Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693511

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693511

India Controlled Release Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 135 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

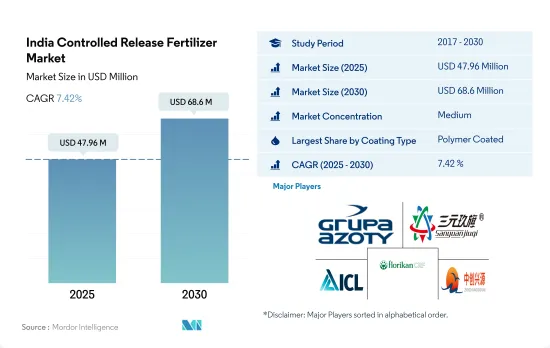

The India Controlled Release Fertilizer Market size is estimated at 47.96 million USD in 2025, and is expected to reach 68.6 million USD by 2030, growing at a CAGR of 7.42% during the forecast period (2025-2030).

High nitrogen requirements and sustainable agricultural practices are increasing the demand for CRFs

- The adoption of controlled-release fertilizers is increasing more in the country as this is an innovative technique that extends nutrient release time by 3, 6, 12, or even 15 months, which gives additional support to the growth of major crops, such as wheat, rice, and maize.

- The controlled-release fertilizer market in the country witnessed an increase in market value by 106.1%, whereas the consumption volume increased by 24.2% during 2017-2021. The main reason for this was the Government of India making it mandatory for all domestic producers of urea to produce 100% neem-coated urea and distribute it at a subsidized price to the farmers.

- Field crops dominated the market, with consumption volume accounting for 89.5% in 2022 as field crops occupied 90.0% of the cultivated area. Major field crops in India include rice, wheat, millet, maize, pulses, and oilseeds, which require high nitrogen content throughout their growth stages.

- Controlled-release urea is the most used form of CRF in India. Nitrogen loss is one of the main problems faced by rice farmers, and the efficiency of nitrogen utilization in rice is often inadequate due to the large loss of nitrogen caused by volatilization and leaching. One way to improve nitrogen efficiency is to use controlled-release urea. Controlled-release urea fertilizers generally outperform granular urea fertilizers in reducing nitrogen loss, stimulating plant growth, and increasing nitrogen concentration.

- Growing concerns regarding health have pushed people to take health-related problems seriously. Increasing inclination toward environmental pollution and the no-leaching property of CRF are positively influencing the controlled-release fertilizer market in the country, which is expected to record a CAGR of 4.5% from 2023 to 2030.

India Controlled Release Fertilizer Market Trends

The intense cereal cultivation in the country is anticipated to drive the Indian fertilizer market

- The area under field crop cultivation in the country increased by 3.5% during the study period. The increased cultivation of cereals, pulses, and oilseeds in the country due to the rising consumer demand domestically and internationally is the major driving factor for the rising acreage. By crop type, rice, wheat, and soybean occupied the largest area under cultivation in the country, accounting for 47 million ha, 31.1 million ha, and 12.3 million ha in 2022. Rice is the most important food crop of India, covering about one-fourth of the total cropped area and providing food to about half of the Indian population. It is cultivated in almost all the states of the country, mainly in West Bengal, Uttar Pradesh, Andhra Pradesh, Punjab, and Tamil Nadu.

- Accordingly, rice consumption in the country increased from 95.8 million tons in 2016 to 107 million tons in 2022, which shows the rising demand for the crop in the country. This trend is further anticipated to drive the demand for fertilizers during 2023-2030. Similarly, wheat cultivation in the country increased from 98.5 million tons in 2017 to 107.6 million tons in 2020. It is cultivated majorly in Punjab, West Bengal, Haryana, and Rajasthan. Wheat is the second most important cereal crop in India and plays a vital role in the country's food and nutritional security. Therefore, the intense cereal cultivation in the country, coupled with rising domestic and international demand, is anticipated to drive the Indian fertilizer market during the forecast period.

Among the primary nutrients, nitrogen is the most-applied nutrient in field crops, with an average application rate of 223.5 kg per hectare

- The overall primary nutrient average application rate in 2022 was 125.1 kg/ha, with nutrients such as nitrogen with the highest average application rate of 223.5 kg/ha. Accordingly, nitrogen is the major source of nutrients for crops such as rice, which is intensively cultivated in the country, and such nutrient deficiency in soil is limiting rice productivity across the nation.

- The State of Biofertilizers and Organic Fertilizers in India marked the poor status of soil health, with increasing consumption of chemical fertilizers in India. Accordingly, 97.0%, 83.0%, and 71.0% of the soil tested were found to be deficient in nitrogen, phosphorous, and potassium, respectively.

- By crop, wheat, rice, and corn/maize are estimated to be the crop types with the highest average nutrient application rate of 231, 156, and 149 kg/ha in 2022. Wheat and rice are important staple food domestically and globally. Multiple nutrient deficiencies are the key factors that reduce yield and profit. Wheat and rice crops require nitrogen, phosphorous, and potassium, along with other micronutrients such as sulfur, boron, iron, and zinc, for their proper growth and development. The proper management of nutrients is necessary for successful crop production, which is driving market growth.

- Field crops consume the maximum amount of primary nutrients, such as nitrogen fertilizer. As grains and cereals are intensively grown in the country, the soil is depleted of its nutrition, and hence, they require more fertilizers to supplement them, which, in turn, is anticipated to drive the market during 2023-2030.

India Controlled Release Fertilizer Industry Overview

The India Controlled Release Fertilizer Market is moderately consolidated, with the top five companies occupying 58.57%. The major players in this market are Grupa Azoty S.A. (Compo Expert), Hebei Sanyuanjiuqi Fertilizer Co., Ltd., ICL Group Ltd, New Mountain Capital (Florikan) and Zhongchuang xingyuan chemical technology co.ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92575

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Primary Nutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.1 Primary Nutrients

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Coating Type

- 5.1.1 Polymer Coated

- 5.1.2 Polymer-Sulfur Coated

- 5.1.3 Others

- 5.2 Crop Type

- 5.2.1 Field Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Grupa Azoty S.A. (Compo Expert)

- 6.4.2 Haifa Group

- 6.4.3 Hebei Sanyuanjiuqi Fertilizer Co., Ltd.

- 6.4.4 ICL Group Ltd

- 6.4.5 New Mountain Capital (Florikan)

- 6.4.6 Zhongchuang xingyuan chemical technology co.ltd

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.