Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693560

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693560

Middle East and Africa Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 282 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

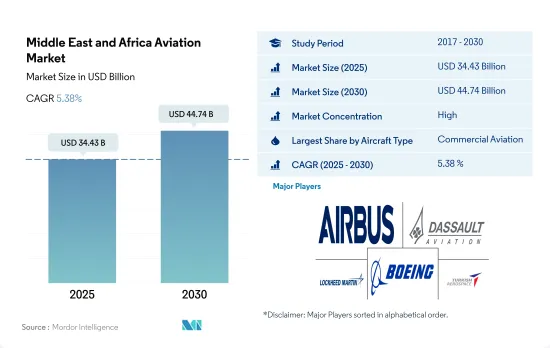

The Middle East and Africa Aviation Market size is estimated at 34.43 billion USD in 2025, and is expected to reach 44.74 billion USD by 2030, growing at a CAGR of 5.38% during the forecast period (2025-2030).

Commercial aviation registered a major value share of 70.6% in 2023

- The economic condition in the Middle East & Africa looks stable as the region's GDP increased by 20% over 2021 and 17% compared to the pre-pandemic levels. As of June 2022, the region's aviation sector supported 11.1 million jobs and USD 276 billion in the GDP.

- During the forecast period, the commercial aviation segment is anticipated to expand with higher growth. The airline companies of the Middle Eastern region witnessed a 116.2% rise in demand in 2022 compared to 2021. With the reopening of international routes and long-haul flights, the demand for passenger aircraft is projected to increase by 66% during the forecast period (2022-2030).

- Due to a significant number of HNWIs and UHNWIs, the Middle East has proven to be a lucrative industry for the business aviation sector. From 2016 to 2021, HNWIs in the Middle East increased by 86%, while those in Africa increased by 19%. Due to their high level of luxury and comfort, business jets with large cabins and extended ranges are in high demand in the Middle East. As of July 2022, large jets accounted for 50% of the Middle Eastern and 36% of the African fleet.

- Military aviation in the Middle East & Africa is expected to grow in the coming years, owing to various aircraft procurement plans by Turkey, Kuwait, Qatar, and Bahrain. Military spending in Africa increased by 6% and by 8% in the Middle East. Fixed-wing aircraft may account for higher growth as countries in the region invest heavily in modernizing their aging military fleets and procuring next-generation aircraft.

Fleet upgradation and replacement programs driving the demand

- The Middle Eastern region had a share of around 6.5% of the global air passenger traffic as of April 2022. The airline companies of the Middle East witnessed a 265% rise in demand in April 2022 compared to April 2021. Similarly, the African region had a share of around 1.9% of the global air passenger traffic as of April 2022. The airline companies of the African region witnessed a 116.2% rise in demand in April 2022 compared to April 2021.

- The deliveries in the commercial aircraft segment witnessed a growth of around 96% in 2022 compared to 2021. The OEMs experienced problems such as a halt in production, supply chain, transportation issues due to lockdowns, and travel restrictions that impacted domestic and international routes. During the forecast period, around 1,080+ commercial aircraft are expected to be delivered to the Middle East & Africa.

- In the general aviation sector, Turkey was the leading country in terms of the active operational fleet of business jets, with around 22.3% of the overall Middle Eastern business jet fleet, followed by Saudi Arabia, the United Arab Emirates, and Israel, with around 20% each and 12% of the deliveries as of 2022. In Africa, South Africa and Nigeria accounted for 25% and 23% of the business jet fleet, respectively.

- Defense expenditures in the Middle Eastern region were around USD 184 billion in 2022, a decline of over 3.2% compared to 2022. In contrast, it was around USD 39.4 billion in Africa in 2022, with a decline of over 5% from 2021.

- During the forecast period, the active fleet may increase in the region, as Middle Eastern countries like the UAE, Saudi Arabia, Qatar, and Turkey are expected to procure newer aircraft for fleet upgradation.

Middle East and Africa Aviation Market Trends

The re-opening of Asian markets is boosting traffic through Gulf hubs

- Air passenger traffic recovery has been strong for the African and Middle Eastern carriers, with year-over-year growth of 87.1% and 64.6% in the first quarter of 2023. In the Middle East & Africa, the number of international and domestic travelers increased by 15% in 2022 compared to 2021. The Middle East has also seen sustained recovery, with most countries having rebounded, except for Iran and Kuwait, where traffic was 26% and 4% short of full recovery, respectively. Jordan, Qatar, Saudi Arabia, and the United Arab Emirates posted strong growth numbers compared to 2019.

- In Q4 2022, Egypt and Nigeria witnessed their passenger traffic perform over 20% above pre-pandemic levels. Qatar's traffic increased nearly 40% Y-o-Y over the same period, boosted by travelers attending the first World Cup hosted in the Arab country. However, passenger volumes in South Africa, Iran, and Kuwait are still more than 10% below their pre-pandemic levels as of Q4 2022.

- According to IATA, The world's busiest hub for international traffic, Dubai International Airport (DXB) recorded 22.9 million passengers in the third quarter of 2023, the highest quarterly traffic since 2019, rising by nearly 40% over a year.

- In 2022, load factors reached 77% and 80% for the Middle Eastern & African airlines, respectively, up more than ten percentage points compared to the 2021 load factors. These facts indicate that the travel recovery continues to gather momentum post the COVID-19 restrictions. Many major international route areas within the Middle East are already exceeding pre-COVID-19 levels. Tourism and the high willingness to travel continue to foster the industry's recovery in the Middle East & Africa.

Major military powers in the region have surged their defense expenditure

- Defense expenditures in the Middle Eastern region were around USD 184 billion in 2022, a decline of over 3.2% compared to 2021. In contrast, it was around USD 39.4 billion in Africa in 2022, with a decline of over 5% from 2021. Countries such as Saudi Arabia, Egypt, Qatar, United Arab Emirates, and Algeria were the major countries in the region with a high defense expenditure during 2017-22. They have active procurement programs for multi-role and utility aircraft in fixed-wing segments.

- Sub-Saharan Africa's combined military expenditure stood at USD 20.3 billion in 2022, down by 7.3% compared to 2021 and 18% compared to 2013. Nigeria and South Africa, the sub-regions two largest spenders, led the decline in military spending in 2022. In 2022, Israel's military spending fell for the first time since 2009. Its total of USD 23.4 billion was 4.2% lower than in 2021.

- The year-on-year (Y-o-Y) growth in Saudi Arabia's military spending was 16% in 2022 compared to 2021, the first Y-o-Y increase since 2018. Saudi Arabia's military expenditure was estimated at USD 75.0 billion last year. The reduction coincided with accusations that Saudi Arabia had started to remove its military personnel from Yemen. However, the Saudi government denied the allegations and insisted that the personnel were just being redeployed. Since 2015, Saudi Arabia has been leading a coalition in a military campaign against the war-torn nation of Yemen, and the fighting continued into 2022. Saudi Arabia had the second-largest military budget in the world, at 7.4% of GDP, after Ukraine in 2022.

Middle East and Africa Aviation Industry Overview

The Middle East and Africa Aviation Market is fairly consolidated, with the top five companies occupying 72.57%. The major players in this market are Airbus SE, Dassault Aviation, Lockheed Martin Corporation, The Boeing Company and Turkish Aerospace Industries (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92654

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.2 Air Transport Freight

- 4.3 Gross Domestic Product

- 4.4 Revenue Passenger Kilometers (rpk)

- 4.5 Inflation Rate

- 4.6 Active Fleet Data

- 4.7 Defense Spending

- 4.8 High-net-worth Individual (hnwi)

- 4.9 Regulatory Framework

- 4.10 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Commercial Aviation

- 5.1.1.1 By Sub Aircraft Type

- 5.1.1.1.1 Freighter Aircraft

- 5.1.1.1.2 Passenger Aircraft

- 5.1.1.1.2.1 By Body Type

- 5.1.1.1.2.1.1 Narrowbody Aircraft

- 5.1.1.1.2.1.2 Widebody Aircraft

- 5.1.2 General Aviation

- 5.1.2.1 By Sub Aircraft Type

- 5.1.2.1.1 Business Jets

- 5.1.2.1.1.1 By Body Type

- 5.1.2.1.1.1.1 Large Jet

- 5.1.2.1.1.1.2 Light Jet

- 5.1.2.1.1.1.3 Mid-Size Jet

- 5.1.2.1.2 Piston Fixed-Wing Aircraft

- 5.1.2.1.3 Others

- 5.1.3 Military Aviation

- 5.1.3.1 By Sub Aircraft Type

- 5.1.3.1.1 Fixed-Wing Aircraft

- 5.1.3.1.1.1 By Body Type

- 5.1.3.1.1.1.1 Multi-Role Aircraft

- 5.1.3.1.1.1.2 Training Aircraft

- 5.1.3.1.1.1.3 Transport Aircraft

- 5.1.3.1.1.1.4 Others

- 5.1.3.1.2 Rotorcraft

- 5.1.3.1.2.1 By Body Type

- 5.1.3.1.2.1.1 Multi-Mission Helicopter

- 5.1.3.1.2.1.2 Transport Helicopter

- 5.1.3.1.2.1.3 Others

- 5.1.1 Commercial Aviation

- 5.2 Country

- 5.2.1 Algeria

- 5.2.2 Egypt

- 5.2.3 Qatar

- 5.2.4 Saudi Arabia

- 5.2.5 South Africa

- 5.2.6 United Arab Emirates

- 5.2.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 Dassault Aviation

- 6.4.3 Embraer

- 6.4.4 General Dynamics Corporation

- 6.4.5 Leonardo S.p.A

- 6.4.6 Lockheed Martin Corporation

- 6.4.7 Pilatus Aircraft Ltd

- 6.4.8 The Boeing Company

- 6.4.9 Turkish Aerospace Industries

- 6.4.10 United Aircraft Corporation

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.