Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693460

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693460

Europe Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 487 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

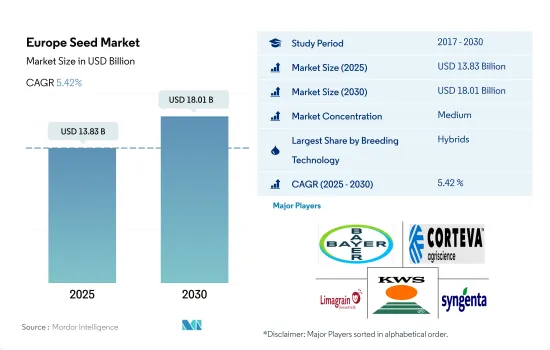

The Europe Seed Market size is estimated at 13.83 billion USD in 2025, and is expected to reach 18.01 billion USD by 2030, growing at a CAGR of 5.42% during the forecast period (2025-2030).

Hybrids dominated Europe's seed market, with Spain, Italy, and the United Kingdom being major countries in the region

- The hybrid seed segment dominated the European seed market. Hybrid seeds accounted for 59.8% of the market, while open-pollinated varieties and hybrid derivatives accounted for 40.2% in 2022. Due to high productivity, the demand for hybrid seeds has witnessed major growth in countries such as Spain, Italy, and the United Kingdom.

- In the vegetable seed market, hybrid vegetables accounted for 89.9% in 2022. The region mainly cultivates hybrids of tomatoes, cucurbits, brassicas, and leafy vegetables.

- Non-transgenic hybrids dominate the market due to the ban on GMO crops in many European countries, including France, Germany, Austria, Greece, Hungary, the Netherlands, Latvia, Lithuania, Luxembourg, Bulgaria, Poland, Denmark, Malta, Slovenia, Italy, and Croatia. These countries have chosen a total ban on GMO crops.

- In Europe, only insect-resistant hybrids are cultivated under transgenic hybrids. Corn is the only grain crop approved for commercial cultivation in countries such as Spain, Romania, and the Rest of Europe (Portugal, Czechia, and Slovakia). Maize was a major genetically modified crop cultivated in Europe, accounting for 1.8% of the corn segment in 2022.

- In Europe, row crops held a major share of the open-pollinated varieties market in terms of value, accounting for 95.4% in 2022. Row crops require a high volume of seeds for sowing (seed rates are comparatively higher), and their prices are 20-30% less compared to hybrid crops. In 2022, other grains and cereals were the major crops grown in Europe using open-pollinated varieties and hybrid derivatives, accounting for 34.8% of the open-pollinated varieties market in the region.

France and Germany are the major seed markets in Europe, and investments by companies in the seed sector are further driving the regional market

- The European agricultural industry is the major contributor to the economy. The European seed market was valued at about USD 11.8 billion in 2022. The region is a major producer of grains and cereals, which accounted for about 55.4% of the European forage seed market in 2022.

- The major crops grown in the region are potato, carrot, cauliflower, broccoli, spinach, and peas, as well as wheat, alfalfa, sunflower, corn, and pulses.

- In 2022, France held the largest market share of 20.7%, followed by Russia (12.5%) and Germany (11.7%). France is also one of the largest producers of sunflowers in Europe.

- Europe is one of the largest producers of forage corn, accounting for 63.3% of the forage seed market and 6.3% of the seed market in 2022. The driving factors for this growth include rising demand for feed and livestock products and shrinking land for grazing animals.

- Russia is anticipated to be the fastest-growing seed market in Europe, registering a CAGR of 8.3% during the forecast period. Over the years, the Russian seed industry has made constant efforts to evolve by innovating and adopting scientific advancements, which may lead to its growth in the future.

- Major companies are investing in improving seed quality due to the rising demand. For instance, in 2021, DLF Seeds, the world's leading forage and grass seed breeder, invested USD 4.6 million in new mixing and distribution facilities to expand their production capacities and improve efficiency in the region.

- The growing demand for a variety of crops in the region and the rising investments by companies in the region are anticipated to drive the market during the forecast period.

Europe Seed Market Trends

Cereals dominated the European row crop acreages due to the extensive cultivation of wheat in various countries

- Europe covers a major area under the group of row crops, which mainly includes grains and cereals, oilseeds, and forage crops. In 2022, row crops accounted for 197.9 million ha in acreage, with a share of 94.6% of the total area. Grains and cereals occupied the major area under cultivation of crops in Europe in 2022, accounting for 134.04 million ha, which increased by 1.6% from the previous year due to strong demand for cereals as a staple food. Demand from processing and blending industries and increased output prices also facilitated the cultivation of grains and cereals. The acreage declined in 2017 and 2018 in major grain and cereal-producing countries such as Turkey, Italy, Russia, France, and Germany. The primary reasons for the decline include unexpected heavy rainfall, hail damage, higher precipitation prior to planting season, and shifting toward oilseeds.

- Europe cultivated oilseeds on over 47.8 million hectares in 2022, which increased by 15.1% between 2016 and 2022. It was mainly due to the increase in cultivation in sunflower, soybean, and canola areas driven by the high demand for edible oil and feed industries. The good sowing conditions in late summer/autumn enabled growers to increase the area under oilseed cultivation.

- The area for forage crop cultivation increased by 3.7% in 2022 from 2016 due to the increased forage and feed demand from the livestock sector. The area under commercial seeds is rising because of the quality forage requirement from dairy farmers. Forage corn has the largest area under cultivation among forage crops, accounting for 5.8 million ha in 2022.

