PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911442

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911442

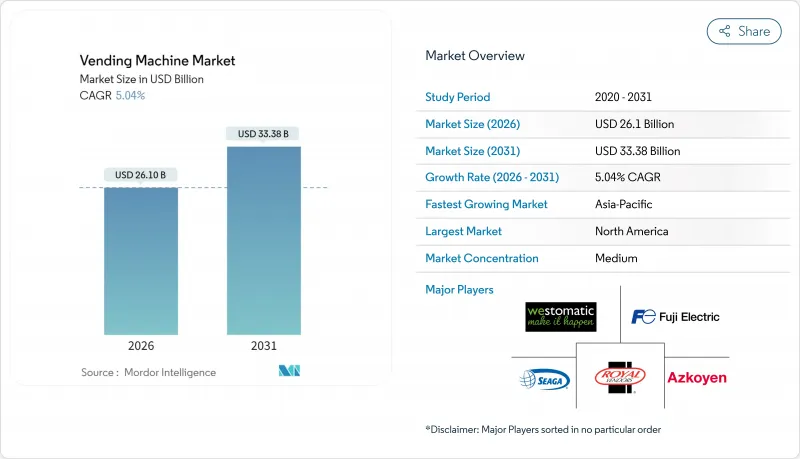

Vending Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The vending machine market is expected to grow from USD 24.85 billion in 2025 to USD 26.1 billion in 2026 and is forecast to reach USD 33.38 billion by 2031 at 5.04% CAGR over 2026-2031.

The current expansion of the global vending machine market is powered by AI-driven assortment optimization, predictive maintenance, and the rapid migration from coin-based mechanisms to cashless and contact-free payments. Regulatory triggers-particularly extended-producer-responsibility (EPR) mandates in Europe and workplace ESG scorecards in North America-push operators to deploy reverse-vending and healthy-product formats, reshaping the competitive playbook. Operators that marry connected fleets with data-rich software layers now monetize insights, rather than margin-squeezed hardware, catalyzing an ecosystem where payment processors, fleet-management platforms, and service integrators capture a growing share of profit pools. Asia-Pacific's urbanization boom and mobile-wallet ubiquity provide outsized white-space potential; simultaneous labor-cost pressures in mature markets lead enterprises to automate micro-retail at transit hubs, hospitals, and industrial campuses.

Global Vending Machine Market Trends and Insights

Increasing Demand for Packaged and Fresh Food for On-the-Go Consumption

Food-service convenience continues to lift the global vending machine market as commuters, office staff, and students prioritize speed and accessibility over traditional retail. The U.S. Bureau of Labor Statistics recorded a 140.66% jump in vending-food prices between 1997 and 2025, with a notable 14.81% increase in 2023, confirming the category's pricing power. Tokyo's AI-equipped salad units adjust prices dynamically to minimize shrinkage and elevate margins. Operators overlay predictive-demand models that fine-tune SKUs by micro-location, cutting waste and boosting revenue per square foot. Partnerships with controlled-atmosphere-packaging suppliers now make fresh produce viable for five-day shelf lives, broadening product scope at transportation hubs and higher-education campuses.

Rapid Adoption of Cashless and Contactless Payment Technologies

A second tailwind for the global vending machine market is the steady replacement of coins and bills with tap-and-go or QR-based options, advancing 12.65% CAGR through 2030. Cantaloupe processed more than 1.15 million connected endpoints across the Americas and Europe in 2024, underscoring scale economics behind payment modernization. Japan's July 2024 banknote redesign illustrates the retro-fit complexity: only 30% of machines were reconfigured at launch, forcing operators to weigh upgrade costs against possible sales disruption. In India, the Reserve Bank's QR-coin pilot places digital wallets at high-footfall locations, an early indication that emerging markets may leapfrog physical cash. Although processor fees of 2-5% compress gross margins, operators recoup value via higher average tickets and lower cash-handling overhead.

