Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693545

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693545

France Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 244 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

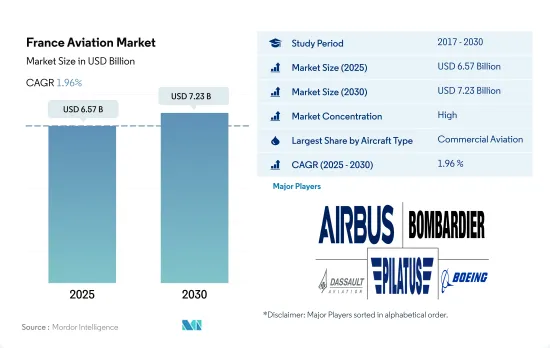

The France Aviation Market size is estimated at 6.57 billion USD in 2025, and is expected to reach 7.23 billion USD by 2030, growing at a CAGR of 1.96% during the forecast period (2025-2030).

Presence of Major OEMs and the Rising Procurement of Commercial, General, and Military Aircraft Drive the Market Growth

- France is one of the largest and most important aviation markets in Europe in terms of traffic due to its size and geographic location and the presence of some of the industry's flagships, such as Air France and Airbus. In terms of deliveries, 22 aircraft were procured in the commercial aviation segment, while seven business jets and 45 helicopters were procured in the general aviation segment in 2021, a 23% rise for commercial aviation and a 13% rise for general aviation from 2020.

- The French aerospace industry is experiencing a significant shift in technology due to the current market uncertainty and the French government's aerospace assistance plan, which is driving the growth of this sector in France. The military aviation sector has benefitted due to the increasing government investment in R&D and the procurement of advanced fighter jets, helicopters, and transport and training aircraft from the local players.

- Though the deliveries have been affected by a halt in production and lockdowns, this segment remained positive. The general aviation market in France could expand over the forecast period due to an increasing emphasis on improving the infrastructure of private airports and the increasing number of HNWIs in the country.

- During the COVID-19 outbreak in 2020, there was a decline in business jet deliveries. However, the piston fixed-wing, turboprop, and helicopter segments remained strong in terms of aircraft deliveries. In 2021, all these segments exceeded the pre-pandemic deliveries.

France Aviation Market Trends

Increased demand from domestic travelers is driving the air passenger traffic

- Europe is the biggest market for passenger flows to and from France, followed by Africa and North America. About 58.3 million passengers traveled from Europe (71.3% of the total), 9.7 million passengers reached France from Africa (11.8%), and 4.9 million passengers arrived from North America (5.9%). The contribution of the overall air transportation and its allied industries, such as airlines, to the French GDP, is around USD 87 billion.

- Air passenger numbers in France increased by 0.02% in 2022. Longer flights will cause an increase in fuel consumption and can result in a sharp increase in operating costs for certain routes. The increasing fuel costs will particularly impact airlines, therefore resulting in increased costs to passengers through higher ticket prices. Re-routing and longer flights may also cause inconvenience for air passengers, with an increased risk of flights being canceled completely and may decrease passenger confidence. The unpredictability of the situation in Ukraine is likely to be a major challenge for airlines in France and further delay the recovery in air passenger numbers.

- In 2021, the airport had a passenger movement of around 482,676 p.a. Similarly, another major airport in France had a drop of over 68% in passenger traffic during 2020. The recovery in passenger traffic with ease in travel restrictions was witnessed by the major French airlines. In 2021, around 35.8 million passengers were carried by Air France-KLM. The overall air passenger traffic is anticipated to surge during the forecast period.

Geopolitical threats are the driving factor for rising defense expenditure

- The country's defense expenditure surged by 0.6% from 2021 to 2022, with USD 53.6 billion in 2022. The defense expenditure of the country was 1.9% of the GDP. In 2022, France was the third-largest country in terms of defense expenditure in Europe after Germany. During 2017-2022, the country's defense expenditure surged by around 9%.

- Despite the French economy being impacted by the pandemic, which led to reduced economic activities due to imposed lockdowns and travel restrictions, the French government surged its defense expenditure in 2021 to ensure its security capabilities. The Military Programming Law 2019-2025, known as LPM in France, defines the defense policy guidelines and the resources for the country. It includes an increase in France's defense budget by around USD 1.47 billion by 2022, followed by an increase of USD 3.39 billion by 2023. The LPM has allotted a total of USD 334 billion to defense expenditures between 2019 and 2025.

- France's defense spending has surged by 14.5% since 2000 compared to the defense expenditures of other European nations and major military powers. For instance, Germany's defense expenditure has surged by 21.6% since then. The United Kingdom's defense expenditure surged by 20%, China's by 495%, Russia's by 183%, and the United States' by 61%. The French defense expenditure emphasizes the modernization of the armed forces by procurement of newer arms and equipment and the upgradation of the existing ones. The French government is allocating funds for two major programs, namely, the Franco-German-Spanish Future Combat Air System or FCAS (around USD 325.22 million) and the Main Ground Combat System, or MGCS, a next-generation tank program (USD 65.67 million).

France Aviation Industry Overview

The France Aviation Market is fairly consolidated, with the top five companies occupying 103.51%. The major players in this market are Airbus SE, Bombardier Inc., Dassault Aviation, Pilatus Aircraft Ltd and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92610

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.2 Air Transport Freight

- 4.3 Gross Domestic Product

- 4.4 Revenue Passenger Kilometers (rpk)

- 4.5 Inflation Rate

- 4.6 Active Fleet Data

- 4.7 Defense Spending

- 4.8 High-net-worth Individual (hnwi)

- 4.9 Regulatory Framework

- 4.10 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Commercial Aviation

- 5.1.1.1 By Sub Aircraft Type

- 5.1.1.1.1 Freighter Aircraft

- 5.1.1.1.2 Passenger Aircraft

- 5.1.1.1.2.1 By Body Type

- 5.1.1.1.2.1.1 Narrowbody Aircraft

- 5.1.1.1.2.1.2 Widebody Aircraft

- 5.1.2 General Aviation

- 5.1.2.1 By Sub Aircraft Type

- 5.1.2.1.1 Business Jets

- 5.1.2.1.1.1 By Body Type

- 5.1.2.1.1.1.1 Large Jet

- 5.1.2.1.1.1.2 Light Jet

- 5.1.2.1.1.1.3 Mid-Size Jet

- 5.1.2.1.2 Piston Fixed-Wing Aircraft

- 5.1.2.1.3 Others

- 5.1.3 Military Aviation

- 5.1.3.1 By Sub Aircraft Type

- 5.1.3.1.1 Fixed-Wing Aircraft

- 5.1.3.1.1.1 By Body Type

- 5.1.3.1.1.1.1 Multi-Role Aircraft

- 5.1.3.1.1.1.2 Training Aircraft

- 5.1.3.1.1.1.3 Transport Aircraft

- 5.1.3.1.1.1.4 Others

- 5.1.3.1.2 Rotorcraft

- 5.1.3.1.2.1 By Body Type

- 5.1.3.1.2.1.1 Multi-Mission Helicopter

- 5.1.3.1.2.1.2 Transport Helicopter

- 5.1.3.1.2.1.3 Others

- 5.1.1 Commercial Aviation

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 Bombardier Inc.

- 6.4.3 Dassault Aviation

- 6.4.4 Embraer

- 6.4.5 Leonardo S.p.A

- 6.4.6 Pilatus Aircraft Ltd

- 6.4.7 Robinson Helicopter Company Inc.

- 6.4.8 Textron Inc.

- 6.4.9 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.