Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693487

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693487

India Maize Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 190 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

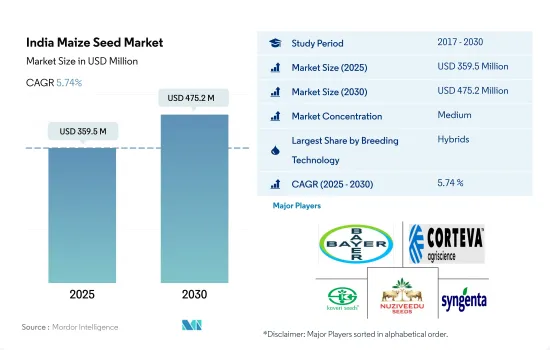

The India Maize Seed Market size is estimated at 359.5 million USD in 2025, and is expected to reach 475.2 million USD by 2030, growing at a CAGR of 5.74% during the forecast period (2025-2030).

Hybrids have emerged as the dominant choice in the Indian maize seed market, primarily for their high-yield potential and resilience against biotic and abiotic stressors

- In 2022, hybrid seeds dominated the Indian maize seed market, accounting for 65.8% of its value, while open-pollinated varieties made up the remaining 34.2%. This preference for hybrids is primarily driven by their widespread adoption in larger Indian states.

- Hybrid maize occupied over 60% of India's total maize cultivation area in 2022. This surge in demand for high-yielding cultivars is fueled by maize's increasing use as animal feed and consumers' growing interest in nutritionally enhanced foods.

- According to the Federation of Indian Chambers of Commerce and Industry (FICCI), hybridization rates in the Indian maize market range from 23% to 100%. Bihar and Tamil Nadu lead the pack with 100% hybridization rates, while the remaining regions predominantly cultivate open-pollinated seed varieties.

- Hybrid maize exhibits several desirable traits, including uniform cobbs, resistance to diseases, pests, and drought, as well as superior grain quality and higher cob counts. These attributes contribute to their higher yields, thus driving the demand for hybrids.

- Key players in the market, like Bioseed, are actively introducing new hybrid varieties to meet the growing demand. In 2022, Bioseed launched its latest corn hybrid, 9792, in the Indian market.

- Open-pollinated varieties face limitations, such as lower yields compared to hybrids and reduced vigor, as the same seed offspring is used in subsequent seasons.

- Given their higher yields, disease resistance, and the ongoing trend of hybridization, the hybrid seed segment in the maize market is projected to register a CAGR of 5.9% during the forecast period.

India Maize Seed Market Trends

Owing to its favorable agro-climatic conditions and robust demand for corn products, India has the second-largest cultivation area in Asia-Pacific

- Corn ranks third in India's cereal crop hierarchy, after rice and wheat. It constituted approximately 10% of the country's food grain production. In 2021, India stood as the world's fifth-largest maize producer, contributing 2.6% to the global output. Additionally, India holds the second-largest maize cultivation area in Asia-Pacific, with 10 million hectares dedicated to maize in the same period. While the Kharif season traditionally dominates maize cultivation, the rise of innovative cultivars and surging demand for corn products, like ethanol, has made winter maize cultivation increasingly viable. Consequently, the country witnessed a 4.2% increase in maize cultivation area from 2017 to 2022.

- Notably, Karnataka, Madhya Pradesh, Maharashtra, Rajasthan, Bihar, Uttar Pradesh, Telangana, Gujarat, and Tamil Nadu emerged as India's primary maize-growing regions in 2022, collectively accounting for 80% of the total maize acreage. These regions' dominance is attributed to their favorable weather conditions for maize crops, leading to heightened demand for maize seeds.

- However, the maize cultivation area experienced a decline of 0.4 million hectares, dropping to 9 million hectares in 2019. This shift was driven by growers pivoting toward high-profit crops like soybean and canola. These oil crops gained favor due to their resilience in adverse weather and the rising demand from oil processing industries.

- Favorable agro-climatic conditions, coupled with the escalating demand for corn products, have been pivotal in driving the expansion of maize cultivation in India. This trend is expected to bolster maize seed sales in the country in the coming years.

The rising prevalence of pests and diseases, leading to significant yield losses, is fueling the need for enhanced maize varieties with multiple traits

- Growers prioritize cultivating corn due to its high profitability and their demand for specific traits. These traits include weed control, enhanced grain quality, early maturity, tolerance to lodging, and resistance to diseases like leaf curl and early rots. Additionally, growers seek corn varieties that exhibit adaptability to diverse agro-climatic conditions. Notably, companies like Bayer AG, BASF SE, and Syngenta offer traits that bolster disease resistance and productivity. These seed varieties are in high demand as there are no viable alternatives or sprays available for disease resistance.

- Maize faces significant pest challenges in India, with four major pests being the spotted stem borer, pink stem borer, shoot fly, and fall armyworm. The spotted stem borer predominantly affects crops during the Kharif season, leading to yield losses ranging from 26% to 80% across different regions. Similarly, the pink stem borer poses a threat during the Rabi season, causing yield losses between 25.7% and 78.9%. Companies like Corteva Agriscience and BASF SE offer insect control products to combat these pests.

- With changing weather patterns and an uptick in lodging issues, traits like wider adaptability, lodging tolerance, uniformity, and drought tolerance are gaining traction. Companies are actively introducing new products in response. For example, in 2023, Bioseed, a subsidiary of DCM Shriram, launched the corn hybrid 9792 in the Indian market.

- Farmers are increasingly turning to improved seed varieties to mitigate losses, boost yields, and enhance resistance against pests and diseases.

India Maize Seed Industry Overview

The India Maize Seed Market is moderately consolidated, with the top five companies occupying 56.72%. The major players in this market are Bayer AG, Corteva Agriscience, Kaveri Seeds, Nuziveedu Seeds Ltd and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92550

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.2 Most Popular Traits

- 4.3 Breeding Techniques

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 State

- 5.2.1 Andhra Pradesh

- 5.2.2 Bihar

- 5.2.3 Karnataka

- 5.2.4 Madhya Pradesh

- 5.2.5 Maharashtra

- 5.2.6 Rajasthan

- 5.2.7 Tamil Nadu

- 5.2.8 Telangana

- 5.2.9 Uttar Pradesh

- 5.2.10 West Bengal

- 5.2.11 Other States

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 DCM Shriram Ltd (Bioseed)

- 6.4.5 Groupe Limagrain

- 6.4.6 Kaveri Seeds

- 6.4.7 Nuziveedu Seeds Ltd

- 6.4.8 Rasi Seeds Private Limited

- 6.4.9 Syngenta Group

- 6.4.10 VNR Seeds

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.