PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692137

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692137

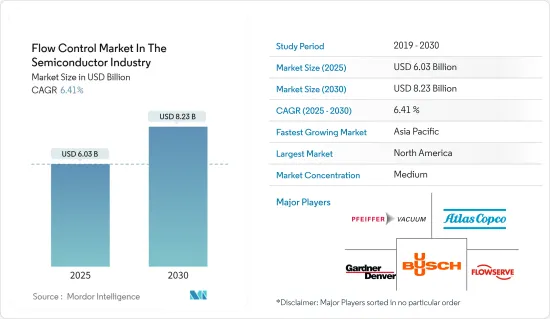

Flow Control In The Semiconductor Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Flow Control Market In The Semiconductor Industry is expected to grow from USD 6.03 billion in 2025 to USD 8.23 billion by 2030, at a CAGR of 6.41% during the forecast period (2025-2030).

Key Highlights

- Increased demand highlighting the need for stringent process control drives investments in new semiconductor production facilities. Precise flow control is crucial in the semiconductor industry. Processes like plasma etch and chemical vapor deposition (CVD) depend on the exact interaction of multiple gases to create essential layers or films. Even a slight deviation in gas flow can cause process failure, making accurate gas metering essential.

- Significant advancements in the semiconductor and electronics industries are expected to drive industrial growth. The strong adoption of the work-from-home lifestyle may also add to the surge in demand for electronic equipment caused by the COVID-19 pandemic. Furthermore, with technological advancements and well-established distribution networks, European and US electronics manufacturers strive to expand operations in emerging nations. Furthermore, the increasing popularity of consumer electronics among China's and India's youth is expected to boost the demand for semiconductor chips, which, in turn, will have a positive impact on the market's growth.

- The growing demand for the semiconductor industry supports the market's growth. For instance, in May 2024, the Semiconductor Industry Association reported that the United States is projected to triple its semiconductor manufacturing capacity by 2032, in line with the semiconductor market's growth worldwide during the forecast period. This would support the market studied by enhancing the demand for flow control equipment in the semiconductor industry.

- However, the higher cost involved with semiconductor manufacturing is anticipated to remain among the major challenging factors for the growth of the market. Additionally, the complexity involved in designing flow control devices/components, considering the critical nature of applications associated with the semiconductor industry, also challenges the growth of the market studied. The market has become consolidated, and significant players are following an acquisition strategy, creating a challenge for the growth of small companies, which would impact the overall market growth.

- During the initial phase of the COVID-19 pandemic, the market faced disruptions, including global lockdowns, which notably hampered chip manufacturers' supply chains and production capacities. Yet, the demand for semiconductor chips surged during and after the pandemic, a trend expected to persist through the forecast period. This increasing demand is poised to spur investments in new production facilities, fueling the need for flow control solutions.

Flow Control Market Trends

Mechanical Seals to Register the Fastest Market Growth

- A mechanical seal's primary function is to prevent fluid or gas leakage through the clearance between the shaft and the container. Mechanical seals are made up of two faces separated by carbon rings. The revolving equipment comes in touch with the initial face, which is stationary. Furthermore, the seal ring (first face) is the main component of the seal on which the mechanical force generated by springs, bellows, or fluids in the equipment acts. In the semiconductor industry, seals are invariably housed in areas of the processing system where they need to withstand highly corrosive gases, liquids, gases, and plasmas, often in vacuum conditions or at elevated temperatures.

- The mechanical seal segment has grown substantially in recent years and is expected to continue growing over the coming years, primarily due to increasing investments in semiconductor manufacturing facilities. In emerging nations, the rise of AI, ML, and IoT, as well as smartphone and consumer electronics development, is predicted to prompt further development policies and investments in the semiconductor industry. Cartridge seals, balanced and unbalanced seals, pusher and non-pusher seals, and conventional seals are examples of mechanical seals driving the market's expansion.