- The crop area particularly depends on weather and climatic conditions in the region. The favorable conditions and stable demand for crops are estimated to drive the acreage in the region.

Hybrid forage seeds are gaining traction with wider adaptability and early matured traits

- Alfalfa and forage corn are popular forage crops extensively cultivated across Europe. Due to their significance in the livestock industry, scientific efforts are being made to enhance the yield and quality of alfalfa through breeding techniques. As the climate changes, so do the environmental factors that impact crops the most. Consequently, demand for high uniformity and wider adaptability alfalfa cultivars that adapt to regional conditions has increased and are widely employed by farmers.

- Companies such as Bayer, DLF, and Barenbrug have introduced many varieties of alfalfa and forage corn in the United Kingdom, such as Alfalfa (DKC 3218, DKC 3204, Debalto, and Marcamo), as well as forage corn (Daisy, Fado, and Power 4.2). These varieties possess the ability to withstand diverse environmental conditions, adapt to various soil types, and withstand field stress and heat conditions.

- The demand for seeds with early maturity and high starch content characteristics is estimated to grow rapidly. These varieties offer a shorter growing period, allowing farmers to harvest sooner, and the high starch content in forage corn enhances its nutritional value for animal feed. Moreover, the EU Commission initiated a new project called REFORMA (2016-2020) to address farmers' requirements. This project aims to develop advanced breeding techniques and introduce new cultivars of alfalfa and other forage crops.

- The demand for robust varieties of alfalfa and forage corn with traits such as disease resistance, high dry matter content, insect resistance, long shelf life, and drought tolerance is projected to increase significantly during the forecast period to compensate for yield losses and increase productivity to meet consumption requirements.

Europe Seed Industry Overview

The Europe Seed Market is moderately consolidated, with the top five companies occupying 53.78%. The major players in this market are Bayer AG, Corteva Agriscience, Groupe Limagrain, KWS SAAT SE & Co. KGaA and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92522

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.1.2 Vegetables

- 4.2 Most Popular Traits

- 4.2.1 Alfalfa & Forage Corn

- 4.2.2 Carrot, Cauliflower and Broccoli

- 4.2.3 Soybean & Sunflower

- 4.2.4 Tomato & Cabbage

- 4.2.5 Wheat & Corn

- 4.3 Breeding Techniques

- 4.3.1 Row Crops & Vegetables

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Insect Resistant Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Crop Type

- 5.3.1 Row Crops

- 5.3.1.1 Fiber Crops

- 5.3.1.1.1 Cotton

- 5.3.1.1.2 Other Fiber Crops

- 5.3.1.2 Forage Crops

- 5.3.1.2.1 Alfalfa

- 5.3.1.2.2 Forage Corn

- 5.3.1.2.3 Forage Sorghum

- 5.3.1.2.4 Other Forage Crops

- 5.3.1.3 Grains & Cereals

- 5.3.1.3.1 Corn

- 5.3.1.3.2 Rice

- 5.3.1.3.3 Sorghum

- 5.3.1.3.4 Wheat

- 5.3.1.3.5 Other Grains & Cereals

- 5.3.1.4 Oilseeds

- 5.3.1.4.1 Canola, Rapeseed & Mustard

- 5.3.1.4.2 Soybean

- 5.3.1.4.3 Sunflower

- 5.3.1.4.4 Other Oilseeds

- 5.3.1.5 Pulses

- 5.3.1.5.1 Pulses

- 5.3.2 Vegetables

- 5.3.2.1 Brassicas

- 5.3.2.1.1 Cabbage

- 5.3.2.1.2 Carrot

- 5.3.2.1.3 Cauliflower & Broccoli

- 5.3.2.1.4 Other Brassicas

- 5.3.2.2 Cucurbits

- 5.3.2.2.1 Cucumber & Gherkin

- 5.3.2.2.2 Pumpkin & Squash

- 5.3.2.2.3 Other Cucurbits

- 5.3.2.3 Roots & Bulbs

- 5.3.2.3.1 Garlic

- 5.3.2.3.2 Onion

- 5.3.2.3.3 Potato

- 5.3.2.3.4 Other Roots & Bulbs

- 5.3.2.4 Solanaceae

- 5.3.2.4.1 Chilli

- 5.3.2.4.2 Eggplant

- 5.3.2.4.3 Tomato

- 5.3.2.4.4 Other Solanaceae

- 5.3.2.5 Unclassified Vegetables

- 5.3.2.5.1 Asparagus

- 5.3.2.5.2 Lettuce

- 5.3.2.5.3 Okra

- 5.3.2.5.4 Peas

- 5.3.2.5.5 Spinach

- 5.3.2.5.6 Other Unclassified Vegetables

- 5.3.1 Row Crops

- 5.4 Country

- 5.4.1 France

- 5.4.2 Germany

- 5.4.3 Italy

- 5.4.4 Netherlands

- 5.4.5 Poland

- 5.4.6 Romania

- 5.4.7 Russia

- 5.4.8 Spain

- 5.4.9 Turkey

- 5.4.10 Ukraine

- 5.4.11 United Kingdom

- 5.4.12 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 DLF

- 6.4.6 Groupe Limagrain

- 6.4.7 KWS SAAT SE & Co. KGaA

- 6.4.8 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.4.9 Sakata Seeds Corporation

- 6.4.10 Syngenta Group

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.