Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693567

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693567

US Military Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 164 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

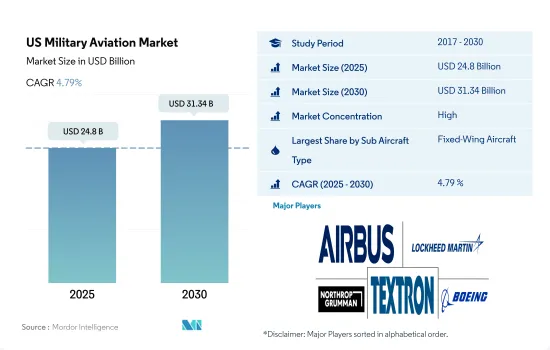

The US Military Aviation Market size is estimated at 24.8 billion USD in 2025, and is expected to reach 31.34 billion USD by 2030, growing at a CAGR of 4.79% during the forecast period (2025-2030).

Rising defense budgets and huge aircraft procurement are driving the market

- Competition in technology between China and the United States is accelerating as both countries are increasingly focused on the R&D of emerging technologies to prepare for future warfare. In 2022, the United States accounted for 39% of global defense military spending, which increased by USD 877 billion in 2022, or 0.7%. The total includes military assistance to Ukraine, estimated at USD 19.9 billion. In 2022, the country released the Department of the Air Force budget, which outlined the budget request for FY 2023 at approximately USD 194.0 billion.

- A significant portion of the defense budget is allocated for F-35 jets, B-21 Raider bombers, KC-46A Pegasus tankers, and other helicopters. Some of these new aircraft will replace the existing fleet that has been operational for over 50 years. In 2022, the Air Force planned to cut down the total fleet of C-130 aircraft and upgrade about 92 C-130 aircraft. The US Air Force plans to retire the older models for the new C-130J aircraft fleet. By the end of 2022, the United States received 47 F-35s, with outstanding deliveries for 1,943 aircraft expected during the forecast period.

- Several ongoing and future procurement programs of the country are expected to drive its military helicopter market during 2023-2029. In March 2023, Boeing announced that the US Army had awarded a contract to build new AH-64E Apache Guardian attack helicopters under a USD 1.95 billion four-year order. In September 2018, the US Air Force (USAF) selected the MH-139 to replace its fleet of UH-1N Huey helicopters. As of December 2022, nine helicopters were delivered, with the rest of the deliveries expected during the forecast period. During the forecast period, a total of 2,330 aircraft are expected to be procured by the country.

US Military Aviation Market Trends

The increase in defense spending can be attributed to the various geopolitical threats faced by the US

- In 2022, the US accounted for 39% of global defense spending military spending, which increased by USD 877 billion in 2022, or 0.7%. In 2022, the US released the Department of the Air Force budget, which outlined that for FY 2023, the budget request was approximately USD 194.0 billion, a USD 20.2 billion or 11.7% increase from the FY 2022 request. The US DoD proposed USD 276.0 billion in acquisition funds for FY2023 (Procurement and Research, Development, Test, and Evaluation (RDT&E)), which comprised USD 145.9 billion for Procurement and USD 130.1 billion for RDT&E. The financing requested in the budget is a balanced portfolio approach to implementing the National Defense Strategy recommendations.

- Of the USD 276 billion in the request, USD 56.5 billion (USD 16.8 billion for RDT&E and USD 39.6 billion for Procurement) will finance aircraft and related systems, including money for aircraft R&D, aircraft acquisition, initial spares, and aircraft support equipment. The single most expensive defense program, the fifth generation F-35 Joint Strike Fighter (JSF), has USD 11.0 billion in requests for 61 aircraft for the Navy (F-35C), Marine Corps (F-35B & C), and Air Force (F-35A). Funding for FY 2023 also included the purchase of 24 F-15EX, 79 logistics and support aircraft, 119 rotary wing aircraft, and 12 UAV/UAS.

- The US Army's budget request for FY 2022 was USD 173 billion, the Navy's was USD 212 billion, and the Air Force's request was USD 213 billion. The aircraft and related systems category includes the following subgroups: Combat Aircraft (USD 23.0 billion), Cargo Aircraft (USD 5.0 billion), Support Aircraft (USD 1.6 billion), with the remaining budget for UAS, aircraft support, technology development, and aircraft modifications.

Fleet modernization and growing modern warfare are the driving factors for the country's active fleet enhancement

- The US Air Force (USAF) continues to develop and procure next-generation aircraft to meet the demands of modern warfare. Fielding of new aircraft has slowed the increase in fleet age. The US Air Force is not buying enough new aircraft to sustain its force structure at its current size. A further decrease in fleet size is likely to be witnessed in the future. The average age of a few aircraft is high, at 45 years for bombers, 49 years for tankers, 32 years for helicopters, 32 years for trainers, and 29 years for fighter/attack aircraft. The Navy and the Army also face challenges with aging aircraft and maintaining their fleets. However, the Air Force is in far worse shape in terms of aging and the slow acquisition of replacements. As of December 2022, the United States had the biggest fleet of military aircraft in the world, with a total of 13,300 operational planes. A considerable chunk of this fleet is made up of combat helicopters (42%) and combat planes (21%). In contrast, training planes and helicopters account for 20%, while transport planes make up only 7%. Meanwhile, tankers and special mission aircraft each represent 5% of the fleet.

- For FY2023, the US Air Force asked for permission from Congress to retire up to 150 aircraft, including 21 A-10, 33 F-22, 8 E-8, 15 E-3 Sentries, 10 C-130H Hercules, 50 T-1 Jayhawks, and 13 KC-135 tankers. The USAF also trimmed its F-35A purchases to free up funds to develop Next Generation Air Dominance (NGAD) and roll out the F-15EX. The USAF plans to buy 33 F-35As in 2023, fewer than the 48 the service asked for in FY2022. With the dynamic nature of modern warfare, the United States aims to maintain a smaller fleet of effective aircraft, which may significantly reduce the overall fleet size during the forecast period.

US Military Aviation Industry Overview

The US Military Aviation Market is fairly consolidated, with the top five companies occupying 98.65%. The major players in this market are Airbus SE, Lockheed Martin Corporation, Northrop Grumman Corporation, Textron Inc. and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92661

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Gross Domestic Product

- 4.2 Active Fleet Data

- 4.3 Defense Spending

- 4.4 Regulatory Framework

- 4.5 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Aircraft Type

- 5.1.1 Fixed-Wing Aircraft

- 5.1.1.1 Multi-Role Aircraft

- 5.1.1.2 Training Aircraft

- 5.1.1.3 Transport Aircraft

- 5.1.1.4 Others

- 5.1.2 Rotorcraft

- 5.1.2.1 Multi-Mission Helicopter

- 5.1.2.2 Transport Helicopter

- 5.1.2.3 Others

- 5.1.1 Fixed-Wing Aircraft

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 Leonardo S.p.A

- 6.4.3 Lockheed Martin Corporation

- 6.4.4 Northrop Grumman Corporation

- 6.4.5 Textron Inc.

- 6.4.6 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.