PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692449

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692449

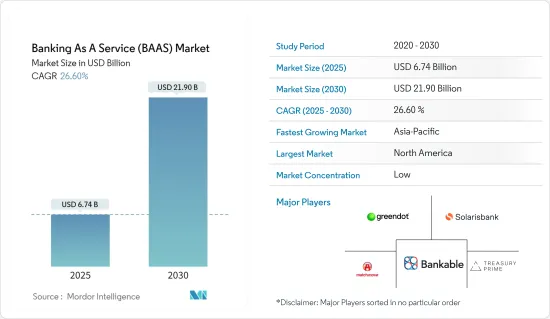

Banking As A Service (BAAS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Banking As A Service Market size is estimated at USD 6.74 billion in 2025, and is expected to reach USD 21.90 billion by 2030, at a CAGR of 26.6% during the forecast period (2025-2030).

Banking as a Service Market (BaaS) enables various industries to develop new propositions with relevant financial services embedded into the customer experience. As a result, it became one of the most important strategic agendas for various businesses beyond banking. Currently, BaaS offerings are primarily focused on retail banking. Point-of-sale (PoS) financing is another area showing an exceptional growth rate with BaaS offerings. According to Finastra, BaaS will become more prevalent in small business lending, with BaaS revenue expected to grow 30% annually.

BaaS application provides endless opportunities, paving the route toward truly embedded finance. BaaS is transforming the financial services ecosystem. According to the Finatsra Survey of 50 senior executives, 85% of senior executives are already implementing BaaS solutions or planning to do so within the next 12-18 months. BaaS, founded on open banking frameworks, flourished in the wake of the COVID-19 outbreak. To enable the delivery of financial services at the point of consumer demand, it offers whole banking procedures (deposits, loans, and payments) as a service from specialized cloud-based API platforms. These platforms leverage the secure and regulated infrastructure of a licensed bank.

Banking as a Service (BaaS) Market Trends

Large Enterprises are Fueling the BaaS Market by Generating Majority Revenue

Large enterprises can access the best prices and features in a number of banks, enabling them to optimize their balance sheets and reduce costs as they scale up by using BaaS providers with large banking networks. A provider of BaaS capable of supporting global embedded finance solutions and expanding in the context of growing deposits is needed for large businesses with a global customer base. Partnerships with BaaS providers enable enterprises to offer a broad range of financial services. It includes payments, loans, and savings quickly and effectively while not having to install or keep the necessary infrastructure. It can attract and retain customers as well as create new sources of revenue. The addition of banking services to enterprise software platforms reduces time, power, and resources for customers, as well as improves customer satisfaction and loyalty. By improving access to a wider range of bank partners, global reach, diverse financing options and services, and enhanced customer experience, BaaS providers are able to help large enterprises. In order to enhance customer experience, companies in different sectors are looking at embedded financial solutions.

Asian Countries are Expected to Grow at the Fastest Rate

The growth of the banking as a service market in the Asia-Pacific is driven by growing urbanization and business demand for cloud computing. It is expected that the expansion of Asia-Pacific will be stimulated by a variety of initiatives undertaken around the world in support of BaaS. Indeed, in July 2022, Finastra announced that they would offer HSBC's foreign exchange (FX) to medium-sized banks of the Asia-Pacific region via their FusionFabric.cloud platform under a BaaS experience. The FX BaaS will allow participating banks to process higher FX volumes and differentiate themselves with various currency offerings while maintaining their customer relationships.

The first phase of the rollout will provide both indicative and executable FX rates to regional mid-tier banks via a plug-in to Finastra's treasury trading system, Fusion Kondor. This solution allegedly incurs both low maintenance and ownership costs, backed by liquidity and risk management capabilities. The ability to integrate foreign exchange directly into corporate treasury systems, as well as competitive pricing and liquidity in a single arrangement, will contribute to reducing friction between regional banks and their customers while demonstrating the use case of BaaS for real impact.

The collaboration between the two entities will seek to take advantage of the best elements of modern API-driven connectivity with licensed institutions' secure, regulated infrastructure. Integrating HSBC FX services with mid-tier banks will allow participating banks to deliver a wide range of currencies to their customers through branch networks and other retail channels without requiring any additional technology integration.

Banking as a Service (BaaS) Industry Overview

The Banking-as-a-Services market is moderately fragmented. Many companies compete for small market shares in the Banking-as-a-Service market. Businesses focus on diversifying their product offerings through product innovation to fulfill the growing demand. Moreover, with technological advancement and product innovation, domestic and international companies are increasing their market presence by securing new contracts and tapping new markets. In addition, the expansion of the Banking-as-a-Service (BaaS) industry is positively impacted by advancements in fund transaction services across the US and several emerging countries. For Instance, in October 2023, the financial technology behemoth FIS, which provides core banking, payment acceptance, and other services to banks and retailers worldwide, acquired BaaS provider Bond for an undisclosed amount. Following is a list of players that are operating in the market: Solaris SE, BNKBL Ltd, Treezor, Matchmove Pay Pte Ltd, Currency Cloud, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Implementation of Open Banking

- 4.2.2 Digital Transformation in Financial Industry

- 4.3 Market Restraints

- 4.3.1 High-Risk Exposure for Baas Service Provider

- 4.3.2 Evolving and Complex Regulatory Landscape

- 4.4 Market Opportunities

- 4.4.1 The Development of Robust Application Programming Interface Ecosystems

- 4.4.2 BaaS Providers Can Offer White-Label Solutions

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Value Chain Analysis For Banking-as-a-service Market

- 4.7 Insights on the Impact of Technology and Innovation In Banking as a Service Market

- 4.8 Insights on the Performance of Banking as a Service Providers Globally

- 4.9 Insights Into Regulatory Landscape Impacting the Market

- 4.10 Insights Into Consumer Behavior and Recent trends in the Market

- 4.11 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Enterprise

- 5.1.1 Large Enterprise

- 5.1.2 Small and Medium Enterprise

- 5.2 By End Users

- 5.2.1 Banks

- 5.2.2 Fintech Corporations

- 5.2.3 Other End Users

- 5.3 By Region

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Solaris SE

- 6.2.2 BNKBL Ltd.

- 6.2.3 Treezor

- 6.2.4 Matchmove Pay Pte Ltd

- 6.2.5 Currency Cloud

- 6.2.6 Clear Bank

- 6.2.7 Green Dot Corporation

- 6.2.8 Square Inc

- 6.2.9 Treasury Prime

- 6.2.10 Starling Bank

- 6.2.11 NymCard*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US