D

- 5.1.2 Growth in Adoption of Robotics for Industrial Automation

- 5.2 Market Challenges

- 5.2.1 Operational Challenges

6 MARKET SEGMENTATION

- 6.1 Offering

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 Process

- 6.2.1 Automated Production

- 6.2.2 Material Handling

- 6.2.3 Part Handling

- 6.2.4 Post-Processing

- 6.2.5 Multiprocessing

- 6.3 End-user Vertical

- 6.3.1 Industrial Manufacturing

- 6.3.2 Automotive

- 6.3.3 Aerospace and Defense

- 6.3.4 Consumer Products

- 6.3.5 Healthcare

- 6.3.6 Energy

- 6.3.7 Other End-user Verticals

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Stratasys Ltd

- 7.1.2 Concept Laser Inc. (GE Additive)

- 7.1.3 The ExOne Company

- 7.1.4 SLM Solutions Group AG

- 7.1.5 3D Systems Corporation

- 7.1.6 Universal Robots AS

- 7.1.7 Formlabs

- 7.1.8 PostProcess Technologies Inc.

- 7.1.9 Materialise NV

- 7.1.10 Authentise Inc.

- 7.1.11 DWS Systems

- 7.1.12 Coobx AG

- 7.1.13 ABB Group

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS