Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693565

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693565

Japan Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 233 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

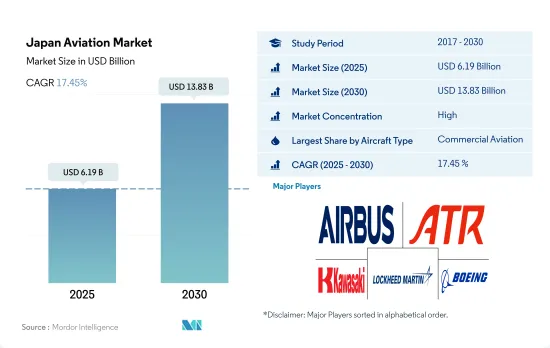

The Japan Aviation Market size is estimated at 6.19 billion USD in 2025, and is expected to reach 13.83 billion USD by 2030, growing at a CAGR of 17.45% during the forecast period (2025-2030).

The commercial aviation segment is expected to dominate the market in Japan due to rising demand for air travel

- The commercial aviation industry, comprising airlines and their supply chains, is estimated to contribute USD 72.1 billion to Japan's GDP during the forecast period. In addition, inputs to the air transport sector and foreign tourists coming by air support are expected to contribute 2.4% of the country's GDP.

- Japan is one of the world's strongly growing commercial aviation markets, despite the COVID-19 pandemic impacting the region's commercial airline industry. The recovery of passenger traffic is anticipated to aid in the revival of Japan's commercial aviation industry. Japan witnessed a total increase of 139% in air passenger traffic in 2021. The rise in passenger traffic is attributed to ease in border restrictions.

- Factors such as the increasing number of high-net-worth individuals, training schools, the government's focus on developing business jet infrastructure, and deregulation activities are expected to drive the growth of general aviation in Japan during the forecast period. Charter operators in the country are constantly expanding their routes and are adding new aircraft to their fleets, driven by the growing need for non-scheduled business travel. This has helped the demand for business jets and turboprops in Japan. On the other hand, the demand for light sport and trainer aircraft remained high, contributing to the growth of the general aviation fleet.

- Japan's Defense Ministry proposed a budget for fiscal 2022 of more than USD 49.3 billion at the beginning of 2021, which is a record and potentially exceeds the long-standing cap of 1% of GDP. By 2027, Japan might be the world's third-largest defense spender, after only the United States and China.

Japan Aviation Market Trends

Ease of restrictions and rising passenger travel driving demand

- The strategic location of Japan in the Asia-Pacific region makes it a popular destination for international travel and tourism. The demand for air travel within Japan and to international destinations continues to grow, driven by factors such as rising incomes, increased tourism, and global business interactions. In 2022, 122 million air passengers traveled through Japan, compared to 51 million in 2020. The growth between 2022 and 2020 was 139%. The growth remained the same between 2022 and 2021.

- In 2019, 37 Japanese airports had international routes. However, in 2022, this number fell to just 17. International traffic has also become more concentrated in fewer airports, partly as a result of the Japanese government's decision to allow international access to Japan through just a small number of airports during the COVID-19 pandemic and partly because many of the international routes that operated from regional airports in Japan served regional markets in China and South Korea, which are not yet back to pre-pandemic operations.

- The drop in travel demand and the associated losses faced by major airlines resulted in airlines deferring their expected aircraft deliveries and restructuring their existing fleet by retiring a few aircraft models early. For instance, Japan Airlines Co.'s national Carrier is looking to replace its older Boeing Co. 737 short-haul fleet with modern and fuel-efficient aircraft models. The airline has a fleet of 45 Boeing 737 jets with an average age of about 12.5 years. The airline is expected to choose between the 737 Max range and Airbus SE's rival A320neo to replace the aging fleet, with an expected order of 30 and 50 narrow-body jets.

Geopolitical threats is driving the growth of defense expenditure in Japan

- Japan is ranked sixth globally in overall military power after the United States, Russia, China, and India. The country's defense budget ranked tenth in the 2022 ranking of 140 countries. In 2022, Japan allocated USD 46.0 billion to its military, up by 5.9% from 2021. The country is in the middle of a significant shift in policy, which had previously capped military spending at 1.0% of GDP. Japan's 2022 National Security Strategy aims to increase spending on security, which includes funding for the military, to up to 2.0% of GDP by 2027. The planned increase is largely in response to Japan's perception of growing threats from China, North Korea, and Russia. At 1.1% of GDP in 2022, Japan's military burden surpassed 1.0% for the third consecutive year and was at its highest level since 1960.

- In the face of rising Chinese aggression, and as a stakeholder in almost all disputes involving the South and East China seas, the need for Japan to procure military aircraft has increased significantly. On this note, in the fixed-wing aircraft segment, Japan ordered a mass procurement contract worth USD 23.11 billion with Lockheed Martin for 105 F-35 combat aircraft, which includes 63 F-35A and 42 F-35B under the sixth-generation stealth fight aircraft program, popularly known as F-X or F-3. In addition, the country placed an order with Bell Helicopters for 150 Bell and 412 UH-X transport helicopters in the military rotorcraft segment. Till 2021, three helicopters were delivered, and the remaining aircraft are expected to be delivered by 2039. These multi-purpose helicopters are ordered to replace Japan's Ground Self-Defense Force's (JGSDF) current fleet of UH-1J aircraft.

Japan Aviation Industry Overview

The Japan Aviation Market is fairly consolidated, with the top five companies occupying 89.11%. The major players in this market are Airbus SE, ATR, Kawasaki Heavy Industries, Ltd., Lockheed Martin Corporation and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92659

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.2 Air Transport Freight

- 4.3 Gross Domestic Product

- 4.4 Revenue Passenger Kilometers (rpk)

- 4.5 Inflation Rate

- 4.6 Active Fleet Data

- 4.7 Defense Spending

- 4.8 High-net-worth Individual (hnwi)

- 4.9 Regulatory Framework

- 4.10 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Commercial Aviation

- 5.1.1.1 By Sub Aircraft Type

- 5.1.1.1.1 Freighter Aircraft

- 5.1.1.1.2 Passenger Aircraft

- 5.1.1.1.2.1 By Body Type

- 5.1.1.1.2.1.1 Narrowbody Aircraft

- 5.1.1.1.2.1.2 Widebody Aircraft

- 5.1.2 General Aviation

- 5.1.2.1 By Sub Aircraft Type

- 5.1.2.1.1 Business Jets

- 5.1.2.1.1.1 By Body Type

- 5.1.2.1.1.1.1 Large Jet

- 5.1.2.1.1.1.2 Light Jet

- 5.1.2.1.1.1.3 Mid-Size Jet

- 5.1.2.1.2 Piston Fixed-Wing Aircraft

- 5.1.2.1.3 Others

- 5.1.3 Military Aviation

- 5.1.3.1 By Sub Aircraft Type

- 5.1.3.1.1 Fixed-Wing Aircraft

- 5.1.3.1.1.1 By Body Type

- 5.1.3.1.1.1.1 Multi-Role Aircraft

- 5.1.3.1.1.1.2 Transport Aircraft

- 5.1.3.1.1.1.3 Others

- 5.1.3.1.2 Rotorcraft

- 5.1.3.1.2.1 By Body Type

- 5.1.3.1.2.1.1 Multi-Mission Helicopter

- 5.1.3.1.2.1.2 Transport Helicopter

- 5.1.3.1.2.1.3 Others

- 5.1.1 Commercial Aviation

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 ATR

- 6.4.3 Bombardier Inc.

- 6.4.4 Kawasaki Heavy Industries, Ltd.

- 6.4.5 Lockheed Martin Corporation

- 6.4.6 Textron Inc.

- 6.4.7 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.