Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693563

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693563

UK Military Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 174 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

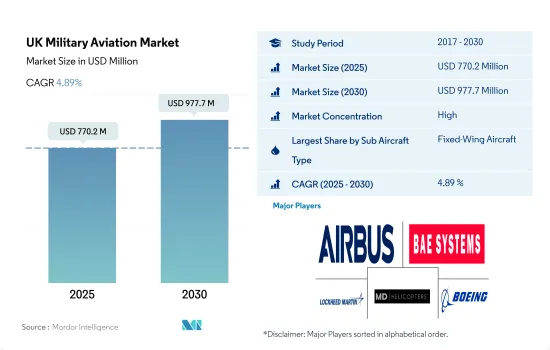

The UK Military Aviation Market size is estimated at 770.2 million USD in 2025, and is expected to reach 977.7 million USD by 2030, growing at a CAGR of 4.89% during the forecast period (2025-2030).

The Country Is Focusing On The Procurement Of New generation Aircraft, Thereby Boosting The Growth Of The Military Aviation Market

- According to the recently released Defense Equipment Plan for 2021-2031, the United Kingdom intends to upgrade its armed forces by procuring advanced military platforms to prepare for potential threats. Over the following 10 years, beginning in 2021, the country aims to spend USD 321 billion on the purchase and support of equipment.

- The country is allocating a significant amount of funds to its military to achieve this goal. The defense budget for 2021 was USD 68.37 billion, a rise of 13% over 2020, out of the total government spending. The country is also committed to its NATO goal to devote 2% of its annual GDP to defense. Currently, the country dedicates a little more than 2% of its GDP to the military.

- The United Kingdom's rising military spending is driving the purchase of new-generation aircraft that may strengthen aviation capabilities. On this note, the United Kingdom ordered 123 fixed-wing aircraft, which include F-35B (114) combat aircraft, under the Future Combat Air System to replace the country's Eurofighter Typhoon fleet. The country also ordered two Airbus A400M transport aircraft, two P-8A Poseidon, and three E-7A special mission aircraft.

- The UK is also procuring 54 helicopters, which include AH-64E (40) multi-mission rotorcraft and CH-47 (14) transport helicopters. All the rotorcrafts are scheduled for delivery by 2028. These helicopters are procured to modernize the country's armed forces and counter any emerging threats in the future. On this note, the AH-64E will replace the Apache AH1 and the CH-47 will be upgraded to the latest Block II standard.

UK Military Aviation Market Trends

Rising geopolitical threats are the driving factor for rising defense expenditure

- As a member of NATO, the United Kingdom is committed to spending 2% of its GDP on defense each year. The country's military budget for 2022 was USD 68.5 billion, a rise of 3.7%. Out of the total government spending, the country has allocated 2.2% of its share to the military. At present, the United Kingdom spends more than 2% of its gross domestic product (GDP) on military expenses.

- According to the recently published Defense Equipment Plan for 2021-2031, the United Kingdom plans to modernize its armed forces to combat future threats. The nation plans to spend USD 321 billion (GBP 238 billion) on equipment procurement and support over the next 10 years, starting from 2021 to 2022. The Army Command allocated USD 55.7 billion (GBP 41.3 billion) to aircraft procurement, including an allocation for AH-64 Apache attack helicopters.

- For the purpose of expanding the naval fleet, the British Navy plans to spend USD 43.2 billion (EUR 38.1 billion). Fundings of USD 39.7 billion (EUR 35 billion), USD 58.8 billion (EUR 58.1 billion), and USD 24.4 billion (EUR 21.5 billion) were provided to the UK Strategic Command, the Defence Nuclear Organization, and the Strategic and Combat Air Program, respectively. The UK Ministry of Defence also announced its plans to procure additional F-35s and A400M aircraft in the coming years. The Air Command plans to retire equipment that is becoming increasingly obsolete in the digital and future operational environments.

An increased defense budget is expected to help with the procurement of more aircraft and helicopters, thereby boosting the country's active fleet size

- Eurofighter Typhoons, F-35, A400M, and C-130J aircraft form the backbone of the UK Royal Air Force. As of April 2022, the UK MoD was in negotiations with the F-35 Joint Project Office to purchase another tranche of F-35 jets. This second batch will consist of 26 aircraft apart from the 48 already under contract. The first batch of 48 aircraft deliveries are expected to be completed by 2025. The RAF plans to have three frontline F-35B squadrons, each with a strength of 12-16 aircraft.

- It also plans to retire Typhoon Tranche 1 and Hawk T1 by 2025 to enhance the efficiency of its fleet. Air Command also planned to retire the BAe146 as scheduled in 2022 and the C130 Hercules in 2023. The E7 Wedgetail, the next-generation airborne command and control aircraft, will replace the E-3D Sentry.

- The United Kingdom is planning to buy additional A400M transport aircraft. It placed an order for 22 A400M, of which 20 were delivered as of February 2022. The remaining two aircraft were expected to be delivered in the latter half of 2022. Earlier, in 2021, the United Kingdom's Royal Air Force also signed a deal for 14 new extended-range CH-47 Chinooks. Deliveries of AH-64E Apache Guardian are ongoing for the British Army as it aims to strengthen its aerial combat capabilities.

- Although UK defense plans to retire several aging aircraft, it will have to actively continue the procurement of replacement aircraft to avoid any gaps within the fleet. The country's continued support for Ukraine in its war with Russia may add pressure on its defense budget. This factor may threaten the country's usual place as Europe's largest defense spender.

UK Military Aviation Industry Overview

The UK Military Aviation Market is fairly consolidated, with the top five companies occupying 100%. The major players in this market are Airbus SE, BAE Systems, Lockheed Martin Corporation, MD Helicopters LLC and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92657

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Gross Domestic Product

- 4.2 Active Fleet Data

- 4.3 Defense Spending

- 4.4 Regulatory Framework

- 4.5 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Aircraft Type

- 5.1.1 Fixed-Wing Aircraft

- 5.1.1.1 Multi-Role Aircraft

- 5.1.1.2 Training Aircraft

- 5.1.1.3 Transport Aircraft

- 5.1.1.4 Others

- 5.1.2 Rotorcraft

- 5.1.2.1 Multi-Mission Helicopter

- 5.1.2.2 Transport Helicopter

- 5.1.2.3 Others

- 5.1.1 Fixed-Wing Aircraft

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 BAE Systems

- 6.4.3 Embraer

- 6.4.4 Lockheed Martin Corporation

- 6.4.5 MD Helicopters LLC

- 6.4.6 Textron Inc.

- 6.4.7 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.