Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692147

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692147

Africa Two-Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 180 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

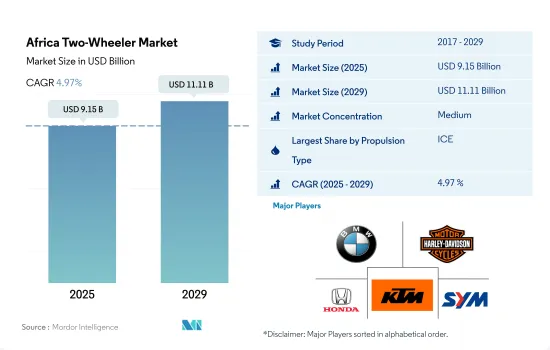

The Africa Two-Wheeler Market size is estimated at 9.15 billion USD in 2025, and is expected to reach 11.11 billion USD by 2029, growing at a CAGR of 4.97% during the forecast period (2025-2029).

Africa's two-wheeler market is gearing up for significant growth, driven by urbanization and the demand for sustainable transportation solutions

- In 2023, the African two-wheeler market showcased resilience and growth, with sales figures reaching 1,880,000 units, marking an improvement from 2022's 1,850,000 units. This growth highlights the increasing reliance on two-wheelers across the continent, driven by their affordability, flexibility in navigating diverse terrains, and growing consumer interest in sustainable and efficient mobility solutions, including electric two-wheelers (E2Ws).

- The forecast for 2024 anticipates a notable increase in sales to 1,990,000 units, reflecting the robust demand for two-wheelers as essential vehicles for both urban and rural transportation needs. Governmental initiatives across various African countries, focusing on improving road safety, enhancing infrastructure, and promoting environmentally friendly transportation options, have positively impacted the two-wheeler market. While policies and incentives for E2Ws vary across the continent, there is a gradual shift towards sustainable mobility, aligning with global trends and local environmental goals.

- From 2024 to 2030, the African two-wheeler market is poised for significant growth, with projections indicating sales could reach 2,325,000 units by the end of the forecast period. This expected growth is likely to be propelled by ongoing urbanization, economic development, and the critical need for accessible transportation solutions. The potential increase in E2W adoption, driven by improvements in technology, affordability, and infrastructure, alongside a heightened awareness of environmental sustainability, sets the stage for a dynamic expansion of the two-wheeler market across Africa.

The Asian two-wheeler market is experiencing robust growth driven by urbanization, economic factors, and the rising demand for affordable, sustainable transportation solutions

- The African two-wheeler market is experiencing significant growth, driven by urbanization, economic development, and the increasing demand for affordable and efficient transportation solutions. As cities across the continent continue to expand, two-wheelers have emerged as a practical and cost-effective alternative to private cars, offering greater mobility and convenience in navigating congested urban areas.

- South Africa's two-wheeler landscape is witnessing consistent growth, positioning itself as a pivotal player in the realm of urban mobility solutions. The year 2023 witnessed a surge in sales, with figures reaching 15,620 units, a notable uptick from the 15,120 units sold in 2022. This escalation signifies a burgeoning interest in two-wheelers within the nation, fueled by their affordability, agility in navigating traffic congestion, and the escalating cost of fuel, which renders two-wheelers an alluring alternative for personal transportation.

- The Rest of Africa's two-wheeler market finds itself on an upward trajectory, propelled by economic growth and a growing inclination towards sustainable transportation preferences. In 2023, this market segment witnessed an expansion, with sales reaching an impressive 1,866,540 units, a modest increment from the 1,836,980 units sold in 2022. This growth underscores the indispensable role two-wheelers play in the region's mobility ecosystem, offering affordable, accessible, and efficient transportation solutions across diverse geographic and socio-economic landscapes.

Africa Two-Wheeler Market Trends

Africa's transport electrification is expanding rapidly, with significant increases across all vehicle types

- Electrification in Africa's transport sector is gaining momentum. In 2022, the electrification rate for passenger cars was 2%, which climbed to 4% in 2023. Light commercial vehicles (LCVs) followed suit, with their electrification rate rising from 0.20% in 2022 to 1.09% in 2023. Buses, a crucial part of public transport in many African countries, saw their electrification rate surge from 0.50% in 2022 to 1.96% in 2023. Even two-wheelers, a popular mode of transport in several regions, witnessed a significant uptick, with their electrification rate leaping from 1.50% in 2022 to 4.65% in 2023.

- Over the past five years, Africa's commitment to greener transportation has been evident. The electrification rate for passenger cars rose from 2% in 2017 to 5% in 2022. LCVs, crucial for goods transport across the continent, saw their electrification rate surge from 0.20% in 2017 to nearly 2% by 2022. Buses, pivotal for mass transit, made notable progress, going from a 0.50% rate in 2017 to 3.42% by 2022. Meanwhile, the electrification percentage for two-wheelers, widely used for daily commutes, climbed from 1.50% in 2017 to 7.81% in 2022.

- Looking ahead to the period of 2024-2030, all vehicle categories in Africa are expected to witness consistent growth in electrification. By 2030, passenger cars with electric components are projected to account for 12% of the total. LCVs are anticipated to reach a 6% electrification rate, while buses, crucial for sustainable urban and inter-city travel, are forecasted to hit a 10% electrification rate by the end of the decade. The two-wheelers segment, known for its efficiency and affordability, is set to achieve a significant electrification rate of 22% by 2030.

Africa Two-Wheeler Industry Overview

The Africa Two-Wheeler Market is moderately consolidated, with the top five companies occupying 49.80%. The major players in this market are BMW Motorrad, Harley-Davidson, Honda Motor Co. Ltd., KTM Motorcycles and Sym (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90861

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Fuel Price

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.2 Country

- 5.2.1 South Africa

- 5.2.2 Rest-of-Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Bajaj Auto Ltd.

- 6.4.2 BMW Motorrad

- 6.4.3 Harley-Davidson

- 6.4.4 Hero MotoCorp Ltd.

- 6.4.5 Honda Motor Co. Ltd.

- 6.4.6 KTM Motorcycles

- 6.4.7 Lifan Technology (Group) Co. Ltd.

- 6.4.8 Suzuki Motor Corporation

- 6.4.9 Sym

- 6.4.10 TVS Motor Company Limited

- 6.4.11 Yamaha Motor Company Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.