PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440438

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440438

Carbon Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

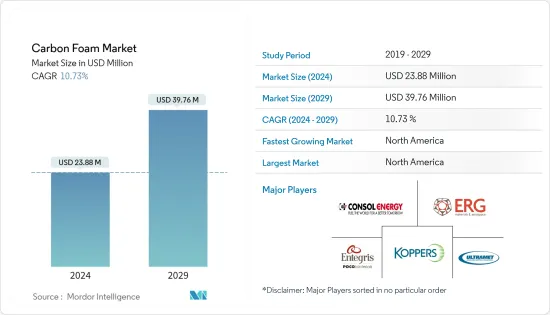

The Carbon Foam Market size is estimated at USD 23.88 million in 2024, and is expected to reach USD 39.76 million by 2029, growing at a CAGR of 10.73% during the forecast period (2024-2029).

COVID-19 highly impacted the market in 2020 because of supply chain and market disruption. During the pandemic, many factories responsible for carbon foam production were shut down. However, the market is growing rapidly and has reached pre-pandemic levels.

Key Highlights

- Over the short term, increasing usage of carbon foam in the aerospace and defense industry is a key factor driving market demand.

- The high cost of the production process of carbon foam is hindering the market's growth.

- Increasing focus on developing low-cost carbon foam will likely create opportunities for the market in the coming years.

- The North American region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Carbon Foam Market Trends

Increasing Usage in the Aerospace and Defense Industry

- Carbon foam can be used to manufacture engineering material for various aerospace and defense applications, including aerospace tooling, fireproof structural products, energy-absorbing structures, blast protection systems, and hot structures. It is widely used to insulate aircraft and rockets.

- It can be used in thermal protection systems and structural panels for EMI shielding and radar-absorbing applications. It can also be used for stealth technology, an essential aspect of the upcoming fifth-generation aircraft.

- Due to its lightweight nature, strength, and excellent thermal properties, it is also used in rocket nozzle systems, even in harsh environments. Solid rocket motors generate their thrust by burning a solid propellant to generate hot gases, which are exhausted through a nozzle.

- Graphitic carbon foam can protect against blast energy, directed energy weapons, and electromagnetic pulse threats.

- In February 2022, the China Aerodynamics Research and Development Centre tested carbon foam-based coatings on hypersonic weapons to enhance their performance. It found that carbon foam-based coatings could reduce the impact of shock waves by more than 20% and dramatically improve aerodynamic stability. It also mentioned that carbon foam has great application potential as a coating material for future hypersonic flight.

- In October 2021, the American Society for Composites acknowledged some of the research work done by the Air Force Research Laboratory. The laboratory developed carbon foam technology and related materials and applied significant systems, such as those in the Boeing 787 Dreamliner and Air Force and NASA satellites, and composite tooling.

- According to the Boeing Commercial Outlook 2022-2041, the total global deliveries of new airplanes are estimated to be 41,170 by 2041. Due to such huge expected deliveries, the demand for carbon foam is expected to rise globally during the forecast period.

- Furthermore, according to the Stockholm International Peace Research Institute (SIPRI), the total global military expenditure increased by 0.7% to USD 2,113 billion last year compared to 2020. Moreover, the five largest spenders in 2021 were the United States, China, India, the United Kingdom, and Russia, accounting for 62% of expenditure. As a result, rising military and defense spending is expected to support the demand for carbon foam for defense applications.

United States to Dominate the North American Region

- The North American region is expected to dominate the market. The United States is one of the region's largest and most powerful economies.

- In July 2021, scientists from the USDA Forest Service's Forest Products Lab and Ligsteel LLC collaborated with Domtar Inc. to produce high-value carbon foam from lignin, a material found in plant cell walls that makes carbon foam hard. Lignin is inexpensive and widely available, with the pulp and paper industry producing 70 million tons per year.

- The United States is the second-largest market for electric vehicles after China. According to the EV volumes, the country's total plug-in electrical vehicles accounted for around 656,900 units last year, registering a growth rate of ~100% compared to 2020.

- According to the IEA, in the United States, the federal aim is for electric vehicles (EVs) to make up 50% of new passenger cars and light trucks sold by 2030. Moreover, as per the International Council on Clean Transportation, in 2020, the California Government announced an executive order which directs the state to require that, by 2035, all new cars and passenger trucks sold in California be zero-emission vehicles, including BEV and PHEV.

- Moreover, according to the Federal Aviation Administration (FAA), the number of aircraft in the country's commercial fleet accounted for 5,882 in 2020, witnessing a decline rate of 22.9% compared to the previous year. The commercial fleet is forecasted to increase to 8,756 in 2041, with an average annual growth rate of 2% per year. This is expected to increase the market demand from multiple applications in the aerospace industry.

Carbon Foam Industry Overview

The carbon foam market is currently consolidated in nature, where the top players hold the majority share of the market studied. Some of the major players in the market include CONSOL Energy Inc., Entegris, Koppers Inc., Ultramet, and ERG Aerospace (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage in the Aerospace and Defense Industry

- 4.2 Restraints

- 4.2.1 The High Cost of the Production Process of Carbon Foam

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Graphitic

- 5.1.2 Non-graphitic

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Building and Construction

- 5.2.3 Automotive

- 5.2.4 Electrical

- 5.2.5 Industrial

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Elements

- 6.4.2 Carbon-Core Corporation

- 6.4.3 CONSOL Energy Inc.

- 6.4.4 ERG Aerospace

- 6.4.5 Firefly International Energy

- 6.4.6 Koppers Inc.

- 6.4.7 Entegris Inc.

- 6.4.8 Ultramet

- 6.4.9 Xiamen Zopin New Material Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Low-cost Carbon Foam

- 7.2 Other Opportunities