Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693549

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693549

United States Flexographic Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 132 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

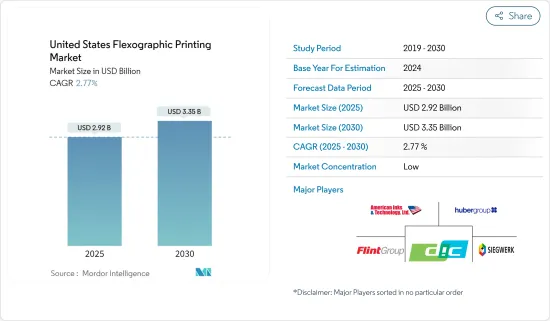

The United States Flexographic Printing Market size is estimated at USD 2.92 billion in 2025, and is expected to reach USD 3.35 billion by 2030, at a CAGR of 2.77% during the forecast period (2025-2030).

Key Highlights

- Flexographic printing offers speeds of up to 750 m (or 2,000 ft) per minute. The process offers significant economies of scale by efficiently combining printing with almost any additional process into a single-pass operation. Package printers and converters increasingly use flexographic printing as a crucial tool for their businesses because it offers quicker changeovers, high image quality, and sophisticated automation at a lesser cost.

- The improvements in flexography are driven by end users who gain from the excellent print results. The flexographic industry is experiencing technological advancements driven by two key factors: the growing demand for product variety and the trend toward shorter production runs. These developments aim to enhance efficiency in a market that is becoming increasingly digitalized.

- UV flexo printing inks and varnishes are widely used and continue gaining popularity. A primary justification for using UV curing technology is the absence of solvents, which lowers emissions and is probably one of the original justifications. However, UV-cured inks are currently being considered in many printing-related fields because of their superior print quality, good adhesion to flexible and various other substrates, high chemical and product resistance, and fast running speeds.

- UV-curing flexo inks are used to print on a wide array of finished product substrates. These include yogurt cups and tops, soup and spice packets, flexible packaging, milk and juice cartons, pet food packaging, and cigarette packs.

- Further, the packaging printing marketplace is changing rapidly, with consumer, retailer, and client demand shifting. Increasing demand for new variety and shorter run lengths are driving advancements in flexographic technology, which aims to improve efficiency in an increasingly digitalized market.

- For instance, in April 2023, Imageworx planned to establish a new division and the Flexographic Innovation Center in Levittown, Pennsylvania. The facility's location provides easy access from Philadelphia and Newark International airports. This center is a collaborative space for industry vendors to demonstrate their advanced technologies to the flexographic printing industry.

- On the contrary, digital technologies may initially incur more significant expenses than printed materials but will present long-term savings. This factor is poised to provide effective competition to flexographic printing, which is identical in the price comparison. Further, the longer lifespan and high resale value of digital printing also influence the adoption of these systems.

United States Flexographic Printing Market Trends

Tags and Labels to Witness Significant Growth

- Flexographic printing has emerged as the fastest-growing segment in the label printing industry. This method offers high-speed production capabilities, creating custom, high-quality labels significantly faster than other printing techniques. Industries such as cosmetics, pharmaceuticals, food, and those employing automatic labeling equipment utilize flexographic printing. This process proves efficient and rapid for label printing applications ranging from low to high volumes.

- Additionally, due to technological advancements, flexographic label printing machines outperform several other label printing techniques in terms of efficiency and speed in the United States. Flexographic label presses are the printing technology for food, beverage, pharmaceutical, and consumer items since they can quickly print label rolls of varied materials without compromising quality.

- The increasing emphasis on consumer convenience and brand differentiation drives the need for innovative and attractive packaging solutions. Labels are pivotal in branding, providing essential product information, and ensuring regulatory compliance.

- According to the US Census Bureau, the value of retail food and beverage stores was approximately USD 985.30 billion in 2023, compared with USD 749.8 billion in 2018.

- Futhermore, With the rise of the retail food and beverage industry, there is a corresponding increase in the demand for packaging, which includes tags and labels. As more products are produced and sold, there is a greater need for labeling solutions to ensure product identification, branding, and compliance with regulations.

Folding Carton Holds a Significant Market Share

- The United States has been one of the largest folding carton box producers and consumers, owing to the significant demand in its downstream industries. Folding carton packaging exports from the United States are also steadily increasing.

- The United States is also home to significant folding carton companies, including International Paper Company, WestRock, Packaging Corporation of America, Sonoco Production Company, Sealed Air Corp, and Graphic Packaging International.

- The market witnessed various product innovations in flexographic presses specifically for folding carton packaging applications. For instance, in February 2024, BOBST introduced oneECG, an extended colour gamut technology, in the label and packaging printing industry.

- Furthermore, This innovation is integrated into BOBST narrow and mid-web printing presses, aiming to redefine efficiency and quality standards. By enhancing efficiency and quality, this innovation benefits converters and solidifies BOBST's position as a player in printing technology.

- Notably, in January 2024, Catapult Print's installation of the Nilpeter FA-26 press marked a significant stride in its mission to redefine print, disrupt the market, and induce change in the US flexible packaging market. Introducing this advanced press underscored Catapult Print's commitment to innovation and quality in the printing industry. This move signifies Catapult Print's dedication to staying at the forefront of the industry and delivering printing solutions.

- Furthermore, flexographic printing employs relief plates to stamp designs onto packaging, ensuring consistent, high-quality prints over time. It is cost-effective, particularly for small-scale projects like foldable carton boxes. The growth in Illinois' folding paperboard box manufacturing industry, with revenue expected to reach USD 985.69 million in 2024, indicates increasing demand for packaging materials.

- This trend supports the demand for flexographic printing. As businesses seek reliable, affordable printing solutions, flexo's versatility and quality position it as a preferred choice. Its ability to maintain print quality and affordability makes it ideal for meeting the evolving needs of the packaging industry amid growing market demands.

United States Flexographic Printing Industry Overview

The United States flexographic printing market is fragmented due to the presence of numerous players, both domestic and global. Players are adopting partnerships, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantages.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92637

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Enables Higher Production Speeds Within Reasonable Cost Overlay

- 5.1.2 Growing Demand for UV-curable Inks

- 5.1.3 The Packaging Industry Is Expected To Drive Demand For Both Equipment And Inks Category

- 5.2 Market Restraints

- 5.2.1 Advent of New Printing Technologies and Shift to Digital Mediums

6 MARKET SEGMENTATION

- 6.1 By Printing Ink

- 6.1.1 By Ink Technology

- 6.1.1.1 Water-based

- 6.1.1.2 Solvent-based

- 6.1.1.3 UV-curable

- 6.1.2 By Application Type

- 6.1.2.1 Packaging

- 6.1.2.1.1 Flexible

- 6.1.2.1.2 Rigid

- 6.1.2.2 Tags and Labels

- 6.1.2.3 Paper-based Printing

- 6.1.1 By Ink Technology

- 6.2 By Equipment

- 6.2.1 By Application Type

- 6.2.1.1 Narrow Web

- 6.2.1.2 Medium Web

- 6.2.1.3 Sheetfed

- 6.2.1.4 Other Printing Equipment

- 6.2.2 By Phase

- 6.2.2.1 Pre-print

- 6.2.2.2 Post-print

- 6.2.3 By End User

- 6.2.3.1 Folding Carton

- 6.2.3.2 Flexible Packaging

- 6.2.3.3 Labels

- 6.2.3.4 Print Media

- 6.2.3.5 Other End Users

- 6.2.1 By Application Type

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DIC Corporation

- 7.1.2 Siegwerk Group

- 7.1.3 Flint Group

- 7.1.4 Hubergroup USA Inc.

- 7.1.5 American Inks & Technology

- 7.1.6 Inx International Ink Co.

- 7.1.7 Wikoff Color Corporation

- 7.1.8 ACTEGA GmbH

- 7.1.9 Zeller+Gmelin Corporation

- 7.1.10 Kolorcure Corporation

- 7.1.11 Comexi Group Industries SAU

- 7.1.12 Bobst Group SA

- 7.1.13 Heidelberger Druckmaschinen AG

- 7.1.14 Omet Americas Inc. (Omet Group)

- 7.1.15 MPS Systems BV

- 7.1.16 Mark Andy Inc.

- 7.1.17 Windmoller & Holscher KG

- 7.1.18 CMS Industrial Technologies LLC

- 7.1.19 Nilpeter USA Inc.

8 INVESTMENT OF THE MARKET

9 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.