- In the fabrication of semiconductor products, seal reliability and contamination reduction are crucial. Chemical filtration, chemical transfer, AODD pump sealing, and silicon wafer fabrication are essential semiconductor applications where mechanical seals have proven to be the best option.

- Deposition, etch, ash/strip, plasma, and heat processing or annealing are synergistic process technologies that constitute some of the most difficult environments for elastomer seal materials. These are frequently encountered during the fabrication of semiconductor-integrated circuits. Clean-room manufactured seals with low particle and trace metal contamination are used to minimize yield loss and chemical erosion rates. These seals can provide benefits such as increased system up-time, increased mean time between failure (MTBF), decreased wet clean or mechanical clean frequency, and reduced cost of ownership (CoO) through lower consumable costs (CoC).

- The digitization and automation trends have significantly enhanced the demand for semiconductors. For instance, in September 2023, Guangzhou JST Seals Technology Co. Ltd launched its FFKM O-rings to provide the highest temperature (up to 620 °F) and the most common chemical resistance among all rubber O-ring and gasket materials. These can be used in the environment of high-temperature hot air in the semiconductor manufacturing process, and the maximum operating temperature is 315 °C. Such developments show the growth in the demand for mechanical sealing equipment in the semiconductor industry, which is in line with the growing investments in semiconductor manufacturing and their increasing sales worldwide.

The United States Expected to Contribute Significantly to Market Growth

- The United States has registered increased domestic chip manufacturing facility proposals since the US CHIPS and Science Act was proposed. Developing new plants and research and design projects have received investments to entice original chip manufacturers (OCMs) to the country, and US states have implemented legislation requiring them to provide additional financing, which would support the demand for flow control components in the market.

- The United States has announced plans to continue contributing to the global value chain with strong leadership positions in high-value-added areas of semiconductor technology, including chip design, electronic design automation (EDA), and semiconductor manufacturing equipment. This would support the growth of semiconductor manufacturing units' establishments in the country and fuel market growth.

- Global semiconductor companies are expanding their footprints in the country, which would create a growth opportunity for the US market. For instance, in April 2024, chip company Taiwan Semiconductor Manufacturing Company (TSMC) announced plans to build a third factory in Arizona, raising its total investment in the United States from USD 40 billion to USD 65 billion, which shows future market growth opportunities for flow control components in the country.

- The country's government has prioritized semiconductor manufacturing in the United States and reinforced chip supply chains. It also identifies policy actions that will further strengthen supply chains, support R&D and chip design, grow the semiconductor workforce, and ensure CHIPS delivers maximum benefits to the country's economic and national security, which would help the semiconductor ecosystems in the country and fuel market growth in the future.

- The Consumer Technology Association estimated US retail sales of consumer technologies to rise 2.8% and reach USD 512 billion in 2024, supported by the increasing sales of personal computers, smartphones, and other gadgets. This would fuel the demand for the semiconductor market due to the application of semiconductors in manufacturing consumer electronics, smartphones, and personal computing devices. This would create growth opportunities for the flow control market in the semiconductor industry in the United States during the forecast period.

Flow Control Industry Overview

The competitive rivalry among flow control equipment providers is moderate, owing to the presence of various dominant brands competing for market share globally. The demand for vacuum pumps has spiked in recent years due to the massive penetration of consumer electronics and smartphones across developing countries. This has led to an increased focus on customer acquisition and formulating distribution channels as key strategies. Some key market players include Pfeiffer Vacuum GmbH, Atlas Copco AB, Gardner Denver, and Busch Holding GmbH.

- February 2024: Busch Holding GmbH's Busch Vacuum Solutions segment expanded its range of O11O Digital Services to include vacuum systems. O11O for systems enables the simultaneous monitoring of multiple vacuum generators in a vacuum system and the supervision of the production process to ensure it runs reliably and with the correct vacuum levels. This effectively minimizes production downtime risk and leads to significant cost savings. Accessible via a PC or a mobile device, the O11O IoT dashboard presents a user-friendly interface for comprehensive system monitoring and to support the company's cross-selling opportunity for flow control components in the market. Such developments demonstrate market vendors' investments in product innovations to remain competitive.

- December 2023: Atlas Copco Group announced plans to acquire KRACHT GmbH (Kracht), a manufacturer of high-quality technologies, including external gear pumps, fluid measurement, valves, hydraulic drives, and dosing systems. This is expected to support the company's future growth in the flow control equipment market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Analysis - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Electronics Industry Driven by IIoT Digitalization

- 5.2 Market Challenges

- 5.2.1 Increasing Market Consolidation Expected to Create Stiff Competition

6 MAJOR APPLICATIONS OF VACUUM PUMPS AND VALVES IN THE SEMICONDUCTOR INDUSTRY

- 6.1 Vacuum Pumps

- 6.1.1 Physical Vapor Deposition/Sputtering

- 6.1.2 Chemical Vapor Deposition (Plasma/Sub-atmospheric)

- 6.1.3 Diffusion/Low Pressure Chemical Vapor Deposition (LPCVD)

- 6.1.4 Atomic Layer Deposition

- 6.1.5 Dry Stripping and Cleaning

- 6.1.6 Dielectric Etch

- 6.1.7 Conductor and Polysilicon Etch

- 6.1.8 Atomic Layer Etching

- 6.1.9 Ion Implantation

- 6.1.10 Load Lock and Transfer

- 6.1.11 Critical Dimension Scanning Electron Microscope

- 6.1.12 Particle Monitoring in Front Opening Universal Pods

- 6.1.13 Airborne Molecular Contamination

- 6.2 Valves

- 6.2.1 Chemical Supply

- 6.2.2 Polysilicon Process

- 6.2.3 Wafer Manufacturing

- 6.2.4 Chemical Manufacturing

- 6.2.5 Slurry Supply

- 6.2.6 Solvent Supply

- 6.2.7 Water Treatment

- 6.2.8 Lithography

- 6.2.9 Etching

- 6.2.10 CMP

- 6.2.11 Chemical and Slurry Recovery

7 MARKET SEGMENTATION

- 7.1 Type of Component

- 7.1.1 Vacuum

- 7.1.2 Valves

- 7.1.2.1 Ball

- 7.1.2.2 Butterfly

- 7.1.2.3 Gate

- 7.1.2.4 Globe

- 7.1.2.5 Other Valves

- 7.1.3 Mechanical Seals

- 7.2 By Country

- 7.2.1 United States

- 7.2.2 China

- 7.2.3 Taiwan

- 7.2.4 South Korea

- 7.2.5 Japan

- 7.2.6 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles - Vacuum Pumps

- 8.1.1 Pfeiffer Vacuum GmbH

- 8.1.2 Atlas Copco AB

- 8.1.3 Gardner Denver (ingersoll Rand Inc.)

- 8.1.4 Flowserve Corporation

- 8.1.5 Busch Holding Gmbh

- 8.1.6 Kurt J. Lesker Company

- 8.2 Company Profiles - Valves

- 8.2.1 Fujikin Incorporation

- 8.2.2 GEMU Holding GmbH & Co.KG

- 8.2.3 VAT Vakuumventile AG

- 8.2.4 Swagelok Company

- 8.2.5 Festo SE & Co. KG

- 8.2.6 GCE Group

- 8.3 Company Profiles - Mechanical Seals

- 8.3.1 DuPont De Nemours Inc.

- 8.3.2 EKK Eagle SC Inc.

- 8.3.3 EnPro Industries Inc.

- 8.3.4 Freudenberg Group

- 8.3.5 AESSEAL PLC

- 8.3.6 Parker-Hannifin Corporation

- 8.3.7 Greene, Tweed & Co. Inc.

9 INVESTMENT AND FUTURE OUTLOOK