PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690170

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690170

Automotive Acoustic Engineering Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

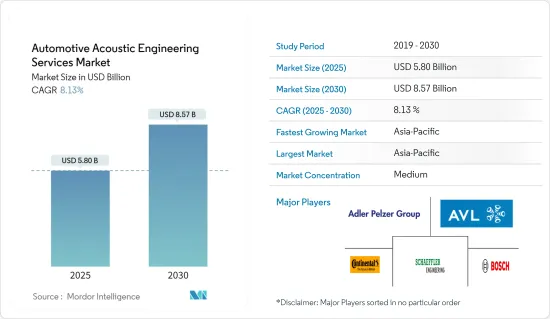

The Automotive Acoustic Engineering Services Market size is estimated at USD 5.80 billion in 2025, and is expected to reach USD 8.57 billion by 2030, at a CAGR of 8.13% during the forecast period (2025-2030).

The significance of automotive acoustic engineering services lies in the continuous quest for enhanced driving experiences and vehicle performance. In recent years, the automotive acoustic engineering services market has witnessed substantial growth, driven by a surge in demand for electric and hybrid vehicles, stringent noise emission norms, and a focus on comfort and luxury in the automotive industry. As automakers strive to meet consumer expectations and regulatory requirements, the demand for specialized acoustic engineering services has risen.

Several driving factors contribute to the growth of the automotive acoustic engineering services market. Firstly, the increasing awareness about noise pollution and its adverse effects on human health and the environment led to stricter noise emission norms worldwide. This trend has forced automakers to invest in advanced acoustic engineering solutions to ensure compliance. Additionally, the rising popularity of electric and hybrid vehicles has led to a higher demand for noise, vibration, and harshness (NVH) management solutions to improve driving comfort. The growing luxury car market and the introduction of new technologies, such as active noise cancellation systems, have further fuelled the demand for automotive acoustic engineering services.

One of the primary challenges is the need for continuous innovation to meet the evolving regulatory landscape and consumer preferences. As automotive technologies advance, acoustic engineers must adapt to new materials, design methodologies, and testing techniques to ensure optimal performance. On the other hand, the growing adoption of electric and hybrid vehicles presents a significant opportunity for acoustic engineering services, as these vehicles require specialized NVH management solutions to address unique challenges such as electric motor noise and battery vibrations. The increasing adoption of autonomous vehicles may lead to new acoustic engineering requirements, such as designing interior soundscapes, to enhance the passenger experience.

As electric and hybrid vehicles continue to gain popularity, the demand for specialized acoustic engineering services will likely increase. Additionally, the integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies may create new opportunities for acoustic engineers to optimize interior soundscapes and enhance the overall driving experience. The growing trend of personalization in the automotive industry may lead to tailored acoustic solutions for individual vehicle models and customer preferences. Overall, the future of automotive acoustic engineering services seems bright, driven by technological advancements, regulatory pressures, and evolving consumer expectations.

Automotive Acoustic Engineering Services Market Trends

Passenger Cars are Dominating the Automotive Acoustic Engineering Services Market

In the automotive industry, passenger cars dominate the market for acoustic engineering services due to their widespread use and the increasing emphasis on comfort, luxury, and noise reduction. As automakers strive to meet customer expectations and regulatory requirements, the demand for specialized acoustic engineering solutions has grown significantly. Passenger cars require advanced noise, vibration, and harshness (NVH) management solutions to provide a quiet, comfortable, and enjoyable driving experience.

The role of acoustic engineering services in passenger cars is crucial, as they enhance driving comfort and reduce noise levels. Acoustic engineers work on various aspects of passenger car design, such as sound insulation, noise barrier systems, and advanced materials to minimize unwanted noise and vibrations. This results in a more comfortable and quieter ride for passengers, which is a critical factor in customer satisfaction and vehicle sales. Several OEMs are working to deliver such products into the market. For instance, in July 2022, 3M's Make-in-India solution was introduced for managing NVH levels in new EVs and hybrid vehicles.

Luxury passenger cars prioritize acoustic engineering services to differentiate themselves from competitors and offer an exceptional driving experience. Acoustic engineers focus on developing innovative solutions to minimize noise and vibrations, such as active noise cancellation systems, advanced sound insulation materials, and optimized engine mounts. For instance, Warwick Acoustics, a UK-based company, developed car audio transducers in October 2023 that significantly reduced the need for rare-earth elements in their production. This innovative technology aims to minimize environmental impact and dependency on finite resources.

As the automotive industry evolves and innovates, the future of acoustic engineering services in passenger cars appears promising. With the growing focus on sustainability and electric vehicles, acoustic engineers must adapt to new challenges, such as managing noise generated by electric motors and battery systems.

Additionally, the increasing adoption of autonomous vehicles may lead to new acoustic engineering requirements, such as designing interior soundscapes to enhance the passenger experience. As automotive technologies advance and customer preferences evolve, acoustic engineering services will remain crucial to passenger car development, ensuring a comfortable and enjoyable driving experience for all.

