Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693531

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693531

Europe Controlled Release Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 180 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

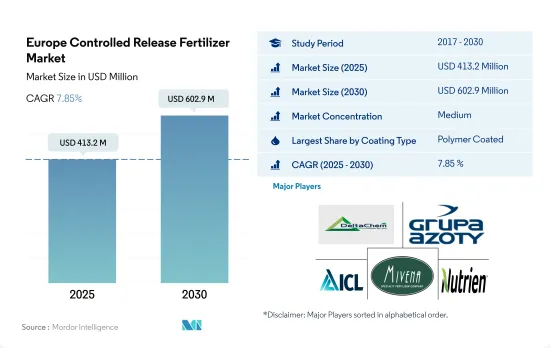

The Europe Controlled Release Fertilizer Market size is estimated at 413.2 million USD in 2025, and is expected to reach 602.9 million USD by 2030, growing at a CAGR of 7.85% during the forecast period (2025-2030).

Increasing environmental and groundwater contamination lead to higher adoption of CRFs in the region

- The European controlled-release fertilizer market grew significantly by 142.4% from 2017 to 2021. Polymer-coated CRF, among all the other coating types, held the major share, 76.4%, in 2022.

- Between 2017 and 2021, there was a striking increase of 143.9% in the value of polymer-coated controlled-release fertilizers, while the volume increased by only 24.3%. These fertilizers are coated with various types of polymers in the region, including polyurethanes, polyethylene co vinyl acetate, ethylene acrylic acid copolymer, formaldehyde-naphthalene sulfonic acid condensate sodium salts, and alkyds based on vegetable oils, as identified by the ECHA. The rise in market value can be mainly attributed to the surge in product prices, which rose by a significant 96.3% in 2022, compared to 2017.

- The European Union has set rules and regulations for controlled-release fertilizers, including polymer encapsulation systems, which are currently under the scope of future restrictions until they are developed to be biodegradable by 2026. These factors restrict the market growth in the region.

- Growing concerns over agricultural sector pollution and water contamination have led farmers to adopt sustainable agricultural practices and environmentally friendly fertilizers. CRFs reduce nutrient leaching and volatilization and release nutrients based on crop requirements, which will provide necessary nutrients to the crops when required and reduce the risk of nutrient losses.

- Hence, the other coating types segment of controlled-release fertilizers, particularly biodegradable and polymer-based ones, has the highest market potential from 2023 to 2030.

Expansion of fruit cultivation in France increases the CRFs' use

- France held the largest market share of 22.4% in the European controlled release fertilizer market in 2022, with the United Kingdom following closely behind.

- The demand for fruits and vegetables, particularly grapes and onions, is a key driver of production activity in Spain. This, in turn, is expected to boost the demand for controlled release coated fertilizers. The use of these fertilizers has shown a significant impact on grape yields, with controlled release fertilizers delivering 70 metric tons per hectare compared to the 30-40 metric tons achieved with conventional fertilizers. Consequently, the increased adoption of polymer-coated controlled release fertilizers has bolstered the market revenue in Spain.

- Polymer-coated fertilizers dominated the market, accounting for a substantial 76.4% share in 2022.

- The United Kingdom witnessed a significant 74.4% surge in the overall market value. This surge can be largely attributed to the Russia-Ukraine conflict that commenced in early 2022, leading to a supply shortage and subsequent price hikes in the country.

- France, a prominent global agricultural producer, harvested 5.2 million metric tons of fruit in 2021, ranking it as the fourth-largest fruit producer in Europe, trailing behind Spain. Given France's emphasis on crop quality, production, and the advantages of controlled release fertilizers, such as minimizing leaching losses, reducing vaporization, and optimizing application frequency, the demand for these fertilizers is projected to rise in the coming years.

Europe Controlled Release Fertilizer Market Trends

The cultivation area for field crops is consistently expanding to cater to both domestic consumption and the growing export demand

- In Europe, field crops like rapeseed, wheat, rye, and triticale are predominantly winter crops, while maize, sunflowers, rice, and soybean are grown in the summer. Barley, in both winter and spring varieties, is widely cultivated. The area dedicated to major food crops in Europe has been steadily expanding, driven by population growth and rising food grain demand. In 2017, the harvested area for field crops stood at 78.5 thousand ha, which climbed to 108 thousand ha by 2022.

- In 2021, the European Union harvested 129.9 million tonnes of common wheat and spelled, accounting for 43.7% of all cereal grains. This marked an 11.0 million tonne increase from 2020, reflecting a 9.3% surge. The rise was propelled by a 5.6% expansion in the harvested area, reaching 21.8 million hectares, and improved apparent yields.

- In 2021, the European Union's production of grain maize and corn cob mix reached 73.0 million tonnes, up by 6.0 million tonnes from 2020. This overall increase was primarily driven by significant rebounds in Romania (a 46.8% increase, adding 4.7 million tonnes) and France (a 14.5% increase, adding 1.9 million tonnes).

- From 2019 to 2022, the region witnessed a notable 34% decline in harvested area. Despite this, corn/maize and wheat saw respective increases of 11% and 2% in their cultivation areas, while other field crops saw reductions. Farmers are expected to boost fertilizer usage during 2023-2030 to bolster yields and counterbalance the declining harvested areas of recent years.

Nitrogen is the primary nutrient consumed more in field crops as most of the soil in the region is deficient in nitrogen

- In 2022, field crops dominated nutrient consumption in Europe, accounting for 85% of the total and utilizing 47 million metric tons. This high demand can be attributed to both the extensive cultivation of field crops and their significant nutrient requirements.

- The primary field crops in Europe include wheat, rapeseed, rye, soybean, and corn, all of which have a substantial reliance on fertilizers. In 2022, the average application rate of nitrogen, phosphorous, and potassium in these crops stood at 187.3 kg per hectare.

- Nitrogen emerged as the most in-demand primary nutrient fertilizer for European field crops, with an average application rate of 130.64 kg/hectare in 2022. Nitrogen deficiency poses the most significant yield constraint, with a majority of agricultural soils in the region lacking this nutrient, necessitating its widespread application.

- Following nitrogen, potassium took the second spot in fertilizer consumption, with an average application rate of 103.75 kg/hectare in 2022. Notably, countries like Sweden, Spain, Poland, and Latvia face more pronounced potassium deficiencies, primarily due to the prevalence of sandy soils. Phosphatic fertilizers followed with an application rate of 56.93 kg/hectare in 2022.

- Primary nutrient fertilizers hold immense significance for crops, as they are integral to metabolic processes and the formation of crucial plant tissues such as cells, cell membranes, and chlorophyll. Phosphorous plays a vital role in cultivating high-quality crops, while potassium activates enzymes essential for plant growth and development.

Europe Controlled Release Fertilizer Industry Overview

The Europe Controlled Release Fertilizer Market is moderately consolidated, with the top five companies occupying 51.97%. The major players in this market are Ekompany International BV (DeltaChem), Grupa Azoty S.A. (Compo Expert), ICL Group Ltd, Mivena BV and Nutrien Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92596

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Primary Nutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.1 Primary Nutrients

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Coating Type

- 5.1.1 Polymer Coated

- 5.1.2 Polymer-Sulfur Coated

- 5.1.3 Others

- 5.2 Crop Type

- 5.2.1 Field Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Turf & Ornamental

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Ukraine

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ekompany International BV (DeltaChem)

- 6.4.2 Grupa Azoty S.A. (Compo Expert)

- 6.4.3 Haifa Group

- 6.4.4 ICL Group Ltd

- 6.4.5 Mivena BV

- 6.4.6 Nutrien Ltd.

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.