Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693568

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693568

US Business Jet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 132 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

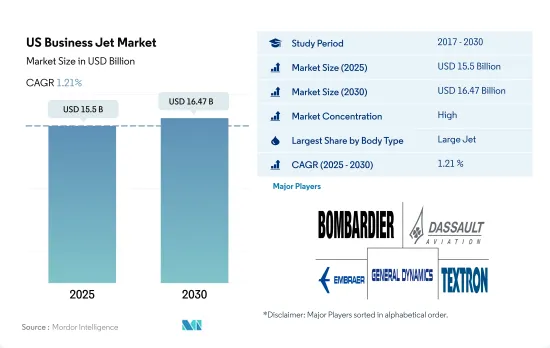

The US Business Jet Market size is estimated at 15.5 billion USD in 2025, and is expected to reach 16.47 billion USD by 2030, growing at a CAGR of 1.21% during the forecast period (2025-2030).

The increase in business travel flight hours after COVID-19 generated a high demand for business jets

- The US business aviation market is part of general aviation and contributes around USD 150 billion to the US economy annually. The US fleet accounted for 67% of the world's business jets, and the country holds around 14,710 registered business jets, the largest fleet size in the region. In 2022, the number of UHNWIs surged by 52% in the country and aided in the increased procurement of business jets. Out of the business jets delivered from 2017 to 2022, light jets constituted around 44%, compared to large and mid-size jets, with 41% and 15%, respectively.

- During the COVID-19 pandemic, a safer way of traveling became one of the major criteria for high-net-worth individuals in the country, which resulted in the increased utilization of private jets. The same trend is expected to continue over the next few years. In terms of deliveries, in 2022, the United States accounted for almost 96% of North America's total business jet deliveries.

- Various aircraft have been delivered to cater to the needs of high-net-worth individuals and business executives. In 2022, Textron became the leading player in terms of deliveries, with 129 aircraft, while Gulfstream Aerospace held the second position with 90 aircraft deliveries. Cirrus Aircraft, Embraer, and Bombardier were the other major players, with 79, 68, and 57 aircraft deliveries in the country, respectively. In October 2019, Chairman Aviation, a US-based fractional and private aviation membership company, ordered a new Cessna Citation CJ3+, its second Citation jet purchase in 2019. The order marks the third Textron Aviation aircraft addition to its fleet. Such factors are expected to drive business jet deliveries to rise by 4,027 between 2023 and 2030.

US Business Jet Market Trends

The rise in the US HNWI population acting as the major growth driver for the market

- Individuals with liquid financial assets over USD 1 million are termed as HNWIs, and those with a net worth of at least USD 30 million are termed as UHNWIs. Due to the growing equity markets and government stimulus, in 2022, North America overtook Europe and Asia-Pacific to lead the total HNWI population. North America's HNWI wealth grew by almost 5% in 2022 compared to 2021. The leading position of North America in terms of the number and assets of HNWIs is mostly attributed to the United States. North America recorded the most significant rise in the ultra-wealthy population, reaching a share of 66% of the global HNWI population in 2022.

- HNWIs and UHNWIs often own private jets for personal or business travel. Growth in the US economy and a strong focus on the industrial and technology sector have propelled the country's per capita income. As of December 2022, there were around 16,524 registered private aircraft in North America, of which the United States accounted for almost 91%, followed by Mexico and Canada, with 6% and 3%, respectively.

- Sustainable investing (SI) is attracting more attention and providing businesses with a high-potential engagement opportunity. In the ultra-HNWI segment, SI is rapidly gaining traction. For instance, about 40% of ultra-HNWIs are willing to invest money in sustainability, compared to 27% of HNWIs who expressed interest in SI products. In 2021 and 2022, there was an increase in the demand for aircraft ownership in the United States, driven by health considerations during the COVID-19 pandemic and a surge in global wealth in the financial markets. This trend is strengthened with capital raising and Initial Public Offering (IPO) activities and boosted by supportive public market valuations.

US Business Jet Industry Overview

The US Business Jet Market is fairly consolidated, with the top five companies occupying 93.54%. The major players in this market are Bombardier Inc., Dassault Aviation, Embraer, General Dynamics Corporation and Textron Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92662

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 High-net-worth Individual (hnwi)

- 4.2 Regulatory Framework

- 4.3 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Large Jet

- 5.1.2 Light Jet

- 5.1.3 Mid-Size Jet

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Bombardier Inc.

- 6.4.2 Cirrus Design Corporation

- 6.4.3 Dassault Aviation

- 6.4.4 Embraer

- 6.4.5 General Dynamics Corporation

- 6.4.6 Honda Motor Co., Ltd.

- 6.4.7 Pilatus Aircraft Ltd

- 6.4.8 Textron Inc.

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.