High Capital, Installation, and Maintenance Expenditures

Up-front investment remains a gating factor for new entrants to the global vending machine market. Modern smart units with refrigeration, vision sensing, and multi-payment modules require meaningfully higher capital outlays than legacy coil machines. Operators must also budget for software licences, connectivity, and regulatory compliance upgrades such as EMV-co-certified readers. Raw-material volatility adds further strain; the U.S. Department of the Treasury's 2024 copper cost review highlighted margin pressure on coin mechanisms that still serve 69.5% of 2024 transactions. Tight lending standards in many emerging economies elongate payback periods, causing smaller route owners to defer fleet renewal.

Other drivers and restraints analyzed in the detailed report include:

- Deployment of IoT-Enabled Smart Vending Fleets for Predictive Maintenance

- Extended-Producer-Responsibility Rules Spurring Reverse-Vending Installations

- Cyber-Security and Data-Privacy Risks for Connected Machines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automatic machines, long the workhorse of the global vending machine market, held 55.12% global vending machine market share in 2025. Their wide installed base anchors predictable revenue but offers fewer upside levers. Smart/IoT units, meanwhile, are scaling at a 9.78% CAGR, signaling a secular shift toward software-centric business models. The global vending machine market size attributed to connected machines is projected to expand from USD 7.9 billion in 2025 to USD 13.84 billion by 2031. This growth unlocks ancillary revenue for cloud-based fleet dashboards and programmatic advertising, cushioning hardware margin compression.

Patent filings corroborate the innovation runway. Coca-Cola's micro-ingredient management patents enable remote flavor tweaks, lowering service calls. Algorithmic planograms that localize assortments at street-block granularity are hitting commercial viability as cellular data prices fall. Early adopters report double-digit upticks in sales conversion when AI modules reorder the SKU face according to real-time demand. Against that backdrop, semi-automatic machines are tapering as a transitional form factor with limited ROI.

Beverages remained kingpin at 32.85% of 2025 revenues; nevertheless, sustainability legislation positions reverse-vending machines as the fastest clip at 10.71% CAGR. Their contribution to global vending machine market size is forecast to triple by 2031 as more jurisdictions introduce mandatory deposit schemes. Traditional snack and packaged-food machines continue to serve core meal occasions, yet salt- and sugar-content regulations require portfolio revamps. Non-food essentials-think PPE and phone accessories-are no longer niche, aided by price elasticity that offsets lower volume throughput.

TOMRA's 48 billion annual container capture underscores how scale addresses waste-management economics. During 2025, several EU grocers integrated on-site compactors, pulling logistics costs out of the return loop and raising operator ROI. Parallel to that, AI-driven fresh-food units in Tokyo are proving that perishables can beat shrinkage headwinds with dynamic pricing engines, validating broader menu diversification.

The Vending Machine Market Report is Segmented by Technology (Automatic, Semi-Automatic, and Smart/IoT-Enabled), Product Type (Snacks and Packaged Food, Beverages, and More), Application (Commercial Buildings and Offices, Transportation Hubs, Educational Institutions, and More), Payment Mode (Cash, Card-Based Cashless, Mobile Wallet and QR, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 32.74% of 2025 global vending machine market revenue, leveraging ubiquitous broadband and card-payments infrastructure. The United States channeled post-pandemic hygiene priorities into contact-free PPE dispensers across government buildings, while Canada's carbon-reduction targets incentivized energy-efficient refrigeration retrofits. Mexico, though smaller, is scaling reverse-vending pilots as beverage majors prepare for anticipated EPR laws. Labor-cost inflation hastens automation uptake across all three markets, sustaining mid-single-digit growth despite maturity pressures.

Asia-Pacific registered the highest 9.86% CAGR outlook, adding critical mass to the global vending machine market through urban migration and mobile money ubiquity. China's QR-first consumer culture accelerates smart-unit penetration, while Japan wrestles with currency redesigns that have rendered 70% of older machines temporarily non-compliant. Thailand's Tao Bin network sells 200,000 drinks daily via 6,000 machines, a poster child for labor substitution economics. India's Reserve Bank QR-coin initiative signals a state-sponsored push to modernize micro-retail payments.

Europe's trajectory is steadier but underpinned by regulatory catalysts. The UK's 2027 Deposit Return Scheme ramps reverse-vending installations, while Germany's Bremen Airport opened an AI-policed autonomous store in June 2025. Scandinavian operators, already largely cashless, now market ESG-compliant snack lines to corporate campuses. Southern Europe lags on mobile-wallet density yet catches up via tourism-linked deployments in airports and railway stations, ensuring the region maintains a high-single-digit growth clip.

