Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693468

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693468

Asia-Pacific Cotton Seed (seed For Sowing) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 219 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

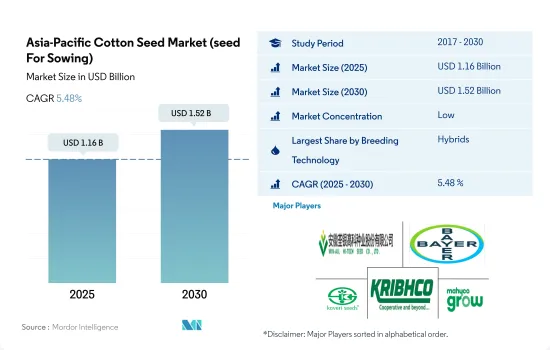

The Asia-Pacific Cotton Seed Market (seed For Sowing) size is estimated at 1.16 billion USD in 2025, and is expected to reach 1.52 billion USD by 2030, growing at a CAGR of 5.48% during the forecast period (2025-2030).

The improved traits of transgenic hybrid cotton seeds, such as herbicide and insect tolerance, are dominating the market

- In the Asia-Pacific region, hybrid seeds dominated the cotton seed market compared to open-pollinated varieties and hybrid derivatives. The hybrid varieties of cotton accounted for about 95.7% of the Asia-Pacific cotton seed market in 2022, and the remaining 4.3% was occupied by open-pollinated varieties (OPV) and hybrid derivatives of cotton.

- In the hybrid cotton seed segment, transgenic hybrid seeds dominated the market in the region with 90.1% of the share value in 2022. The large market share of transgenic cotton is mainly attributed to its improved traits, such as herbicide tolerance and insect tolerance, which reduce the use of insecticides on crops and help farmers cut down the cost of cultivation.

- In transgenic cotton hybrids, insect-resistant hybrids are highly cultivated, accounting for more than 99.0% of the transgenic cotton market in 2022. Insect-resistant cotton hybrids help reduce insect attacks (especially lepidopteran insects), thus reducing pesticide usage and increasing yields.

- In the case of non-transgenic cotton seeds, the market share is much less than that of transgenic seeds, mainly due to reduced cultivation in many countries of the region. Moreover, the increasing adoption of transgenic seeds is helping minimize the loss of farmers due to their insect-resistant characteristics.

- Open-pollinated varieties and hybrid derivatives of cotton seeds were valued at about USD 42.4 million in 2022. These local seeds are specific to the region, with lower prices than hybrids.

- The improved traits of hybrid cotton seeds, such as herbicide resistance, and affordability of OPV cotton seeds are anticipated to drive the market during the forecast period.

China and India dominated the Asia-Pacific cotton seed market as they are the largest producers of cotton in the world

- In the Asia-Pacific region, the cotton seed segment is primarily driven by the demand for cotton from the textile industry. The region's cotton seed market accounted for 75.1% of the global cotton seed market in 2022.

- China is the largest cotton-producing country in the world, with an annual production of 5.9 million metric ton in 2022. The country largely follows intensive cultivation practices. Moreover, the favorable climatic conditions for cotton cultivation drive cotton production. China accounted for about 12.0% of the Asia-Pacific cotton seed market in 2022.

- India is the second-largest cotton-producing country in the world, with an annual production of 5.2 million metric ton in 2022. India has held the second rank in cotton production for the past two years; India has a larger cultivable cotton area than China. This substantial cultivable land in India is projected to drive the cotton seed market during the forecast period. India accounted for about 73.3% of the Asia-Pacific cotton seed market in 2022.

- Pakistan accounted for about 4.1% of the Asia-Pacific cotton seed market in 2022. The cotton cultivation area in the country decreased from 2.7 million hectares in 2017 to 1.9 million hectares in 2022. Despite the decrease in the cultivation area, the overall production increased in the country due to the increased adoption of hybrid cotton seeds. Cotton has higher export potential, which is driving the market.

- Therefore, increasing demand from the textile industry and the high export potential of cotton textiles are the major factors anticipated to boost cotton production in Asia-Pacific, thereby boosting the growth of the cotton seed market during the forecast period.

Asia-Pacific Cotton Seed Market (seed For Sowing) Trends

Rising demand for cotton from textile industries combined with its high exports drives the cotton acreage in the region

- The Asia-Pacific region is one of the largest cotton-producing regions globally, with countries such as China, India, and Pakistan being the leading cotton producers. The overall cultivation area of cotton in the region accounted for about 2.4% of the total cultivation area in 2022. Cotton cultivation is highly dependent on climatic conditions, and any adverse conditions, such as floods, severely affect the overall cotton acreage.

- The overall cultivation area of cotton in the region was almost constant between 2017 and 2022. There were fluctuations in the cotton cultivated during the same period, which is attributed to various reasons such as adverse climatic conditions, the COVID-19 pandemic disrupting the supply chain of cotton by reducing the demand for cotton, and the growing prices of cotton resulting in textile manufacturers shifting to other synthetic or alternative fiber crops.

- Among countries in the Asia-Pacific region, India held the largest commercial cotton seed cultivation area with about 5.0 million ha, followed by China with 3.0 million ha and Pakistan with 1.4 million ha in 2022. All these countries collectively held about 79.6% of the region's cotton commercial acreage in the same year. Since cotton already competes for acreage with other crops, such as soybeans and pulses, its cultivation area is anticipated to increase moderately during the forecast period. The high export potential of cotton and the increasing demand for cotton worldwide from textile industries are the major factors driving the cotton cultivation area in the region. The increasing demand for cotton and its high export potential are anticipated to drive the cotton cultivation area in the region during the forecast period.

Insect-resistant and disease-resistant varieties of cotton are dominating the market, especially in India, which is one of the leading cotton-producing countries

- Cotton crop is prone to damage by a number of insect pests. There are over 166 insects recorded as pests in cotton crops. They are prone to damage from the seedling stage by grasshoppers, thrips, aphids, and jassids. The major pests that cause severe damage are spiny bollworms, spotted bollworms, and pink bollworms. For instance, from 2021 to 2023, farmers in India, especially in Punjab, witnessed a severe infestation of pink bollworms, which led to significant crop losses across the country. In India, insect-resistant cotton was approved for cultivation in 2002. Since then, the adoption rate has increased, accounting for 95% in 2022. This exponential growth indicates farmers' acceptance of insect-resistant cotton in the country and the benefits derived from the technology. Therefore, the demand for insect-resistant seeds is expected to increase during the forecast period to avoid crop losses due to insects.

- Companies such as Bayer AG, Anhui Tsuen Yin Hi-Tech Seed Industry Co. Ltd, and Kaveri Seeds are providing seed varieties resistant to sucking pests and helping growers earn high profits by producing high-quality cotton for processing industries. Moreover, Seed manufacturing companies are developing varieties with drought-tolerant and disease-resistant traits due to abnormal climatic conditions and the prevalence of diseases such as cotton leaf curl virus (CLCV), soil-borne diseases, and bacterial diseases. Therefore, products such as Pravir, Surpass, and Balraj + (MRC 7365 BG II) are used by cotton growers to protect crops against diseases.

- The prevalence of sucking pests and diseases, as well as changing weather conditions, is expected to increase the demand for improved cotton seed varieties in the region during the forecast period.

Asia-Pacific Cotton Seed (seed For Sowing) Industry Overview

The Asia-Pacific Cotton Seed Market (seed For Sowing) is fragmented, with the top five companies occupying 15.21%. The major players in this market are Anhui Tsuen Yin Hi-Tech Seed Industry Co. Ltd, Bayer AG, Kaveri Seeds, Krishak Bharati Co-Op Limited (KRIBHCO) and Maharashtra Hybrid Seeds Co. (Mahyco) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92531

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.2 Most Popular Traits

- 4.3 Breeding Techniques

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Insect Resistant Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Country

- 5.2.1 Australia

- 5.2.2 Bangladesh

- 5.2.3 China

- 5.2.4 India

- 5.2.5 Indonesia

- 5.2.6 Japan

- 5.2.7 Myanmar

- 5.2.8 Pakistan

- 5.2.9 Philippines

- 5.2.10 Thailand

- 5.2.11 Vietnam

- 5.2.12 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Anhui Tsuen Yin Hi-Tech Seed Industry Co. Ltd

- 6.4.2 Bayer AG

- 6.4.3 DCM Shriram Ltd (Bioseed)

- 6.4.4 JK Agri Genetics Ltd (JKAL)

- 6.4.5 Kaveri Seeds

- 6.4.6 Krishak Bharati Co-Op Limited (KRIBHCO)

- 6.4.7 Maharashtra Hybrid Seeds Co. (Mahyco)

- 6.4.8 Nuziveedu Seeds Ltd

- 6.4.9 Rallis India Limited

- 6.4.10 Rasi Seeds Private Limited

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.