Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693488

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693488

India Cotton Seed (seed For Sowing) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 194 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

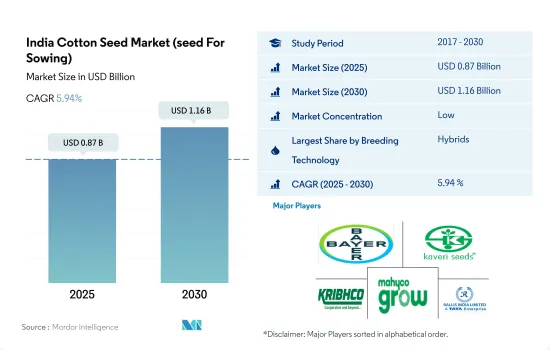

The India Cotton Seed Market (seed For Sowing) size is estimated at 0.87 billion USD in 2025, and is expected to reach 1.16 billion USD by 2030, growing at a CAGR of 5.94% during the forecast period (2025-2030).

Hybrids occupied the major share of the market due to the higher usage of Bt cotton in the country

- Hybrids have a higher share of the cotton seed market in the country. The higher share of hybrids is due to their high-yielding and pest-resistant properties, which help reduce losses and the cost of production.

- In cotton, hybrids give a 50% higher yield than normal varieties. Hybrids also show wider adaptability due to their high buffering capacity to environmental fluctuations. The market value of hybrid cotton seeds in the country was USD 0.7 billion in 2022. They are expected to register a CAGR of 6.0% during the forecast period.

- In India, out of the total area under cotton hybrids, 95% of the area was occupied by transgenic hybrids in 2022. The area under transgenic cotton increased from 3.5 million ha in 2017 to 4.7 million ha in 2022. The increasing transgenic area under cultivation is a sign of farmers' confidence in the Bt cotton technology in India. Moreover, Bt cotton reduces yield losses due to bollworms driving their usage.

- In 2022, open-pollinated varieties and hybrid derivatives of cotton seeds accounted for USD 9.5 million. The open-pollinated varieties market is projected to record a CAGR of 5.2% during the forecast period. The open-pollinated varieties are mainly cultivated in rainfed conditions due to the low cost of seeds and their ability to withstand water stress.

- Adopting hybrids and improved OPVs resulted in many advantages, such as self-sufficiency and stability in production and foreign exchange earnings with an increase in cotton trade, which are estimated to drive the cotton seed market in the country, registering a CAGR of 6% during the forecast period.

India Cotton Seed Market (seed For Sowing) Trends

Maharashtra held the most significant area for cotton cultivation, driven by high demand and favorable agronomic conditions

- Cotton covers the major area under fiber crop cultivation in India and plays an important role in the agricultural and industrial sectors. The country has the largest area under cotton cultivation, accounting for 64.4% of the Asia-Pacific area under cotton cultivation, covering 13.7 million ha in 2022. This area witnessed a significant increase of 10.9% between 2017 and 2022, driven by the rising demand for cotton in domestic and international markets. The textile industry is one of the largest industries in the country and has witnessed phenomenal growth in the last two decades in terms of installed spillage and yarn production. This factor is estimated to encourage the farmers to expand the area under cultivation. As a result, the cotton cultivation area in the country is estimated to reach 16.1 million ha in 2030. Additionally, Maharashtra, Telangana, and Gujarat accounted for the major cultivation land for cotton in India, accounting for a share of 24.2% (2.8 million ha), 20.4% ( 2.4 million ha), and 19.4% (2.2 million ha) in 2022. This was because these states have favorable agronomic conditions highly suitable for cotton cultivation.

- India leads the world in organic cotton cultivation, owing to the increasing global demand for organic textile products. The rise in consumer awareness about the harmful effects of toxic chemicals and pesticides used in cotton cultivation and processing has led to an expansion in organic cotton acreage. The area dedicated to organic cotton increased from 276.6 thousand ha in 2019 to 291.1 thousand ha in 2021. This trend is expected to boost the organic seed market in India further.

- Increasing global demand for organic textile products and favorable agronomic conditions are estimated to drive the expansion of cultivated land.

Infestation of bollworms in cotton is driving the demand for insect-resistant cotton seeds in India

- Cotton crops are prone to damage by several insect pests. There are over 166 insects recorded as pests in cotton crops. They are prone to damage from the seedling stage by grasshoppers, thrips, aphids, and jassids. The major insect pests that cause severe damage are jassids, spiny bollworms, spotted bollworms, and pink bollworms. During 2021-2022, in North India, farmers witnessed a severe infestation of pink bollworms, which led to significant crop losses in the country. In India, insect-resistant cotton was approved for cultivation in 2002. Since then, the adoption rate has increased to 95% in 2022. This exponential growth indicates farmers' acceptance of insect-resistant cotton in the country and the benefits derived from the technology. Therefore, the demand for insect-resistant seeds is expected to grow during the forecast period to avoid crop losses due to insects.

- Companies such as Bayer AG, Maharashtra Hybrid Seeds Co. (Mahyco), and Kaveri Seeds are providing seed varieties resistant to sucking pests and helping growers earn high profits by producing high-quality cotton for processing industries. Furthermore, seed manufacturing companies are developing varieties with disease-resistant and wider adaptability traits due to abnormal climatic conditions, demand for high yield, early maturity, and the prevalence of diseases such as cotton leaf curl virus (CLCV), soil-borne diseases, and bacterial diseases. Therefore, products such as Pravir, Surpass, and Balraj + (MRC 7365 BG II) are used by cotton growers to have resistance to diseases.

- The prevalence of sucking pests and diseases, as well as higher demand for higher yields in shorter periods, are increasing the demand for improved cotton seed varieties in the country during the forecast period.

India Cotton Seed (seed For Sowing) Industry Overview

The India Cotton Seed Market (seed For Sowing) is fragmented, with the top five companies occupying 14.13%. The major players in this market are Bayer AG, Kaveri Seeds, Krishak Bharati Co-Op. Limited (KRIBHCO), Maharashtra Hybrid Seeds Co. (Mahyco) and Rallis India Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92551

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.2 Most Popular Traits

- 4.3 Breeding Techniques

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Insect Resistant Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 State

- 5.2.1 Andhra Pradesh

- 5.2.2 Gujarat

- 5.2.3 Haryana

- 5.2.4 Karnataka

- 5.2.5 Madhya Pradesh

- 5.2.6 Maharashtra

- 5.2.7 Odisha

- 5.2.8 Punjab

- 5.2.9 Rajasthan

- 5.2.10 Telangana

- 5.2.11 Other States

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ankur Seeds Pvt. Ltd

- 6.4.2 Bayer AG

- 6.4.3 DCM Shriram Ltd (Bioseed)

- 6.4.4 JK Agri Genetics Limited

- 6.4.5 Kaveri Seeds

- 6.4.6 Krishak Bharati Co-Op. Limited (KRIBHCO)

- 6.4.7 Maharashtra Hybrid Seeds Co. (Mahyco)

- 6.4.8 Nuziveedu Seeds Ltd

- 6.4.9 Rallis India Limited

- 6.4.10 Rasi Seeds Private Limited

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.