- Fuji Electric Co., Ltd.

- Crane Merchandising Systems (Crane NXT)

- Azkoyen Group

- Evoca Group

- SandenVendo GmbH

- Westomatic Vending Services Ltd.

- Royal Vendors, Inc.

- Seaga Manufacturing, Inc.

- Jofemar S.A.

- Selecta Group

- Cantaloupe Inc. (USA Technologies)

- 365 Retail Markets LLC

- TCN Vending Machine Co., Ltd.

- Guangzhou Baoda Intelligent Technology Co., Ltd.

- Daalchini Technologies Pvt. Ltd.

- Canteen Vending Services (Compass Group)

- Aramark Corporation

- FAS International S.p.A.

- Vending.com (Federal Machine Corp.)

- Vendekin Technologies Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for packaged and fresh food for on-the-go consumption

- 4.2.2 Rapid adoption of cashless and contactless payment technologies

- 4.2.3 Deployment of IoT-enabled smart vending fleets for predictive maintenance

- 4.2.4 Extended-producer-responsibility rules spurring reverse-vending installations

- 4.2.5 Workplace ESG targets boosting healthy and sustainable vending offerings

- 4.2.6 Medicine and PPE vending in rural healthcare networks

- 4.3 Market Restraints

- 4.3.1 High capital, installation and maintenance expenditures

- 4.3.2 Sugary-drink and calorie restrictions in public institutions

- 4.3.3 Cyber-security and data-privacy risks for connected machines

- 4.3.4 Hygiene and vandalism concerns in certain public areas

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Sustainability and Circular-Economy Analysis

- 4.9 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Technology

- 5.1.1 Automatic Vending Machines

- 5.1.2 Semi-Automatic Vending Machines

- 5.1.3 Smart / IoT-Enabled Vending Machines

- 5.2 By Product Type

- 5.2.1 Snacks and Packaged Food

- 5.2.2 Beverages

- 5.2.3 Tobacco and Nicotine Products

- 5.2.4 Non-Food Essentials (PPE, Electronics, Personal Care)

- 5.2.5 Reverse Vending Machines (Recycling)

- 5.3 By Application / Deployment Location

- 5.3.1 Commercial Buildings and Offices

- 5.3.2 Transportation Hubs (Airports, Rail, Bus, Metro)

- 5.3.3 Educational Institutions

- 5.3.4 Healthcare Facilities

- 5.3.5 Hospitality and Leisure Venues

- 5.3.6 Industrial and Manufacturing Sites

- 5.3.7 Others (Residential, Retail Malls)

- 5.4 By Payment Mode

- 5.4.1 Cash

- 5.4.2 Card-Based Cashless (Credit/Debit, NFC)

- 5.4.3 Mobile Wallet and QR

- 5.4.4 Biometric and Facial Recognition

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 UAE

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global overview, Market overview, Core segments, Financials as available, Strategic info, Market rank/share, Products and services, Recent developments)

- 6.4.1 Fuji Electric Co., Ltd.

- 6.4.2 Crane Merchandising Systems (Crane NXT)

- 6.4.3 Azkoyen Group

- 6.4.4 Evoca Group

- 6.4.5 SandenVendo GmbH

- 6.4.6 Westomatic Vending Services Ltd.

- 6.4.7 Royal Vendors, Inc.

- 6.4.8 Seaga Manufacturing, Inc.

- 6.4.9 Jofemar S.A.

- 6.4.10 Selecta Group

- 6.4.11 Cantaloupe Inc. (USA Technologies)

- 6.4.12 365 Retail Markets LLC

- 6.4.13 TCN Vending Machine Co., Ltd.

- 6.4.14 Guangzhou Baoda Intelligent Technology Co., Ltd.

- 6.4.15 Daalchini Technologies Pvt. Ltd.

- 6.4.16 Canteen Vending Services (Compass Group)

- 6.4.17 Aramark Corporation

- 6.4.18 FAS International S.p.A.

- 6.4.19 Vending.com (Federal Machine Corp.)

- 6.4.20 Vendekin Technologies Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Forecast of Technology Convergence and New Business Models