PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690792

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690792

Insight Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

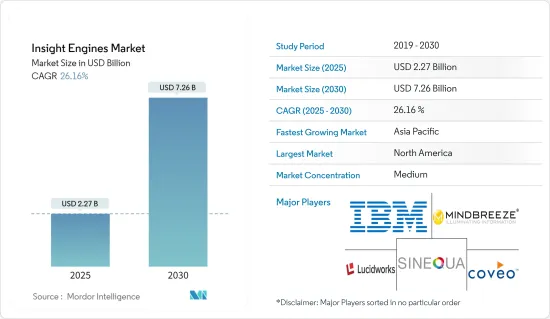

The Insight Engines Market size is estimated at USD 2.27 billion in 2025, and is expected to reach USD 7.26 billion by 2030, at a CAGR of 26.16% during the forecast period (2025-2030).

Key Highlights

- Insight engines differ from traditional search engines by offering contextual information about a given fact or entity rather than just providing links to source materials. Their primary applications encompass internal and external searches and data analytics extraction.

- Even with the widespread adoption of data and analytics solutions, many companies still find it challenging to achieve their business objectives. As a solution, there's a noticeable shift towards insight engines. These engines consolidate data from various sources, delivering vital business insights. Accenture highlights a monumental surge in data availability, now at 44 zettabytes. A significant 80% of this data is unstructured, covering everything from text documents and audio to videos, emails, and social media posts, with the remaining 20% being structured.

- To harness insights from this vast data pool and determine user or organizational needs, it's essential to extract facts from documents and ensure easy access to these stored facts. Major search engines, including Google and Bing, achieve this by utilizing a 'knowledge graph' for fact storage, a method they've employed for years.

- For numerous organizations, the investment required to extract valuable insights from data can be substantial, necessitating their own infrastructure and resources. This challenge drives many companies to view cognitive search as a fitting solution. KDNuggets, a prominent information technology and services firm, forecasts that organizations will allocate around 15% of their IT budgets to cognitive search, analytics, and related cloud-based services.

- Several industries, including retail, BFSI, media, and telecommunications, are set to adopt insight programs in the near future. Take the BFSI sector: companies are on a quest to enhance banking experiences for their customers. By leveraging advanced analytics, they aim to gain insights into processes and customer behaviors, leading to informed business decisions based on historical performance.

- Moreover, the surge in data generation by businesses, consumers, and devices propels the insight engine market. Organizations face a deluge of data from sources like social media, customer interactions, and IoT devices. Insight engines excel at discerning meaningful patterns and trends from this data, a feat often missed by traditional processing methods. This capability has fueled the global adoption of insight engines.

Insight Engines Market Trends

BFSI Segment Holds a Significant Share

- Banks grapple with unique challenges amidst a rapidly changing consumer landscape and evolving business expectations. In this context, search technology has emerged as a crucial tool for navigating the complexities of the modern financial world. Data sources, once confined to traditional channels, now encompass a wide array of options. Employees in financial institutions demand uninterrupted access to data, whether it's stored in the cloud, on SaaS platforms, or in other silos. Advanced insight engines are now adept at processing billions of documents across various formats, guaranteeing real-time data availability.

- Concurrently, insurers are contending with a tightening regulatory landscape while also facing challenges from cyber threats and disruptive innovations. In this dynamic environment, search technologies stand out as vital allies, empowering organizations to adapt swiftly and maintain their growth trajectory.

- Insight engines, driven by machine learning and artificial intelligence, tap into varied data sources to furnish bankers with a holistic view of their clients. This encompasses insights from annual reports, risk analytics, social media, and industry blogs. Such comprehensive insights not only inform investment decisions but also help in spotting opportunities and streamlining deal origination. Leveraging their extensive transactional and digital customer data, banks can utilize insight engines to access genuine credit reports. This proactive approach enables banks to detect fraud early, recognize payment discrepancies, and highlight any atypical activities.

- Furthermore, financial institutions, notably banks, are increasingly deploying insight engines to sift through social media. By harnessing Natural Language Processing, they can assess client sentiment and analyze discussions surrounding their services and strategies. This capability allows financial analysts to produce more precise reports, enhancing the advice given to both clients and internal stakeholders through access to vital, segmented data. Tailoring banking services using data not only heightens customer engagement but also propels revenue growth. A testament to this trend, in June 2023, Envestnet Data and Analytics unveiled that their Insights Engine for Banking (IEB) solution clinched the title of Best AI-based Solution for Financial Services.