Asia-Pacific to Hold a Major Market Share

Asia-Pacific is expected to hold a major share in the automotive acoustic engineering services market due to several factors, including rapid economic growth, increasing automotive production, and a growing consumer base. With a large and diverse population, the region offers significant opportunities for automotive manufacturers and suppliers, including those specializing in acoustic engineering services. Additionally, stringent government regulations on vehicle emissions and noise levels drive the demand for advanced acoustic engineering solutions in Asia-Pacific.

One of the primary reasons for the region's dominance in the automotive acoustic engineering services market is the rapid expansion of the automotive industry in countries like China, India, and Japan. These countries have become major production hubs for domestic and international automakers, leading to increased demand for acoustic engineering services to meet local and global market requirements.

China is one of the world's largest automotive markets. More than 23.56 million passenger cars were sold in the country in 2022, and the country's yearly sales recorded an increase of 9.7% compared to 2021. As China's automotive industry continues to expand, there is a growing emphasis on offering premium in-car audio experiences, which drives the demand for advanced acoustic engineering services. Chinese automakers are investing in R&D to stay competitive in the global market and meet the evolving needs of domestic consumers.

For instance, in November 2023, China's Geely-owned powertrain company, Aurobay, bet on hybrid technology and sought a partner in India. Aurobay aims to strengthen its presence in the Indian market by collaborating with local automakers and focusing on developing advanced hybrid powertrain solutions for the future.

Similarly, in December 2022, Bose and Volvo Cars announced a new collaboration in sound, aiming to enhance the in-car audio experience for Volvo vehicle owners. This partnership will integrate Bose's cutting-edge audio technology into Volvo's vehicles, providing superior sound quality and an immersive listening experience for passengers.

Similarly, Japanese automakers are consistently pushing the boundaries of acoustic engineering to create vehicles with improved noise, vibration, and harshness (NVH) performance. This focus on acoustic excellence drives the growth of Japan's acoustic engineering services market, as local OEMs and suppliers collaborate to develop cutting-edge solutions that enhance the overall driving experience. For instance, in July 2023, Asahi Kasei Microdevices (AKM) launched the AK7709VQ, a new multicore digital signal processor (DSP) conceived for next-generation in-vehicle sound design. This powerful DSP enables the real-time large-scale computational processing required to provide an immersive sound experience for passengers.

Such country-level developments secure the future automotive acoustic engineering services market in Asia-Pacific. As automotive manufacturers in the region strive to meet the growing demand for high-quality, comfortable, and sustainable vehicles, the need for advanced acoustic engineering solutions will continue to grow. This trend will require acoustic engineers to adapt to new technologies, materials, and design methodologies, ensuring that they remain at the forefront of the industry and maintain the region's major market share in automotive acoustic engineering services.

Automotive Acoustic Engineering Services Industry Overview

The automotive acoustic engineering services market is significantly concentrated, with a few players accounting for a major market share. Some prominent companies in the market are AVL List GmbH, Schaeffler Engineering GmbH, Siemens, Adler Pelzer, Robert Bosch, Autoneum, and Bertrandt AG.

Several market players focus on developing the latest technologies and delivering the best quality products through partnerships and product innovations. For instance,

- In February 2024, Ansys and Schaeffler partnered to drive sustainable product development using Ansys' simulation software. This collaboration will help Schaeffler optimize its components and systems, reducing material usage, energy consumption, and overall environmental impact while maintaining high performance and quality. The Ansys solutions will also help decarbonize product development and shape design strategies for hybrid/electric powertrain solutions and industrial applications.

- In June 2023, Harman Kardon and Volkswagen joined forces to develop a premium sound system for Volkswagen's upcoming ID.7 electric vehicle. The collaboration aims to create an exceptional in-car audio experience, combining Harman Kardon's expertise in sound engineering with Volkswagen's commitment to innovative vehicle design.

- In January 2023, Panasonic Automotive unveiled a new EV audio system designed specifically for electric vehicles, offering high-quality sound with low power consumption. This innovative system is expected to enhance the in-vehicle audio experience for EV owners while contributing to energy efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Process

- 5.1.1 Designing

- 5.1.2 Development

- 5.1.3 Testing

- 5.2 By Software

- 5.2.1 Calibration

- 5.2.2 Vibration

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Interior

- 5.3.2 Body and Structure

- 5.3.3 Powertrain

- 5.3.4 Drivetrain

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Commercial Vehicle

- 5.5 By Propulsion Type

- 5.5.1 Internal Combustion Engine

- 5.5.2 Electric and Plug-in Hybrid

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Rest of the World

- 5.6.5 Middle East and Africa

- 5.6.6 South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Siemens Digital Industries Software (Siemens AG)

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Continental Engineering Services GmbH (Continental AG)

- 6.2.4 Bertrandt AG

- 6.2.5 Schaeffler Engineering GmbH

- 6.2.6 Autoneum Holding Ltd

- 6.2.7 IAC Acoustics (Catalyst Acoustics Group)

- 6.2.8 AVL List GmbH

- 6.2.9 EDAG Engineering Group AG

- 6.2.10 FEV Group GmbH

- 6.2.11 Spectris PLC

- 6.2.12 Adler Pelzer Holding GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS