Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693497

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693497

Philippines Rice Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 144 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

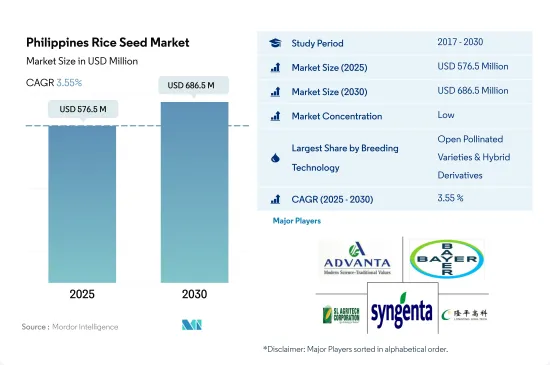

The Philippines Rice Seed Market size is estimated at 576.5 million USD in 2025, and is expected to reach 686.5 million USD by 2030, growing at a CAGR of 3.55% during the forecast period (2025-2030).

Increased efforts by the government to increase the penetration rate of hybrid and introduction of transgenic varieties are driving the market growth

- Open-pollinated varieties and hybrid derivatives dominated the rice seed market in the Philippines compared to hybrid rice seeds in 2022. They held a share of around 85.2% with a market value of USD 441.6 million, whereas hybrid seeds held 14.8% of the country's rice seed market in 2022. Despite government strategies to convert the cultivated land area to hybrid, its penetration rate was shallow, and the adoption rate in the country was below 15%.

- Open-pollinated varieties are heavily planted in areas where farmers cannot afford the high cost of hybrid seeds. The main benefit of OPVs is that farmers do not have to buy seeds for subsequent plantings and can save on input costs as these seeds require fewer fertilizers and are less expensive than hybrid seeds.

- Hybrids accounted for a market value of USD 76.7 million in 2022, projected to increase at a CAGR of 4.6% during the forecast period, reaching USD 110.3 million by 2030. The increased hybrid share was mainly due to the need to increase production to meet the country's rising consumption demand.

- The transgenic rice grown commercially in the Philippines was golden rice (GR), which accounted for 4.2% of the country's hybrid rice seed market in 2022. Golden rice (GR) is a transgenic rice variety that is an effective source of vitamin A. Moreover, the transgenic segment is projected to grow at a CAGR of 5.3% during the forecast period (2024-2030). The high growth rate is mainly due to the rising demand for golden rice, as the Philippines is the first country globally to grow this variety commercially.

- Increased efforts from the government to increase the penetration rate of hybrid and the introduction of transgenic varieties are the factors driving the market's growth.

Philippines Rice Seed Market Trends

The Philippines focuses on rice cultivation to meet staple food demand, with OPVs dominating due to the low cost of seeds benefiting small scale-farmers

- The Philippines is one of the major rice-producing countries in the Asia-Pacific region, accounting for 3.4% of the total area. Rice is an important staple food for 80% of the population and a rich income source for many farmers. In the Philippines, the area under rice production was 4.8 million hectares in 2022. It is the eighth-largest country in terms of the area of rice cultivation. The acreage increased by 6.2% from 2016 to 2022 due to the rising demand for quality rice with increasing living standards. The major rice cultivation areas in the Philippines are Luzon, Western Visayas, Southern Mindanao, and Central Mindanao. Almost 60% of the harvested rice area is irrigated, and most of the remaining rice is grown in lowland rainfed conditions. More than 40% of the national rice production area was in Luzon.

- In the country, out of the rice production area in 2022, hybrid rice was cultivated on 584.2 thousand hectares, which was less than the acreage of open-pollinated varieties and hybrid derivatives, as OPVs accounted for 86.7% of the area cultivated. This high share of acreage was due to low-cost seeds, as the country mostly has small and marginal farmers. However, hybrid rice acreage is growing faster than OPVs, which may boost productivity.

- Growing concerns about self-sufficiency, increasing rice stocks as it is a major staple food consumed across the country, increasing availability of commercial seeds, adoption of transgenic rice, and the rising rice cultivation area are expected to drive the country's rice seed market during the forecast period.

Increased demand for advanced disease-resistant and wider adaptability rice seeds to help in high-yield productivity through partnerships is driving the growth of the market

- In the Philippines, rice is the most grown staple food crop. Wider adaptability is the most adopted trait in rice cultivation due to changes in soil conditions with the demand for high yield and nutritional value from produced crops. For instance, seed varieties such as S6003 and S9001 Kharif by Syngenta AG and SL-20H provide higher yields with early maturity in different conditions. Moreover, seed companies popularly offer other major traits: resistance to bacterial blight, brown plant hopper, rice blast, and heat at the heading stage. Major seed companies include Bayer AG, DCM Shriram Ltd (Bioseed), Corteva Agriscience, and SeedWorks International Pvt. Ltd offers rice seeds resistant to common diseases such as bacterial blight and rice blasts.

- Weather conditions are changing in the country, and to help growers produce a high quantity of good quality rice, the Philippine Rice Research Institute (PhilRice) and the International Rice Research Institute (IRRI) offer rice varieties that are drought-tolerant and can better survive during water stress conditions. Additionally, in 2021, Bioseed, a subsidiary of DCM Shriram, signed a partnership agreement with IRRI (International Rice Research Institute) to develop rice varieties for the Philippines, which are resistant to drought and flood conditions. Therefore, the development of drought-tolerant seed varieties is expected to increase during the forecast period to meet the high demand of growers.

- An increase in new varieties, such as disease-resistant and drought-tolerant varieties, are being developed to meet the demand for rice seeds. These are expected to help the market's growth during the forecast period.

Philippines Rice Seed Industry Overview

The Philippines Rice Seed Market is fragmented, with the top five companies occupying 24.49%. The major players in this market are Advanta Seeds - UPL, Bayer AG, SL Agritech Corporation (SLAC), Syngenta Group and Yuan Longping High-Tech Agriculture Co. Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92560

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.2 Most Popular Traits

- 4.3 Breeding Techniques

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Other Traits

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 DCM Shriram Ltd (Bioseed)

- 6.4.5 SeedWorks International Pvt. Ltd

- 6.4.6 SL Agritech Corporation (SLAC)

- 6.4.7 Syngenta Group

- 6.4.8 VIETNAM NATIONAL SEED GROUP (Vinaseed)

- 6.4.9 Yuan Longping High-Tech Agriculture Co. Ltd

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.