- Additionally, BFSI institutions face significant hurdles in navigating stringent regulations. Compliance mandates, such as the General Data Protection Regulation (GDPR), the Dodd-Frank Act, and Anti-Money Laundering (AML) laws, necessitate meticulous oversight of financial operations. Insight engines equip organizations with tools for real-time data analysis and reporting, facilitating the prompt identification of suspicious activities and the effortless generation of compliance reports. By taking this proactive approach, institutions not only reduce the risk of non-compliance but also shield themselves from potential penalties. Such advantages are propelling the adoption of insight engines in the BFSI sector.

Asia-Pacific Expected to Witness Major Growth

- Countries like Japan, China, India, Australia, and South Korea are spearheading the rapid growth of the insight engine market in the Asia-Pacific region. China, a technological frontrunner in Asia-Pacific, boasts one of the world's fastest internet speeds and is home to major enterprises, including Alibaba.

- According to the National Bureau of Statistics, China's online retail sales saw consistent growth in the first half of 2023, driven by the rising trend of livestreaming e-commerce. Simultaneously, Thailand's Business News forecasts a 6% annual growth in online shopping for both this year and the next, targeting a market value between USD 17.8-19.5 billion. Leading categories include personal and household care products, beverages, and food. This uptick in online sales is poised to boost demand for insight engine software among retail players.

- China's regulatory framework, supported by key players like iQiyi, Tencent, and Youku, effectively prevents international giants, including the FAANG group (Facebook, Amazon, Apple, Netflix, and Google), from penetrating its market. These FAANG companies utilize advanced insight engines, especially for large-scale recommendations, and wield significant influence in advertising across various industries. Thus, while this regulatory approach safeguards the domestic market, it simultaneously offers local players an opportunity to thrive, even if their growth rate lags behind the more vigorous pace observed in the U.S.

- Looking ahead, the forecast period highlights promising opportunities for the insight engine market, particularly in emerging markets like India, driven by a surge of local entrants eager to make their mark.

- In March 2023, Insightsoftware unveiled its plans to upgrade Angles Professional for Oracle, showcasing the enhancement at the Gartner Data & Analytics Summit 2023. Responding to a rising demand for advanced operational analytics, Insightsoftware partnered with Logi Analytics. This collaboration aims to equip Oracle ERP Cloud users with tools to create interactive dashboards and reports, ensuring smooth sharing across departments.

Insight Engines Industry Overview

The insight engine market is fragmented due to the significant presence of players such as IBM Corporation, Mindbreeze GmbH, LucidWorks Inc., and Sinequa SAS. Vendors in the market are also extending the reach of their content indexing capabilities to rich media either natively or via partnership by using machine learning capabilities such as computer vision, speech-to-text functions, etc.

For instance, in April 2024, Litera unveiled a new GenAI-driven KM tool to help companies enhance their negotiation positions and bolster transaction planning. This tool enables firms to pinpoint 'relevant precedents, deal points, and market insights,' empowering them to better support their clients. By delving into 'all matter, deal, and negotiating data' from past transactions, Litera aims to provide a comprehensive solution for its users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volumes of Data and the Requirement of Structured Data

- 5.1.2 Rising Generation of Analytical Queries Via Search and Natural Language Processing

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding the Data Quality and Data Sources Validation

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment Type

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Size of the Enterprise

- 6.3.1 Small- and Medium-Sized Enterprises

- 6.3.2 Large Enterprises

- 6.4 By End-user Industry

- 6.4.1 BFSI

- 6.4.2 Retail

- 6.4.3 IT and Telecom

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Mindbreeze GmbH

- 7.1.3 Coveo Solutions Inc.

- 7.1.4 Sinequa SAS

- 7.1.5 LucidWorks Inc.

- 7.1.6 ServiceNow Inc. (Attivio Cognitive Search Platform)

- 7.1.7 Micro Focus International PLC

- 7.1.8 Google LLC

- 7.1.9 Microsoft Corporation

- 7.1.10 Funnelback Pty Ltd

- 7.1.11 IntraFind Inc.

- 7.1.12 Dassault Systems SA

- 7.1.13 EPAM Systems Inc. (Infongen)

- 7.1.14 Expert System SpA

- 7.1.15 IHS Markit Ltd

- 7.1.16 Insight Engines Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET