PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440206

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440206

Europe Mutual Fund Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

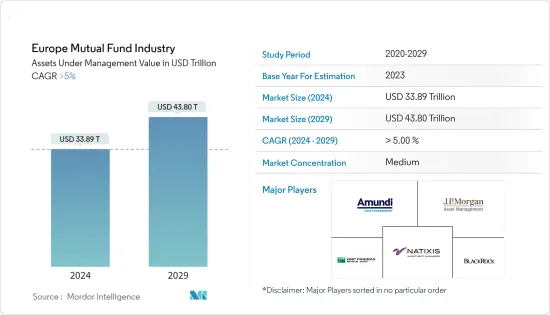

The Europe Mutual Fund Industry in terms of assets under management value is expected to grow from USD 33.89 trillion in 2024 to USD 43.80 trillion by 2029, at a CAGR of greater than 5% during the forecast period (2024-2029).

The outbreak of the COVID-19 pandemic had a significant impact on the global economy, including the mutual fund industry in Europe. The pandemic caused a sharp increase in market volatility, with stock markets experiencing significant declines followed by periods of recovery. This volatility affected mutual fund performance and resulted in fluctuations in asset values. To cope with lockdowns and social distancing measures, mutual fund companies had to quickly transition to remote work arrangements and enhance their digital capabilities. This accelerated the adoption of digital processes, including online transactions, customer service, and fund reporting. As vaccination efforts progress and economies start to recover, the mutual fund industry is expected to rebound. However, uncertainties remain, and the industry will continue to adapt to changing market dynamics and evolving investor preferences.

As the virus swept across Europe, stock prices in European financial markets began to decrease, and volatility began to rise. European equities markets began to rise after reaching low troughs in late March but at a slower pace than the US share market. The COVID-19 crisis sparked widespread panic and a rush for cash. Both money market funds and long-term funds saw outflows among UCITS. Europe funds and exchange-traded funds (ETFs) are mutual funds that invest in stocks from all around Europe. These funds will provide multi- or single-nation exposure across a diverse spectrum of developed and emerging economies, market capitalizations, currencies, and industry sectors.

In Europe, UCITS funds have the flexibility to invest in any country in the region once registered in any one member country. Debt securities are preferred in the region over equity securities funds. Total assets under management have continuously expanded over the years, reaching USD 31 trillion (or 182% of European GDP) in the previous year, with roughly 54.9% being managed on behalf of investment funds and 45% being managed on behalf of discretionary mandates.

Europe Mutual Fund Market Trends

Investment Funds Domiciled in Europe

The mutual fund industry in Europe is quite robust, with a wide range of investment funds domiciled in various European countries. These funds offer investors the opportunity to diversify their portfolios and gain exposure to different asset classes, regions, and investment strategies. One of the most popular types of investment funds in Europe is the Undertakings for the Collective Investment in Transferable Securities (UCITS) funds. These funds adhere to a set of regulatory standards established by the European Union (EU) and can be marketed and sold across EU member states. UCITS funds offer a high level of investor protection and are subject to strict regulations regarding portfolio diversification, risk management, and disclosure requirements.

European investment funds can be domiciled in various countries, including Luxembourg, Ireland, Germany, France, and the United Kingdom. Luxembourg and Ireland are particularly popular due to their favorable regulatory frameworks, tax advantages, and expertise in fund administration. Many asset managers choose to establish their funds in these countries to take advantage of their well-established fund industries. European investment funds offer a wide range of investment strategies to cater to different investor preferences and risk appetites. These strategies may include equity funds, fixed-income funds, balanced funds, money market funds, alternative investment funds (e.g., hedge funds or private equity funds), and socially responsible investment (SRI) funds. Investors can choose funds that align with their investment objectives and preferences.

European investment funds are subject to regulatory oversight by national regulatory authorities, such as the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg, the Central Bank of Ireland, or the Financial Conduct Authority (FCA) in the United Kingdom. Additionally, the European Securities and Markets Authority (ESMA) plays a crucial role in ensuring the consistent application of regulations across the EU and promoting investor protection. Under the UCITS framework, investment funds domiciled in one EU member state can be passported to other member states, allowing for cross-border distribution without the need for separate regulatory approval in each country. This has facilitated the marketing and sale of investment funds across Europe, providing investors with a wide range of options from different fund managers.

Fund Wise Segmentation of AuM

The segmentation of assets under management (AuM) in the European mutual fund industry can vary depending on various factors such as asset class, investment strategy, fund type, and investor preferences. While it is challenging to provide an exhaustive breakdown of AuM by the fund in real time, it can provide a general overview of the common fund categories and their approximate share of AuM based on historical trends. Equity funds invest primarily in stocks and shares of companies. They can be further categorized based on geographic regions (e.g., European equities, global equities) or investment styles (e.g., value, growth, small-cap, large-cap). Equity funds are often popular among investors seeking long-term capital appreciation. They tend to attract a significant portion of AuM in the European mutual fund industry.

Fixed-income funds invest in debt securities such as government bonds, corporate bonds, and other fixed-income instruments. They may focus on specific bond sectors like government bonds, high-yield bonds, or investment-grade corporate bonds. Fixed-income funds are favored by investors seeking regular income and relatively lower-risk investments. Balanced funds, also known as asset allocation or mixed funds, invest in a combination of equities, fixed-income securities, and sometimes other asset classes like cash or alternative investments. These funds aim to provide a balanced approach to risk and return, targeting both capital appreciation and income generation. Balanced funds can be suitable for investors looking for a diversified investment portfolio.

Money market funds invest in short-term debt securities such as Treasury bills, commercial paper, and certificates of deposit. They focus on preserving capital and providing liquidity. Money market funds are commonly used by investors for cash management purposes or as a temporary parking place for funds. Alternative investment funds cover a broad range of strategies that are distinct from traditional equity and fixed-income investments. These funds can include hedge funds, private equity funds, real estate funds, infrastructure funds, and commodity funds. Alternative investment funds typically aim to achieve absolute returns or provide exposure to non-traditional asset classes.

Europe Mutual Fund Industry Overview

Europe's mutual fund report includes an overview of MF companies operating across Europe and presents detailed profiling of a few major companies, including product offerings, regulations governing them, their headquarters, and financial performance. Currently, some of the major players dominating the market are listed below. Some of the major players in this market are Blackrock, Amundi, BNP Paribas Asset Management, JP Morgan Asset Management, and Natixis Investment Management.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Economic Growth

- 4.2.2 Low Interest Rates

- 4.3 Market Restraints

- 4.3.1 Market Volatility

- 4.3.2 Political and Economic Uncertainty

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Innovations Shaping The Industry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Fund Type

- 5.1.1 Equity

- 5.1.2 Debt

- 5.1.3 Multi-Asset

- 5.1.4 Money Market

- 5.1.5 Other Fund Types

- 5.2 By Investor Type

- 5.2.1 Households

- 5.2.2 Monetary Financial Institutions

- 5.2.3 General Government

- 5.2.4 Non-Financial Corporations

- 5.2.5 Insurers & Pension Funds

- 5.2.6 Other financial Intermediaries

- 5.3 By Geography

- 5.3.1 Luxembourg

- 5.3.2 Ireland

- 5.3.3 Germany

- 5.3.4 France

- 5.3.5 United Kingdom

- 5.3.6 Netherlands

- 5.3.7 Italy

- 5.3.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview (Market Concentration And M&A Deals)

- 6.2 Company Profiles

- 6.2.1 BlackRock

- 6.2.2 Amundi

- 6.2.3 BNP Paribas Asset Management

- 6.2.4 JP Morgan

- 6.2.5 Natixis

- 6.2.6 AXA

- 6.2.7 UBS

- 6.2.8 HSBC

- 6.2.9 DWS Group

- 6.2.10 PIMCO

- 6.2.11 Invesco*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US