PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690961

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690961

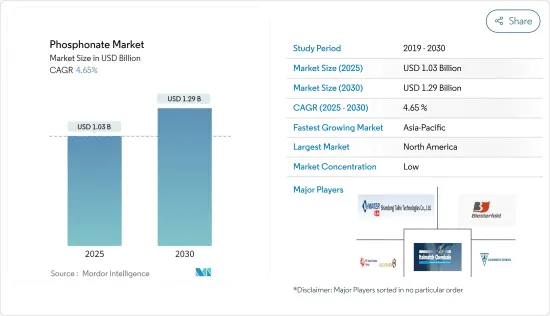

Phosphonate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Phosphonate Market size is estimated at USD 1.03 billion in 2025, and is expected to reach USD 1.29 billion by 2030, at a CAGR of 4.65% during the forecast period (2025-2030).

The positive outlook of the water treatment industry and steady progress in the detergent and cleaning agent industry in recent times are likely to drive the demand for phosphonates in the coming years.

Key Highlights

- There are wide applications of phosphonates in the water treatment industry. The rapid growth of the cleaners and detergents industry is also expected to drive the demand for phosphonates.

- However, environmental concerns due to its non-degradable nature and availability of substitutes are expected to hinder the market's growth.

- Nevertheless, emerging applications of phosphonates in pro-drugs and nano-porous phosphonates are expected to create new opportunities for the market studied.

- Asia-Pacific is expected to dominate the market, with the majority of demand coming from China and India.

Phosphonate Market Trends

Increasing Demand in the Water Treatment Industry

- Orthophosphate and polyphosphates, types of phosphonates, play a pivotal role in water treatment. Their primary function is to curb corrosion and metal leaching from pipes, notably lead and copper. By reacting with these metals, phosphates form less soluble compounds, thereby minimizing contamination risks. Furthermore, phosphates sequester iron and manganese, averting water discoloration.

- Water treatment is an advanced technique that uses chemicals to eliminate and prevent scaling, reduce corrosion, kill bacteria and algae, and purify water. There are three main types of water treatment chemicals: flocculants, biocides, and scale inhibitors.

- HEDP phosphonate is commonly used as a chemical additive in various industrial water treatment processes. HEDP is a type of scale inhibitor that can prevent scale and dirt.

- Compared to other scale inhibitors, HEDP has many advantages. It provides excellent dirt resistance, low pollution, good dissolution, and good synergy.

- The changing climate due to the proliferation of greenhouse gases has greatly increased the frequency of droughts in countries like the United States and Mexico.

- As reported by the US Drought Monitor, in 2023, around 28% of the United States faced drought conditions, with severe categories spiking in recent months. These droughts severely deplete the country's freshwater resources, including groundwater, dams, and canal water, leading to a critical shortage of clean drinking water.

- Several sewerage infrastructures have been created to process municipal wastewater. In the United States, approximately 34 billion gallons of wastewater is being processed every day. This municipal wastewater mostly contains nitrogen and phosphorus from food, human waste, soaps, and detergents.

- Governments are investing in promoting wastewater treatment policies across North America. For instance, in February 2024, the US EPA announced an investment of nearly USD 6 billion for clean drinking water and wastewater infrastructure.

- Furthermore, in India, advanced sewerage programs are being implemented to combat water scarcity. Initiatives like the Atal Mission for Rejuvenation & Urban Transformation (AMRUT), Swachh Bharat Mission (Urban) 2.0, and the Smart Cities Mission are driving these efforts under the Ministry of Housing & Urban Affairs.

- In December 2022, the National River Conservation Plan (NRCP) earmarked approximately USD 75,478 million (INR 6,248,160 million) for pollution control efforts on 36 rivers. These efforts span 80 towns across 16 states and aim to establish a sewage treatment capacity of 2,745.7 million liters per day (MLD) to combat pollution.

- In recent years, rising water demand from the industrial sector, coupled with evolving government regulations aimed at curbing water pollution, have spurred a heightened demand for water treatment solutions.

- Investments in new water treatment facilities in industrial complexes are expected to boost the demand of the market studied. For instance,

- In January 2024, Membion, hailing from Roetgen, garnered an investment of EUR 5 million (~USD 5.5 million) for its groundbreaking Membion MBR modules. These patented modules are space-efficient, occupying 75% less area, and can diminish bacterial load in wastewater by 1,000 times, surpassing traditional plants. They are designed for both municipal and industrial wastewater treatment.

- In October 2023, Water Corporation completed an upgrade worth USD 8.3 million to the Mowanjum wastewater treatment plant in Australia. This initiative is part of a new Aboriginal Communities Water Services (ACWS) program, leading to the first licensed plant in an Aboriginal community.

- In June 2023, The US Environmental Protection Agency (EPA) unveiled a landmark investment exceeding USD 278 million to enhance water and wastewater infrastructure for American Indian and Alaska Native tribes, marking the largest annual funding allocation for such initiatives.

- With rising water scarcity and fewer resources, the demand for water treatment is increasing globally, which is expected to provide a huge market for phosphonates during the forecast period.

Asia-Pacific Expected to Dominate the Phosphonate Market

- Asia-Pacific leads the phosphonate market, driven by rising water usage in nations like China, India, and Japan, subsequently boosting phosphonate consumption.

- China and India are set to propel the phosphonate market due to high demand from detergents, water treatment, oil field chemicals, cosmetics, and other end-use industries.

- Heightened hygiene awareness in China, especially after the COVID-19 pandemic, has spurred demand for premium floor cleaners, especially with the country's common use of tile and wood flooring.

- India is one of the largest producers and suppliers of detergent globally. The demand for fabric detergents in India is mainly driven by the rising penetration of washing machines.

- Key detergent manufacturers are innovating products and establishing new facilities to bolster the market's growth. For instance,

- In December 2023, Godrej Consumer Products (GCPL) launched "Godrej Fab," a liquid detergent aimed at transforming the laundry experience.

- In May 2022, Proctor & Gamble (P&G) inaugurated its inaugural liquid detergent manufacturing unit on the outskirts of Hyderabad, India, with an investment of INR 200 crore (USD 26.83 million).

- The India Brand Equity Foundation (IBEF) projects India's dishwasher market to exceed USD 90 million by 2025-2026, spurred by demand in major cities like Delhi, Mumbai, and Bangalore.

- Due to these trends, the Asia-Pacific phosphonate market is set for consistent growth in the years ahead.

Phosphonate Industry Overview

The global phosphonate market is fragmented in nature. The major players (not in any particular order) include Italmatch Chemicals, Shandong Taihe Water Treatment Technologies Co. Ltd, Biesterfeld AG, Aquapharm Chemical Pvt. Ltd, and Zschimmer & Schwarz Chemie GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Wide Applications of Phosphonates in the Water Treatment Industry

- 4.1.2 Rapid Growth of the Cleaners and Detergents Industry

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Environmental Impact Due to Non-Degradable Nature

- 4.2.2 Availability of Substitutes

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Types

- 5.1.1 ATMP

- 5.1.2 HEDP

- 5.1.3 DTPMP

- 5.1.4 Other Types

- 5.2 By End-user Industry

- 5.2.1 Detergent and Cleaning Agent

- 5.2.2 Water Treatment

- 5.2.3 Oil field chemicals

- 5.2.4 Cosmetics

- 5.2.5 Building Materials

- 5.2.6 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aquapharm Chemical Pvt. Ltd

- 6.4.2 Biesterfeld AG

- 6.4.3 Bozzetto Group

- 6.4.4 Changzhou Kewei Fine Chemicals Co. Ltd

- 6.4.5 Excel Industries

- 6.4.6 Italmatch Chemicals

- 6.4.7 Jiangsu Yuanquan Hongguang Environmental Protection Technology Co. Ltd

- 6.4.8 Jiyuan Qingyuan Water Treatment Co. Ltd

- 6.4.9 Mks DevO Chemicals

- 6.4.10 Shandong IRO Water Treatment Co. Ltd

- 6.4.11 Shandong Kairui Chemistry Co. Ltd

- 6.4.12 Shandong Taihe Watre Treatment Technologies Co. Ltd

- 6.4.13 ShanDong XinTai Water Treatment Technology Co. Ltd

- 6.4.14 Uniphos Chemicals

- 6.4.15 Zschimmer & Schwarz Chemie GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications of Phosphonates in Pro-drugs and Nano-porous Phosphonates

- 7.2 Other Opportunities